5Paisa Review: 5paisa is a leading online stock broker that offers discount brokerage services to retail investors in India.

It is a publicly traded and professionally managed company that is promoted by the IIFL founders.

What is 5Paisa?

- It is an online trading platform that offers equity, commodities, and currency trading on the BSE, NSE, and MCX.

- 5 paisa is a flat-rate discount broker, and it charges a flat Rs. 20 in brokerage irrespective of the size of the trade, segment, and exchange.

Constituents of 5Paisa:

The application offers the following services:

1. 5paisa Mutual Funds:

- This service includes both regular and direct mutual funds.

- It charges a flat Rs. 10 per executed order for the online mutual fund’s investment.

2. 5paisa Demat account:

- It is offered through its depository participant membership with CDSL.

- 5paisa was awarded as a Premier Depository Participant by CDSL in March 2019.

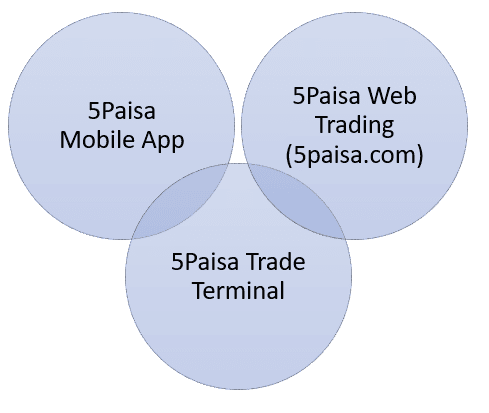

3. 5paisa Trading platform:

- It includes a mobile trading application, a trading website, and an installable trading terminal.

- These platforms are built on the latest technology and are recognized for the best use of mobile technology in financial services.

How is 5paisa different from other brokers?

Given below are the reasons why 5paisa is different from other brokers:

Also Read: How to do Intraday Trading in 5paisa?

1. Lowest charges:

It charges a flat Rs. 20 per executed order and this charge will become Rs. 10 with our value-added services, which is the lowest in the industry.

2. Research Ideas:

It is the only discount broker that provides exhaustive research and advisory services to more than 4,000 companies.

3. Margin funding:

It provides its customers with a facility of margin trade funding, where a customer only pays a partial amount of the delivery that is bought in cash and the balance will be funded by the company at a nominal rate of 0.06% per day.

4. Multi-product App:

It is more than just a trading app; it is a one-stop shop for all investment products, such as gold, peer-to-peer lending, insurance, mutual funds, and US investments.

5. Analytics Services:

It offers a portfolio analyzer, which is a tool to analyze the performance of the portfolio on your own and then improve your investment strategy.

6. Value-added packs:

With this pack, you get the first 100 trades free every month, and the fees are charged from the 101st trade for all segments.

Must Know: Which App is Best for The Share Market?

5paisa Brokerage Plans:

The following is a list of the brokerage services:

| Basis | Basic Pack | Power Investor Pack | Ultra-Trader Pack |

| Account Opening Fee | Free | Free | Free |

| Brokerage | Rs. 20 per order | Rs. 10 per order | Rs. 10 per order |

| Call & Trade | Rs. 100 per call | Rs. 100 per call | Free |

| Demat AMC | Rs. 25 per month | Rs. 25 per month | Rs. 25 per month |

| DP Transaction Charges | Rs. 12.5 per script (sell side) | free | Free |

| Fund Transfer Charges | Net Banking: Rs. 10 UPI: Free IMPS: Free | Net Banking: Rs. 10 UPI: Free IMPS: Free | Free |

| Direct MF Investment Charges | Rs. 20 | Free | Free |

| Research Advisory | Not Available | Free | Free |

| Free Trades | NA | NA | Free 100 trades per month, maximum of Rs. 1000 |

| Dedicated Customer Support | NA | Free | Available |

5Paisa Charges 2022:

The Account Opening Charges & AMC:

| Service | Charge |

| Trading Account Opening Charges (one time) | Free |

| Trading AMC | Free |

| Demat Account Opening Charges (one time) | Free |

| Demat AMC | Rs. 300 yearly (charged at Rs. 25 per month) |

The brokerage charges are as follows:

| Segment | Brokerage Fee |

| Equity Intraday | Rs. 20 per trade |

| Equity Delivery | Rs. 20 per trade |

| Equity Futures | Rs. 20 per trade |

| Equity Options | Rs. 20 per trade |

| Commodity Futures | Rs. 20 per trade |

| Commodity Options | Rs. 20 per trade |

| Currency Futures | Rs. 20 per trade |

| Currency Options | Rs. 20 per trade |

5Paisa Trading Platforms:

The trading platforms of 5paisa are as follows:

Also Check: Motilal Oswal Review 2022

Pros and Cons of 5Paisa:

The following are the main advantages of 5paisa:

- There is a flat fee of Rs. 20 per order, regardless of the size of the trade, segment, or exchange.

- All-in-one account for investing in stocks, mutual funds, commodities, currency, research, and advisory services.

- Free and paperless accounts open in 5 minutes.

- Promoted by IIFL promoters.

- Technical calls on both email and mobile.

- Lowest DP charges.

- Account for free mutual funds

- Free trading platforms include mobile apps, websites, and desktop terminals with no software charges.

- Offers free technical, derivative, and fundamental research and advice to customers for an additional cost.

- Algo trading and Robo advisory services.

- It provides stock investment ideas as well as research tools.

- The trading app is multilingual.

The main disadvantages of 5paisa are as follows:

- Does not offer a 3-in-1 account.

- Margin funding is given to customers without notice, and this leads to major confusion.

- It does not offer NRI trading.

- Very high Demat debit transaction charges.

- Higher exchange transaction charges.

- Call & Trade is available at an additional cost.

- Research and advisory services are not available in the Optimum plan.

Must Check: Top 7 Best Stock Market App

Conclusion:

We hope that the above blog gives you an idea about whether to have a Demat account with 5paisa or not.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, stocks, intraday trading, technical analysis, and the stock markets. Stay tuned with us for more such blogs.