Legends Who Change The Trading World Forever: The world of trading has seen many legends come and go, but there are a few who have left an indelible mark on the trading world and changed it forever. These individuals have not only made significant contributions to the field of trading, but they have also inspired countless others to pursue careers in this exciting and dynamic field.

There are many legends in the trading world who have made a significant impact on the industry. These individuals have not only changed the way we approach trading but have also paved the way for future traders to follow.

In this blog, we will take a look at some of the most influential traders of all time and examine the impact they have had on the world of trading.

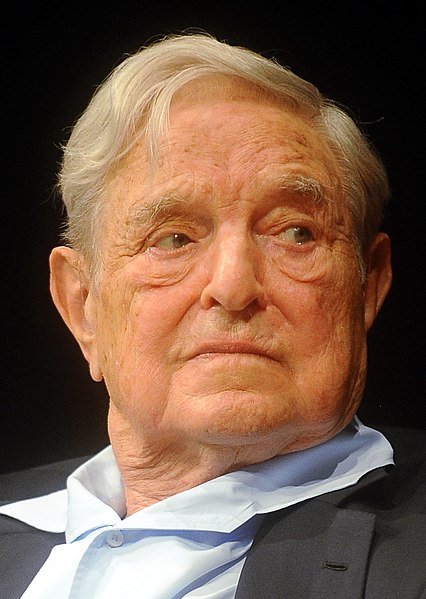

1. George Soros

Known as “The Man Who Broke the Bank of England,” Soros is a legendary trader who made a fortune by betting against the British pound in 1992.

Soros is best known for his incredible success in currency trading, he correctly predicted that the Bank of England would be forced to devalue the pound, particularly his bet against the British pound in 1992.

Known as the “Black Wednesday” event, Soros’ trade against the pound resulted in a profit of $1 billion for his hedge fund, Quantum Fund. This trade cemented Soros’ reputation as a master trader and cemented his place in trading history.

2. Paul Tudor Jones

Paul Tudor Jones is a legendary hedge fund manager and philanthropist who has made a significant impact in the financial world. He is the founder of Tudor Investment Corporation, one of the most successful hedge funds in the world.

Jones is known for his ability to predict market trends and his aggressive trading style, which has earned him a reputation as one of the most successful traders in the industry

Jones made a fortune by correctly predicting the stock market crash of 1987, and he has since become one of the most respected traders in the industry. Jones is known for his ability to navigate the markets and make profitable trades, and he is often cited as an inspiration for many traders today.

Jones’s success has inspired many traders to pursue careers in the futures market, and his legacy continues to shape the world of trading today. He is also a philanthropist, and his work in this field has helped many people around the world.

3. Stanley Druckenmiller

Stanley Druckenmiller is one of the most successful hedge fund managers of all time. He is the founder and former chairman of Duquesne Capital, a hedge fund that was known for its impressive performance and high returns.

Druckenmiller began his career in the financial industry as a research analyst at Pittsburgh National Bank in the 1970s. He quickly moved up the ranks and became a portfolio manager at the bank before leaving to start his own hedge fund in 1981.

Duquesne Capital was founded with just $1 million in assets under management, but under Druckenmiller’s leadership, it quickly grew to become one of the most successful hedge funds in the world. The fund was known for its aggressive trading style and its ability to generate high returns for its investors.

One of Druckenmiller’s most notable trades was his bet against the British pound in 1992. He correctly predicted that the pound would devalue and make a fortune for his investors as a result. This trade is considered to be one of the most profitable trades in the history of hedge funds.

Druckenmiller’s success as a hedge fund manager was not limited to his trading skills. He was also known for his ability to manage risk and his disciplined approach to investing. He was a master at identifying trends and patterns in the markets and making trades based on those patterns.

Overall, Stanley Druckenmiller is a true legend in the hedge fund industry and an inspiration to many aspiring traders and investors. His discipline, risk management, and trading skills make him a model for those who want to achieve success in the financial markets.

4. Jesse Livermore

Jesse Livermore was a legendary stock trader who made and lost several fortunes during his career in the late 19th and early 20th centuries. He is perhaps best known for his success as a “market manipulator,” using his vast wealth to manipulate stock prices for his own profit.

Livermore began his career as a “boy plunger” on the trading floors of the Boston Stock Exchange, where he quickly gained a reputation as a skilled and successful trader. In 1907, at the age of 25, he made a fortune by short-selling stocks during the Panic of 1907. He repeated this feat during the Panic of 1910, and by the age of 30, he was a millionaire several times over.

But Livermore’s success was not without its setbacks. He lost his fortune several times throughout his career, including a particularly devastating loss in the stock market crash of 1929.

One of the key principles that Livermore is known for is his reliance on the “tape,” which is a record of stock prices and trading volume. Livermore believed that the tape was the best indicator of a stock’s true value, and he relied heavily on it in his trading decisions. He also believed in the importance of discipline and patience in trading, and he was known to be a master at reading the market’s moods and trends.

Livermore’s trading strategies and methods have been studied and analyzed by many traders and investors, and his legacy continues to be felt in the world of stock trading today. His story is a testament to the power of perseverance, discipline, and the ability to read the market.

In conclusion, Jesse Livermore is a legend in the world of stock trading, his approach, his strategies, his ability to read the market are still studied by many traders and investors today. Despite several losses, he never gave up, his determination and discipline helped him regain his wealth several times and make a fortune. His legacy continues to be an inspiration to many in the trading world.

5. Warren Buffet

Lastly, we have Warren Buffett, who is often referred to as the “Oracle of Omaha.” Buffett is the CEO of Berkshire Hathaway and is considered one of the greatest investors of all time. He is known for his ability to find undervalued companies and make profitable investments, and he has become a role model for many traders. He has an investment approach called “value investing” where he looks for companies that are undervalued by the market and have a long-term investment horizon.

Buffett’s investment philosophy is centered on value investing, which is the practice of buying stocks that are undervalued by the market. He has consistently outperformed the market and has become one of the wealthiest individuals in the world. Buffett’s success has inspired many traders to adopt a similar investment strategy, and his legacy continues to shape the world of trading today.

You also read : Warren Buffet Net Worth.

These five legends have left a lasting impact on the world of trading and investing. Their methods, strategies, and approach to trading continue to be studied and followed by traders around the world. They have shown that success in trading is not just about luck, but about the ability to navigate the markets and make profitable trades. They are true legends in the trading world who have changed the industry forever.