Best Technical Analysis Books are very important for a trader or investor in the stock market. The relevant question here is how much time you will need to learn the technical analysis of stocks. Furthermore, is it worth investing precious time in studying books on technical analysis of The Indian stock market? Well, the answer is a big yes. In fact, the art and science of technical analysis help the investor to make higher returns. Also, learning new things in the stock markets can always help to make more money.

Everyone in the world after the pandemic has increased their interest in the stock market.

But just having a Demat account and trading haywire will not fetch you good returns.

You will need to have proper knowledge of the same.

Hence, to have good knowledge about the same, it is very important that we read books that are totally focused on technical analysis as well as chart analysis.

What is Technical Analysis?

- Technical analysis is the best practice of studying price charts to discover patterns and trends that could be used to help traders and analysts predict future price movements before they even occur.

- This will help them to gain a competitive advantage as well as maintain a good grip on the market.

- There are several types of charts that are used in technical analysis, but the investor should learn the basic four types of charts as follows:

Top 20 Best Technical Analysis Books:

- The investors and traders that put technical analysis to regular use will boost their experience level as well as become more successful.

- This will also help them to maximize their profits and eventually keep risks to an absolute minimum.

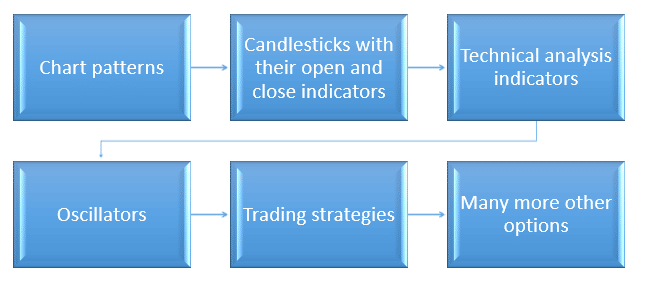

- All these books and guides will teach us about the following:

The following is the list of the top 20 best technical analysis books that can be made available even online:

1. Getting started in Technical Analysis:

- If you are planning to start with technical analysis, then there is no better book to read apart from this one, which is written by Jack D. Schwager.

- He has written a very good guide for new beginners that is clear as well as easy to understand.

- Apart from this, he continues to be aptly thorough in exploring many new and unique concepts.

- Traders and investors can learn the following through this book:

The book also includes a variety of examples of these basic technical analysis concepts and also how traders can completely leverage them to their best advantage.

Don't Forget Check:What is Technical Analysis of Stocks?

2. Technical Analysis for Dummies:

This book written by Barbara Rockefeller provides the following content:

- All the above will help to expand the knowledge of the investors.

- This book is the first great book for all novice traders so that they can begin to learn about candlesticks, chart formations, market principles, how to spot trends, and then how to use market data as a tool.

- It will also provide practical examples of real-time market situations.

3. Technical Analysis Explained:

- This book is written by Martin J. Pring, who is the chairman and strategist for a technical analysis research firm that provides insight to all financial institutions as well as individual investors across the globe.

- This book is also considered a bible to the technical analysis guide, making it a top choice among the traders that are initially trying to learn the markets.

- This book is also used as a reference again and again when investors are in constant trouble.

- With the help of this book, traders are able to learn how to incorporate technical analysis into their investment strategies in a very practical way with the help of advanced tools and indicators to find the trends as well as predict the market movements.

4. The Art and Science of Technical Analysis: Market Structure, Price Action, and Trading Strategies:

- This book by Adam Grimes goes beyond all the basic books and approaches technical analysis as an art and science, with principles and discipline, versus a regimented strategy that must be followed step by step.

- It also introduces the trader to both the basics and provides a comprehensive look into the psychology of trading.

- This book also includes detailed trade data to teach performance analysis so that the traders can learn from their mistakes or success as well.

Don't Forget to Learn:Top 10 Intraday Trading Techniques

5. Technical Analysis from A to Z:

This book by Steve Achelis acts as a full series on the following:

- For the 2nd edition of this book, it has been updated to include more than 35 new market indicators for better education.

- This author can teach traders who want to put a little more meat on the bones a lot.

6. Trading Fuel:

- Trading Fuel is basically a free fuel for your entire trading arena made by Prashant Raut.

- The book is not yet on the market but will be soon.

- The book contains advanced trading psychology and trading patterns, along with learning all four types of chart patterns.

- This book will also gently elaborate on the most advanced yet basic technical indicators in detail.

- This book will also guide you to take the best decisions about the management of your funds as well as mind management when you are trading.

7. Japanese Candlestick Charting Techniques:

- Many times, we can learn a lot from how a single candle will open and close.

- With this practice, this book was written by Steve Nison.

- The book is going to educate the traders on how to watch for early signals so that the reversals could be ahead using the candlesticks, and then explain the meaning and types of different candlesticks, such as Doji, or an engulfing candle. More Know About Candle.

8. Chart Patterns: After the buy:

- Thomas Bulkowski, the author of this book, has studied thousands and thousands of price charts and has also done an extensive, detailed statistical analysis of the performance of the chart patterns.

- With the help of this advanced book, traders will be able to learn the following:

Also Like:How to Start Investing with little money?

9. Encyclopedia of Chart Patterns:

- This book was also written by Thomas Bulkowski.

- This book is for traders who have the basic knowledge of technical analysis and wish to enjoy a deep dive into the world of chart patterns.

- This book features over 60 different patterns.

- Apart from teaching over 60 different chart patterns, including the head and shoulders, bull flag, and many others, this book also features strategies on how to trade the patterns and what to expect for the most typical results.

10. Investment Psychology Explained: Classic Strategies to Beat the Market:

- This book by Martin Pring digs into what the traders are feeling and thinking behind each and every market movement.

- This book also teaches the traders their own emotions along with how to remain stoic despite any sort of market condition.

- This book also teaches traders how to prevent emotions from interfering with their judgments about making trades, which will avoid FOMO-driven market events.

- Apart from this, the book teaches how to go against the crowd when the sentiments are at their extreme. Learn More About 2% Risk Trading.

11. Beyond Candlesticks:

- This book, also by Steve Nison, can be considered a sequel to the Japanese Candlestick Charting Techniques.

- The author is uncovering further Japanese technical analysis techniques and also shows how to combine them with traditional strategies to maximize trading effectiveness.

- The book also works as a step-by-step guide with detailed illustrations and other actionable advice.

12. Beyond Technical Analysis: How to develop and implement a Winning Trading System:

- This book is written by Tushar S. Chande.

- The title of the book might nudge the traders to simply grasp the basic technical analysis concepts and also to learn how to read the patterns.

- This will help the traders to develop their own individual trading systems for trading in the market.

- This book also provides up-to-date techniques as well as clear guidelines to help move from passive analysis to execution.

13. Cloud Charts: Trading Success with the Ichimoku Technique:

- The book by David Linton is a guide to the Ichimoku Cloud method.

- This book also provides a solid foundation after going through the fundamental technical analysis concepts like candlesticks, moving averages, and point and figure.

- This book also features the basis for the Ichimoku technique and how we can compare the same with other methods.

14. Effective Trading in Financial Markets using Technical Analysis:

- The authors of this book, Ashish Kyal, and Smita Roy Trivedi focus on India when it comes to examples and other case studies.

- This book also aims to offer a broader global perspective.

- This book is written with the intention of covering a broad audience niche that will also include dealers working in financial institutions, investors, and fund managers.

Also Read: Top 10 Best Investment Books for Indian Investors

15. The Handbook of Technical Analysis:

- The author, Mark Andrew Lim, wrote this book with the intention of helping financial technical analysis students prepare for exams.

- This book is also considered an invaluable reference for some serious traders.

- The book also offers the most effective alternatives to popular technical approaches.

16. Quantitative Trading System: Practical Methods for Design, Testing, and Validation:

- Dr. Howard B. wrote this book on the process of designing mechanical trading systems.

- This book will also discuss why many of these systems fail and how to build the most profitable one.

17. Technical Analysis: The Complete Resource for Financial Market Technicians:

- This book, written by Charles D. Kirkpatrick II and Julie R. Dahlquist, is both an academic exploration of technical analysis as well as a thorough compilation of pattern recognition methods.

- This book also focuses on traditional techniques as well as modern indicators, which seem to be a must-have for serious traders.

18. Technically Speaking: Tips and Strategies from 16 Top Traders:

- This book by Chris Wilkinson is a collection of interviews with 16 successful traders sharing their best techniques.

- This book will skip the past theory so as to present what will actually work straight from the mouth of the horse.

- The readers of this book suggest reading it as it will make sense for those who wish to have a great impact on their trading skills.

19. Technical Analysis using multiple timeframes:

- This book by Brian Shannon is packed with actionable tools and techniques for analyzing both short and long-term market movements.

- It also helps the traders with the following:

This book also highlights the importance of fundamental analysis apart from basic technical analysis.

20. Elliot Wave Principle:

- This book by Robert Prechter offers even experienced traders a wealth of knowledge.

- This book is a controversial study of market behavior, focusing on certain market movements.

Also Check: Top 10 Books On Stock Market You Should Read!

Conclusion:

We hope that the above blog gives you an entire list of the best books for technical analysis.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, the stock market, and technical analysis. Stay tuned with us for more such blogs.