What is Dow Jones Index and when was it started?: Dow Jones or Dow Jones & Company is one of the world’s largest business and financial news companies.

Besides the famous Dow Jones Industrial Average (DJIA), the company has also set up various other market averages.

Who is Dow Jones Index?

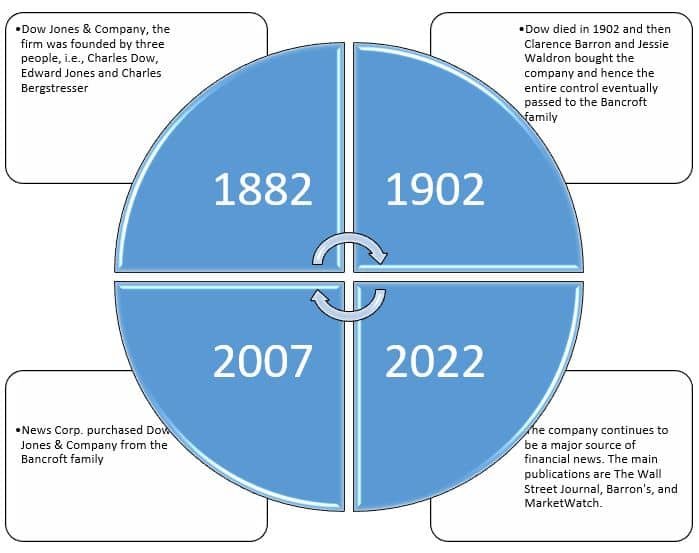

- Dow Jones was not a single person, but two of the three people who founded Dow Jones & Company in 1882.

- Charles Dow and Edward Jones are the Dow Jones, whereas Charles Bergstresser happens to be the third founder of the company.

- In the year 1889, all three went on to found The Wall Street Journal, which is also considered to be the world’s most influential financial publication.

- Dow was exclusively known for his ability to explain all the complicated financial news to the public.

- He also believed that investors would need a simple benchmark to indicate whether the stock market was either rising or declining.

- He had chosen several industrial-based stocks for his very first index, and hence his first reported average was 40.94.

- According to the Dow Theory, an upward trend in industrial stocks should be confirmed by the same upward move in transportation stocks.

What is Dow Jones Index?

The Dow Jones has got a very remarkable history to remember.

The following twists and turns happened with Dow Jones:

Know About:What is the Nifty Index?

- On the other hand, the company no longer controls the Dow Jones Industrial Average (DJIA) that it originally created.

- Currently, the Dow Jones Industrial Average (DJIA) is owned by S&P Dow Jones Indices LLC, which is a joint venture between S&P Global and the CME Group.

What is the Dow Jones Industrial Average (DJIA)?

- The Dow Jones Industrial Average (DJIA), a.k.a. Dow Jones or simply the Dow, is the most popular and widely recognized stock market index.

- The index measures the daily stock market movements of the 30 main US publicly traded companies that are listed on NASDAQ or the New York Stock Exchange (NYSE).

- These 30 companies are considered the leaders in the US economy.

- Dow Jones & Company, the founder and editor of The Wall Street Journal, Charles Dow, created the Dow Jones Industrial Average (DJIA).

- Initially, when the index was launched in 1896, it was basically comprised of only 12 US companies that were only engaged in industrial activities.

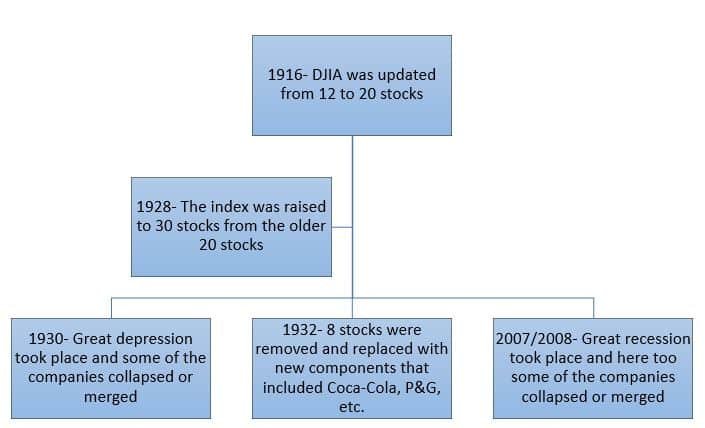

- With the passage of years, the index also changed with the changes in the economy and now includes other sectors as well, such as technology, health, and retail.

- The index will tend to change when one or more components are experiencing financial distress. That means it is less important to a company in its sector when there happens to be a significant shift in the economy that needs to be reflected in its composition.

Must Know:Top 10 Most Expensive Stocks In The World

The History of the Dow Jones Industrial Average:

- The Dow Jones Industrial Average (DJIA) was created in May 1896 by Charles Dow and his business associate Edward Jones.

- Two years back, before the formation of the DJIA, Dow had already developed his first stock index, which is the Dow Jones Transportation Average (DJTA), which is considered to be the most important average for the US transportation sector.

- The main components of the DJIA were the industrial companies like gas, sugar, railroads, tobacco, and oil.

- The DJIA index reflects the performance of 30 stocks of the leading US blue-chip companies.

The index has undergone many changes over the years, and we can look at those changes from the following:

The 12 original Dow Jones Industrial Stocks are as follows:

| Sr. No. | Stocks |

| 1 | American Tobacco |

| 2 | American Sugar |

| 3 | American Cotton Oil |

| 4 | Chicago Gas |

| 5 | General Electric |

| 6 | Distilling and Cattle Feeding |

| 7 | Laclede Gas |

| 8 | National Lead |

| 9 | North American |

| 10 | Tennessee Coal, Iron, and Railroad |

| 11 | US Rubber |

| 12 | US Leather |

- The index is also updated in the way that it is calculated.

- Initially, when it was created, it used simple arithmetic mean where the price of 12 stocks was simply divided by 12.

- Today, the same is divided using the Dow Divisor, which is adjusted for certain structural change events.

Also Read:The Momentum Trading 1-2-3 System

Components of the Dow Jones Industrial Average (DJIA):

- There is no specific criteria for a company to be included in the 30 company stocks of the DJIA.

- However, a company must account for a significant portion of the economic activities in the US to appear in the DJIA.

- The company should also be listed on NASDAQ or NYSE and be a part of the major companies in the industrial sector.

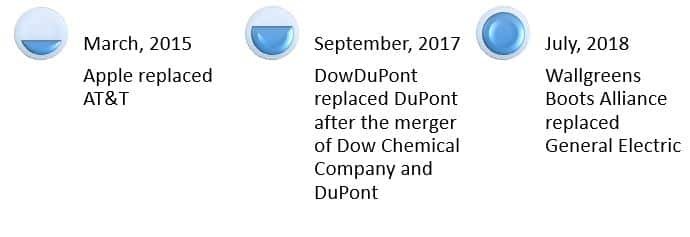

- The index is making numerous changes to its components so as to reflect changes in the economy.

The recent changes that occurred include the following:

The DJIA is comprised of the following companies:

| Sr. No. | Company | Industry |

| 1 | 3M | Conglomerate |

| 2 | American Express | Financial Services |

| 3 | Apple | Technology |

| 4 | Boeing | Aerospace |

| 5 | Caterpillar | Construction |

| 6 | Chevron | Oil & Gas |

| 7 | Cisco | Technology |

| 8 | Coca-Cola | Food & Beverages |

| 9 | Disney | Entertainment |

| 10 | DowDuPont Inc. | Chemical industry |

| 11 | Exxon Mobil | Oil & Gas |

| 12 | Goldman Sachs | Financial Services |

| 13 | Home Depot | Retail |

| 14 | IBM | Technology |

| 15 | Intel | Technology |

| 16 | Johnson & Johnson | Pharmaceuticals |

| 17 | JP Morgan Chase | Financial Services |

| 18 | McDonald’s | Food |

| 19 | Merck & Company | Pharmaceuticals |

| 20 | Microsoft | Technology |

| 21 | Nike | Apparels |

| 22 | Pfizer | Pharmaceuticals |

| 23 | Procter & Gamble | Consumer Goods |

| 24 | Travelers Companies Inc. | Insurance |

| 25 | United Technologies | Conglomerate |

| 26 | United Health | Managed Health Care |

| 27 | Verizon | Telecom |

| 28 | Visa | Financial Services |

| 29 | Wal-Mart | Retail |

| 30 | Walgreens Boots Alliance | Retail |

Must Learn:Price Action Trading Guide

How does DJIA work?

- The DJIA was created to measure the movements of the leading companies in the US that are engaged in industrial activities.

- The index uses a price-weighted index, which means that stocks with a higher share price will carry a greater weight in the index than stocks with a lower share price.

- Here, the prices of the 30 stocks in the index are first added together and are then divided by a divisor, known as the Dow Divisor.

- This divisor is there to counteract the effect of certain structural changes, also known as stock splits.

How to join DJIA?

- When you are choosing a company to represent an industry in the DJIA, the editors at The Wall Street Journal will be considering a number of factors.

- They will select a company that will represent and leads the market.

They will also look into the following factors:

The editors are looking for companies that will stay powerful in the industry.

Criticism of the Dow Jones Industrial Average (DJIA):

- Although the index is an important one, there are still many shortfalls attached to the same.

- With over 5,300 common stocks that are traded on NASDAQ and NYSE, this index is not the best indicator of how the overall market will perform since the index will include only 30 stocks.

- A less than 1% representation of the total stock market may be highly misleading and might not portray the actual state of the economy.

- The use of the price-weighted index apart from the market-weighted index, it will give an advantage to some of the DJIA components over others.

- Major professional fund managers are using alternative indices such as the S&P 500 Index to monitor the overall performance of the stock market.

Must Know:Best Stocks to buy below RS 10 in India 2022

Conclusion:

The above blog will give you the details about the Dow Jones as well as the Dow Jones Industrial Average.

Frequently Asked Questions (FAQs)

About Us:

Trading Fuel is our website for blogs where we imbibe knowledge about finance, economics, the stock market, and technical analysis.

~Stay tuned with us for more such blogs~