How Does The Stock Market Work?

- Every trader in the stock market aims for wealth maximization.

- For that, we will have to understand how the stock market works.

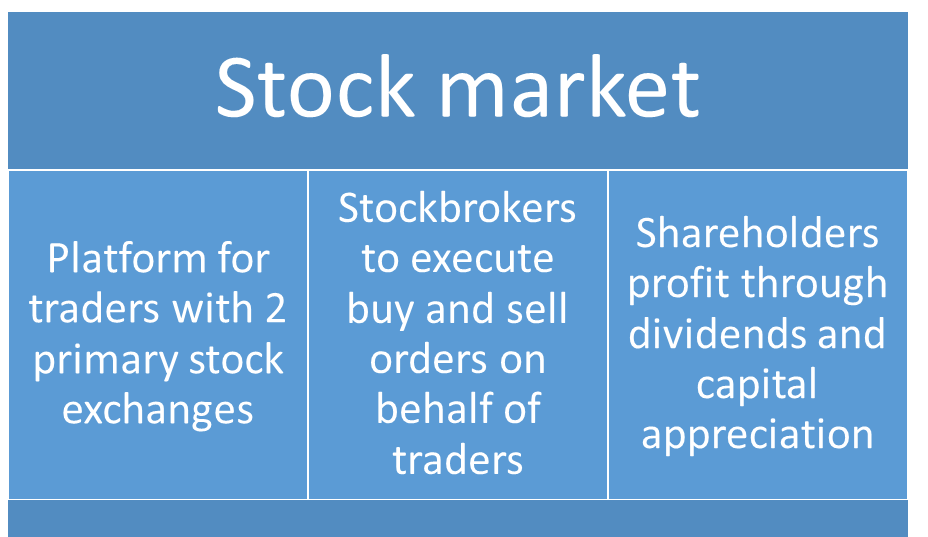

- The stock market serves as a platform for buyers and sellers to trade company shares.

The main highlights of the stock market are as follows:

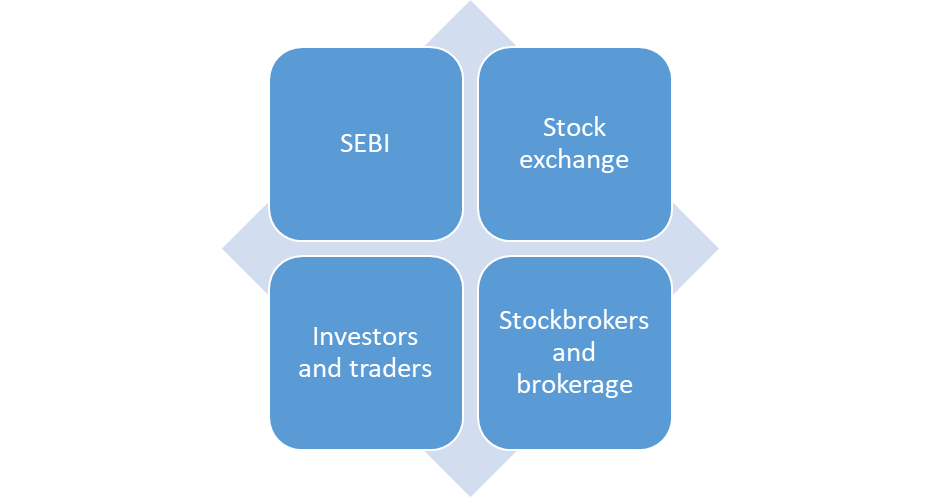

Main participants in the stock market:

- A stock market is a place where investors engage in the buying and selling of shares, bonds, and derivatives that are facilitated by a stock exchange.

- This also functions as a marketplace to connect buyers and sellers.

- There are four main participants in the stock market.

They are as follows:

SEBI:

- The Securities and Exchange Board of India (SEBI) acts as a regulatory authority for Indian stock markets to ensure their efficient and transparent operation.

- The primary objective here is to safeguard the interests of all the participants and to prevent all unfair advantages, if any.

- SEBI establishes compliance with exchanges, companies, brokerages, and other involved entities with the goal of protecting investor’s interests.

Stock exchange:

- For investors to engage in the buying and selling of shares and securities, there has to be a platform to facilitate these transactions.

- This platform is nothing but the stock exchange.

In India, there are two main stock exchanges, as follows:

Stockbrokers and brokerages:

- A stockbroker is an individual or firm that acts as an intermediary for executing the orders of sale and purchase on behalf of the investors.

- For this, they receive compensation in the form of a fee or commission.

- This fee or commission for the investor is brokerage.

Stockbrokers have the following roles:

Investors and traders:

- Individuals who own shares of the company are known as investors.

- They invest in the shares with the intention of becoming partial owners of the company.

- Individuals who purchase and sell shares on a daily basis are known as traders.

- Traders are focused on market trends and price movements.

Types of market:

To understand how the stock market works, we need to understand the types of markets as well.

There are two types of markets, such as:

Primary market:

- This market offers companies the opportunity to generate capital for their investment needs and to fulfill financial obligations.

- To enter the primary market, the company issues an initial public offering (IPO), during which the company enters the primary stock market.

Secondary market:

- This market is the one where the shares are traded after their IPO to the public in the primary market.

- This market provides a platform for traders to buy and sell shares and contribute to the ongoing liquidity and efficiency of the stock market.

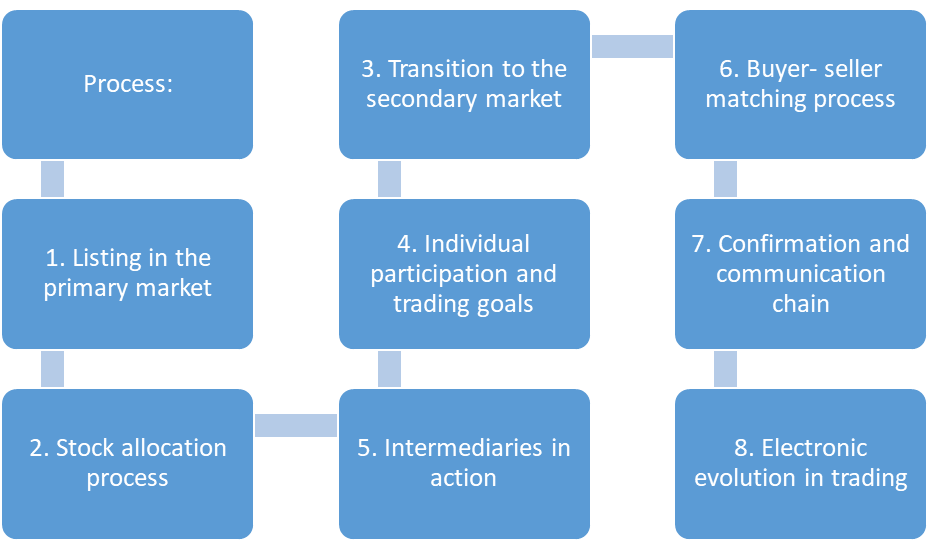

The workings of the stock market:

The stock market works as a process.

The process is as follows:

Listing in the primary market:

- The company starts its journey through an IPO.

- Here, a document is published with all the company and stock details.

Stock allocation process in the primary market:

- The stocks issued through IPOs are allocated to the investors who have placed bids.

Transition to the secondary market:

- To trade the stocks in the stock market, they have to enter the secondary market.

- The majority of the buy-and-sell transactions happen in the secondary market.

Individual participation and trading goals:

- Individual traders actively participate in the buying and selling of stocks with the aim of making profits and minimizing losses.

Intermediaries in action:

- All the brokers and brokerage firms that are registered with the stock exchange are known as intermediaries.

- The role of a broker is to convey a buy order to the exchange and then search for the corresponding sell order for the same share.

Buyer-seller matching process:

- The exchange will facilitate corresponding buy-sell orders for the same share.

- Identification of the seller and buyer will result in the agreed-upon price.

Confirmation and communication chain:

- The exchange will inform the broker that your order has been confirmed.

- The broker will relay the confirmation and then complete the transaction.

Electronic evolution in trading:

- The entire trading process is electronic today.

- Computers tend to play a very crucial role in matching buyers and sellers and then concluding the transactions within minutes.

- An example of how the stock market works:

When you purchase a share, its credit will be processed by the end of the day. - The stock market ensures that the trade of all the stocks is honored during the defined settlement process.

- If the settlement is not completed within T+2 days, then it will jeopardize the integrity of the stock market and imply that the trades cannot be upheld.

- Stockbrokers also have an assigned investor code for their clients to easily identify them.

- For the transaction of the investor, the stockbroker will issue a contract note that will have the details of the trade, including its time and date.

- For this, the clients have to pay the brokerage fees to their brokers, including stamp duty and securities transaction tax.

Conclusion:

The functioning of the stock market looks like a very simple process, but in detail, it is a very long and hectic one.

Frequently Asked Questions (FAQs)

Shares give profit in two ways: capital appreciation and share dividends.

Share trading involves the principal investors buying and selling shares through stockbrokers and, in return, paying brokerage for the same.

The stock market is controlled by the Securities and Exchange Board of India (SEBI).

The CEO of the stock market is Ashishkumar Chauhan.

The full form of Nifty is the National Stock Exchange Fifty.

About Us:

Trading Fuel is our blogging website, where we update blogs for the stock market and market trends. Keep reading and enhancing your knowledge.