There are stories of people doing Options Trading Strategies and earning good amount of money. Through regular trading trader can have regular cash flow then one time fortune. Trading Fuel would like to highlight some of the popular option.

Iron Condor Strategy

This is most popular option trading strategies for consistent monthly income. This is consider to be non directional strategy which is having 4 legs. This means that you need to trade 4 option positions in order to execute the strategy. Due to this reason the margin required is little higher for this strategy. Iron condor strategy is the combination of Bull put Spread and Bear Call Spread.

Here is how the condor option trading Strategies works:

Sell 1 OTM Put: A

Buy OTM put (lower Strike): B

Sell 1 OTM Call: C

Buy 1 OTM Call (Higher Strike): D

Here are some of the Characteristic features of Iron Condor Option Trading Strategy:

1) Potential of earning Profit:

it is limited to net credit received. The profit is achieved when price of the underlying is between strike price of short put and short call

2) Maximum Loss:

Strike price of long call – Strike price of Short call – Net credit received.

3) Break even point:

Upper Break even point= Strike Price of short call + Net Credit received. Lower Break even Point= Strike price of short put- Net Credit received.

When to execute this Strategies:

This Strategy should be executed when one is expecting minimum movement in stock or consolidation phase.

Pay off Graph of Iron Condor Option Trading Strategy

Must Know: Basics of Option Trading – Must Know!

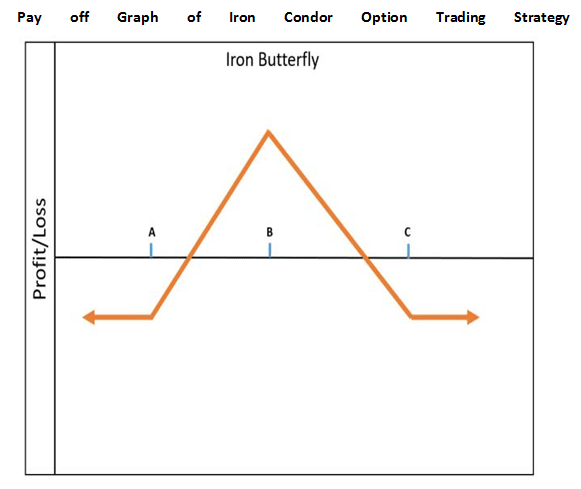

Iron Butterfly Option Trading Strategies:

This strategy is similar to Iron condor except the fact that options at the money ( ATM) are sold in this strategy. The strategy can be more suitable for aggressive traders because the risk is limited.

Here is how the Butterfly Options Trading Strategies works:

Sell 1 ATM Put: A

Buy 1 OTM out with lower strike: B

Sell 1 ATM Call: C

BUY 1 OTM Call with Higher Strike Price: D

Here are some of the Characteristic features of Iron Butterfly Options Trading Strategies:

1) Profit Potential:

It is limited to the net credit received. Maximum profit is achieved when the price of underlying expires at the strike price where the call and put options are sold

2) Maximum loss:

Strike Price of long Call- Strike price of short call – Net credit received.

3) Break even point:

Upper Break even point= Strike Price of short call + Net credit received

Lower Break even Point = Strike price of short put- Net credit received.

4) When to execute the Strategy:

The strategy should be executed when you are expecting minimum movement in stock or consolidation phase. Pay off Graph of Iron Condor Option Trading Strategy

Rules to Select Strike Prices for Option Trading Strategy:

• For long Option take Strike from the next/far month. The strike price which is at the money (ATM) or slightly out – of the money (OTM).

• For short option take the strike price of the current/ near month that is two strikes OTM from the long strike selected. One strike and the profit will start to dip after price crosses the short strike which can be major problem in managing the trade. More than two strikes mean they will not be able to get the optimum hedge %.

Lastly to conclude there are various options trading strategy available to traders which he can opt in Order to minimize the risk. More of them will be posted soon.