Alan Andrews Pitchfork Trading Strategy:

Pitchfork was developed by Alan Andrews, Andrews pitchfork may be a trend channel tool consisting of three lines; a median line within the center with two parallel equidistant trend lines on either side. These lines are drawn by selecting three points, usually supported reaction highs or lows moving from left to right the chart. As with normal trend lines and channels, the surface trend lines mark potential support and resistance areas. A trend remains in continuation as long as the Pitchfork channel holds, reversals occur when prices escape of a pitchfork channel.

Alan Andrew’s pitchfork is catchy. It is simple and It also catches trends with a channel.

Essentially, Andrew’s pitchfork may be a tool for drawing price channels. While two lines surrounding price are usually enough to draw a channel, the pitchfork has an additional line. It is the median line or the handle of the pitchfork.

The median line is central to the present trading method. This is why Andrew’s pitchfork is also known as the median line method.

A bullish pitchfork as one where the pattern is rising and a bearish pitchfork as one where the pattern is falling. When trading a pitchfork it’s entirely possible to trade either the bullish or bearish pattern on both the long or short side.

Pitchfork consists of:

- Handle (start of A to the median line )

- Resistance line (Upper or lower boundary)

- Median line (central line of a pitchfork)

- Support trending (Upper or lower boundary)

Pitchfork analysis is useful for identifying:

- Support and resistance lines

- Price channel

- Ranges

- Breakouts and fadeouts

- Overbought and oversold conditions

How to Draw A Pitchfork?

The first thing you need to do when drawing the Andrews Pitchfork indicator is to build a straight line between point B and point C. Take the points’ high and low and connect them with a straight line. Then find the midpoint of this line. Have a look at this example:

There are three steps to drawing a pitchfork.

1. Step One – Pivot Points

You need three points for a pitchfork.

For a bull channel:

- A major pivot low as point A.

- A next higher pivot is high as point B.

- The following pivot low as point C.

For a bear channel:

- A major pivot high as point A.

- A next lower pivot low as point B.

- The following pivot high as point C.

2. Step Two – Median Line

Draw a line passing through point A and the mid-point of point B and C. This is the median line.

Price crosses the median line · In a bullish pattern if the price crosses cleanly from point C up through the median line, the chance of testing the upper resistance line increases. Here the first price target remains the upper line.

Price reversal at median · A reversal at the median line suggests weaker momentum and indecision. This increases the odds that the price will fall back to retest the lower support line. In this situation, the new price target is on the lower line between point C and the second target.

3. Step Three-Channel Lines

Project parallel lines to both sides of the median line to form the channel. One line should pass through point B, and the other through point C. The top line is the upper median line and the bottom line is the lower median line.

The median line determines the slope of the channel. This is in contrast to the normal trend line channel method in which the angle depends on the trend line.

Confirming the Validity of the Andrew’s Pitchfork

Now that we have constructed the Andrew’s Pitchfork study on the chart, we need to confirm its authenticity. The Pitchfork structure is considered valid if the price action demonstrates reactive movements off Andrew’s lines. Below you will see the places where the price action confirms to our Pitchfork trading indicator:

Let’s now take a closer look at the essential guideline for trading inside the Andrews Pitchfork:

1. Buy when the price bounces from the lower level of the Pitchfork.

2. Sell when the price bounces from the upper level of the Pitchfork.

3. Use a Stop Loss order as follows:

- If you are buying after a bounce from the lower level of the Pitchfork, place a Stop Loss order below the bottom created from the bounce.

- If you are selling after a bounce from the upper level of the Pitchfork, place a Stop Loss order above the top created from the bounce.

4. Hold your inside Pitchfork trades as follows:

- The price reaches the opposite Pitchfork level.

- The price breaks the Median Line in the direction opposite to the initial price bounce.

Pitchfork Trading Rule:

There are many ways to trade using Andrew’s pitchfork but the basic idea is that price will oscillate around the median line. In this version, we will focus on trading the first re-test of the limiting median line.

Long Trade

- Draw a bull channel with Andrew’s pitchfork

- Wait for price to fall and test the lower median line

- No bar high should be lower than the lower median line

- Buy a tick above the high of a bull bar at the lower median line

Short Trade

- Draw a bear channel with Andrew’s pitchfork

- Wait for price to rise and test the upper median line

- No bar low should be higher than the upper median line

- Sell a tick below the low of a bar at the upper median line

Basic of Pitchfork Trading Strategy:

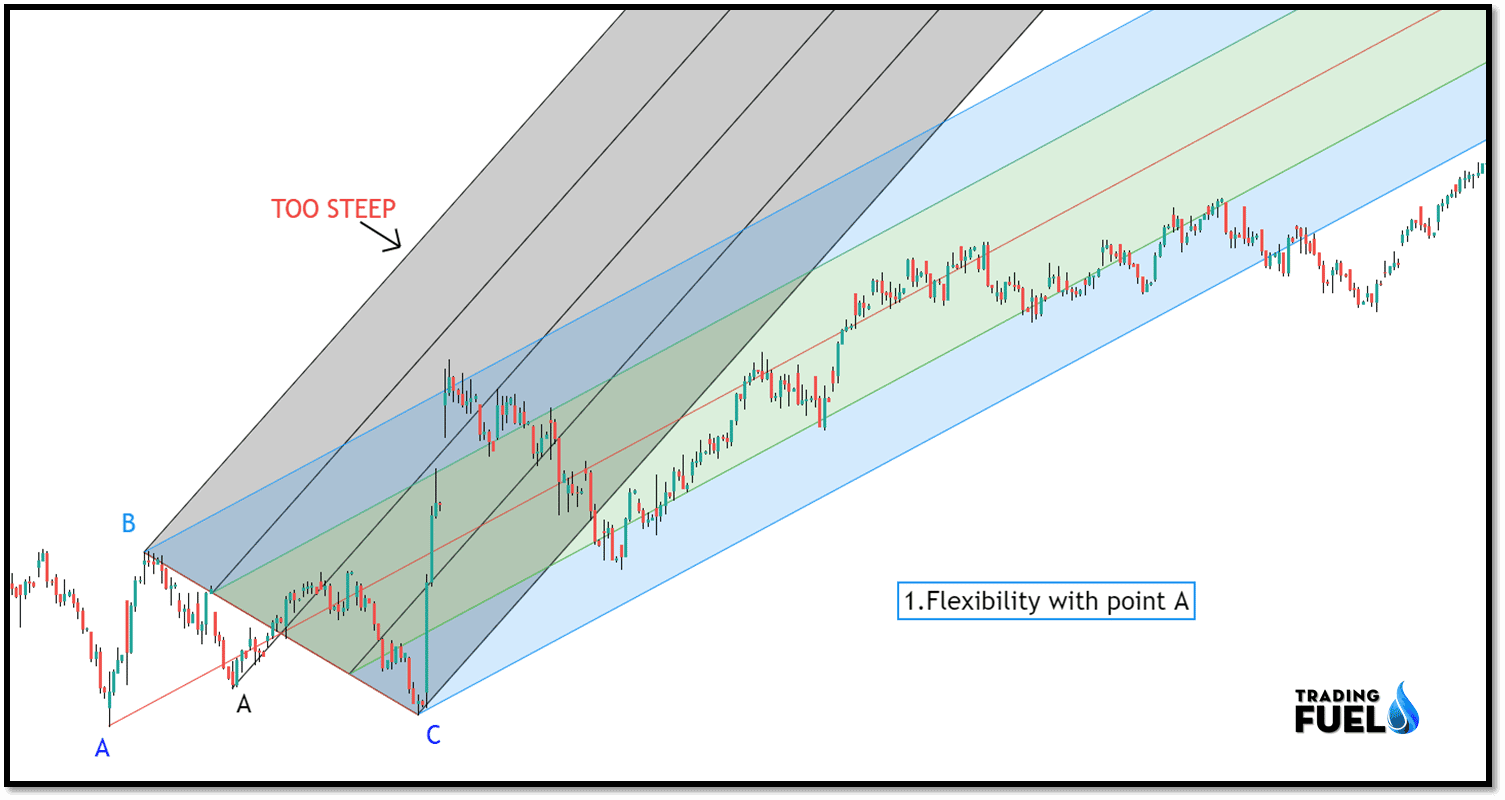

1. Flexibility with Point A:

- As we have already discussed points A, B, C are nothing else but swing high and low of a trend.

- There might be a case when there will be multiple swing lows available for the allocation of point A.

- Under such conditions we can select any swing low as a point A, keeping the steepness of the pitchfork slope in mind.

2. Support and Resistance:

- The outer line of the pitchforks acts as a support and resistance depending on the on-going trend.it helps to assist the future possible zone of resistance and support.

- For a downtrend as shown in the example, the upper line will act as a resistance line and the lower line will act as a support zone.

- For an uptrend, the lower line will act as support and the upper line will act as a resistance zone.

- Depending upon the support and resistance we can assign our entry and target in pitchfork.

3. Trigger Lines:

- Upper trigger line:

The upper trigger line is formed by connecting point A and point C, an upward breakout of the line is considered a strong bullish move or it is an indication that on-going down might came to an end.

- Lower trigger line:

The lower trigger line is formed by connecting the point A and point B, a downward breakout of the line is consisted strong bearish moves or it is an indication that the on-going uptrend might come to an end.

Pitchfork Trading Strategy Example:

a. Winning Trade –

After making a new low in the downwards trend, the market bounced up to test the upper median line. The resistance was clear as a bearish outside bar formed at the line. This bar was also our signal to go short.

Pitchfork Trading Strategy (Entry) : After the price has rejected the upper trend line in a downtrend line it is an entry clear signal.

PTS (Exit) : Most preferable zone to exit will be the lower trend line of the pitchfork as it acts as a support zone, and after entering at an upper trend line, the target of the lower trend line will provide a good risk to reward ratio.

PTS (Stop loss) : Based on the Dow Theory, stop loss must be placed above point C.

b. Losing Trade –

Price fell and found resistance at the median line. It bounced up to the upper median line which resisted it. We entered short with the first bearish bar that overlapped with the line.

Pitchfork Trading Strategy (Entry) : After the price has rejected the upper trend line in a downtrend line it is a clear entry signal.

PTS (Exit) : Most preferable zone to exit will be the lower trend line of the pitchfork as it acts as a support zone, and after entering at an upper trend line, the target of the lower trend line will provide a good risk to reward ratio.

PTS (Stop loss) : Based on the Dow Theory stop loss must be placed above the point C. which get trigger in this case.

We consider this trade a failure because it was a trend continuation trade but the price rose above point C.

Conclusion:

In this blog, we have learned about the basics of pitchfork and how it can be used as a standalone trading system. It is a simple structure for which we need to identify the swing (pivot) high and low of a trending market. Pitchforks work well in a trending market, but in a sideways market, it tends to give a lot of false signals. So before using a pitchfork, one must have a clear understanding of the different market trends. Along with the technical aspect of trading, one must give equal importance to risk management and follow a good risk management system always.

Contain & Image ©️ Copyright By, Trading Fuel Research Lab