What is Pre-Market Open in The Stock Market? – Trading Fuel

There are many ways through which we can trade or various decisions we need to take for the market.

The main factor attached to such trading is pre-market trading.

The quantum of transactions traded in the pre-open market is much lower than in normal trading hours.

What is the pre-market open?

Pre-market open is generally the time between 9:00 A.M to 9:15 A.M.

This is generally the trading time on the BSE and NSE.

The pre-market open session is considered the trading session before the regular market session.

Pre-market opening helps in stabilizing heavy volatility because of some major event or announcement that happens overnight, i.e. before the market actually opens.

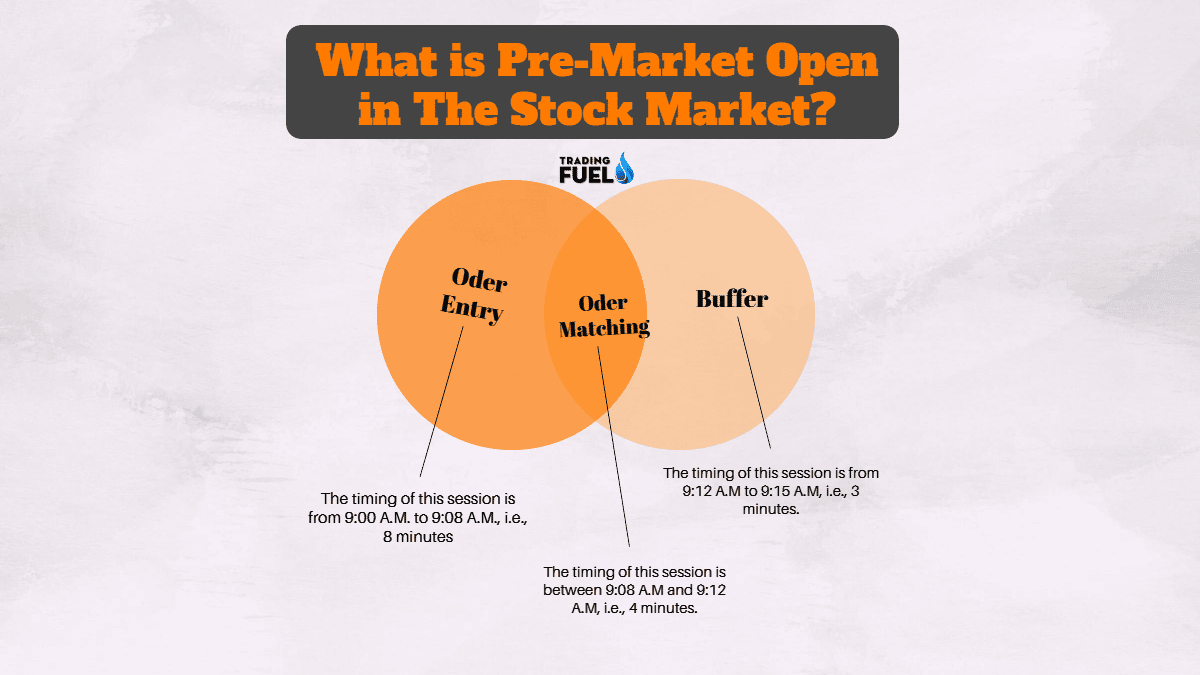

The entire breakup of the pre-market open session:

The entire schedule of 15 minutes of the pre-open market is divided into 3 sessions.

The list is as below:

Order Entry Session:

The timing of this session is from 9:00 A.M. to 9:08 A.M., i.e., 8 minutes.

There are two tasks that are fulfilled in this session:

- Placing an order to buy or sell the stocks.

- Modify or cancel the placed order.

No orders will be accepted after this 8-minute session.

Order Matching Session:

The timing of this session is between 9:08 A.M and 9:12 A.M, i.e., 4 minutes.

Here also, there are 2 tasks that can be undertaken:

- Order confirmation as well as order matching.

- Calculating the opening price of the stocks for the normal trading session.

This session won’t allow you to buy, sell, cancel, or modify your order if any.

Buffer Session:

The timing of this session is from 9:12 A.M to 9:15 A.M, i.e., 3 minutes.

The following tasks are undertaken in this session:

- Facilitating the transition from pre-open to regular session.

- Buffer session

This session is basically used as a buffer session for any abnormalities that may occur in the previous sessions.

What is the pre-market open strategy?

This strategy is basically where we identify stocks that have signed up or down moves during the entire pre-market open session.

The basic fundamentals that are applied here are that stocks that show a significant move, i.e., more than 1% during the pre-market open session are filtered and used for trading purposes.

It is believed that stocks that show a generous move of more than 1% in the pre-market open session will show momentum and will help in the trading course.

How can we identify stocks using this strategy?

Stock selection is an energizing process that necessitates the use of various scanners.

The following are the ways through which we can identify the stocks:

- You can choose stocks from the F & O list because stocks from the derivative segment tend to be volatile because of the outstanding positions, hence these stocks show higher momentum.

- The volume of such stocks traded should be more than 10,000 in the pre-market open session.

- The stocks selected should range between RS. 100 and RS. 2000. We need to avoid stocks that are below RS. 100 or above RS. 2000.

- The volatility index (VIX) for that stock should be above 20.

Once we are able to identify the stock based on the above three criteria, then on opening we need to closely monitor the prices for the first 15 minutes.

Here, we have to check that the first 15 min price range should be more than 1.3% of the average instrument price.

How is the stock opening price achieved in the pre-market open session?

During the pre-market open session, a call auction will take all the orders and then arrive at the equilibrium.

The equilibrium price is the price at which the maximum number of stocks are traded based on the price and the demand and supply quantity.

The orders are matched with the equilibrium price and then trades take place during the pre-market open timings.

Let us see an example to understand this concept well:

Example:

Suppose the previous day’s closing price of Stock A was Rs. 150.

The following table gives the details of the pre-market open session:

| Stock Price | Buy | Sell | Demand Quantity | Supply Quantity | Max Tradable Quantity | Unmatched Orders |

| 152 | 1000 | 985 | 3400 | 985 | 985 | 2415 |

| 154 | 1275 | 1161 | 12500 | 21000 | 21000 | (8500) |

| 155 | 6000 | 4340 | 9000 | 9500 | 9000 | (500) |

| 102 | 3000 | 7500 | 5000 | 7250 | 5000 | (2250) |

| 98 | 2000 | 10000 | 30000 | 35000 | 25000 | (10000) |

The stock price at RS. 98 has the highest tradable quantity, so it will be considered as the equilibrium price.

The orders that are not matched or traded in the pre-open are carried to the normal trading session and the opening price in such cases is:

- Limit orders that are not traded or matched during the pre-open session will be moved to the normal trading session at the same price.

- Market orders that are not matched or traded in the pre-open will be moved to the normal session at the opening price.

- If the opening price is not identified during the pre-open session, then the market orders will be shifted to the normal session at the previous day’s close price.

Who can trade in the pre-market open session?

Everyone can trade in the pre-market open session.

Sometimes a few brokers won’t activate this feature, so all you need to do is to ask your broker to activate your pre-market open feature.

What are limit orders?

If you place an order for a certain stock at a specific price, the order will be executed only when the stock reaches that price. This process is known as a limit order.

What are market orders?

When you don’t specify the order price during the entire buy or sell transaction and you want to execute it at the prevailing price, it is known as a “market order.”

The bottom line:

Currently, only NIFTY 50 and SENSEX 30 stocks on the NSE and BSE allow you to trade in the pre-market open session.

Stocks that are excluded or included will still be considered as a part of the pre-market open strategy.

Conclusion:

I hope the above blog of the pre-market open has given you complete knowledge of stock selection in the pre-market open as well as placing an order.

Frequently Asked Questions (FAQs):

About Us:

Trading Fuel is our blog website where we try to provide you with insights into finance, economics, and the stock market; details about the stock market and its technical analysis; and intraday trading.

~We wish you happy reading and stay tuned with us for more such blogs~