Derivative Trading Basis

Option Trading Explained – Beginner to Expert Guide | Trading Fuel: A derivative is a contract whose price is dependent on one or more basic variables, which are called, the underlying asset, and index.

The underlying asset can be, Equity, forex, commodity, or any other asset.

The future contract at NSE is based on S&P CNX nifty index, bank index, etc.

It has a maximum of 3- month expiration cycles.

Three contracts are available for trading

Learn More:Option Trading For Beginners (A to Z Guide)

Why use options trading?

- Leverage

- Reinforce the stop-loss concept when buying

- Income enhance when selling

- Portfolio hedge for PMS

- Low investment requirement

- Higher potential return.

1. Forwards:

A forward contract is a customized OTC (over the counter) between two players (buyer and seller), where settlement takes place on a specific date in the future at a pre-agreed price. These are the customized contract between two parties to suit their need. These are now exchange-traded contracts.

[ Must Read – How to Calculate Turnover in Intraday Trading]

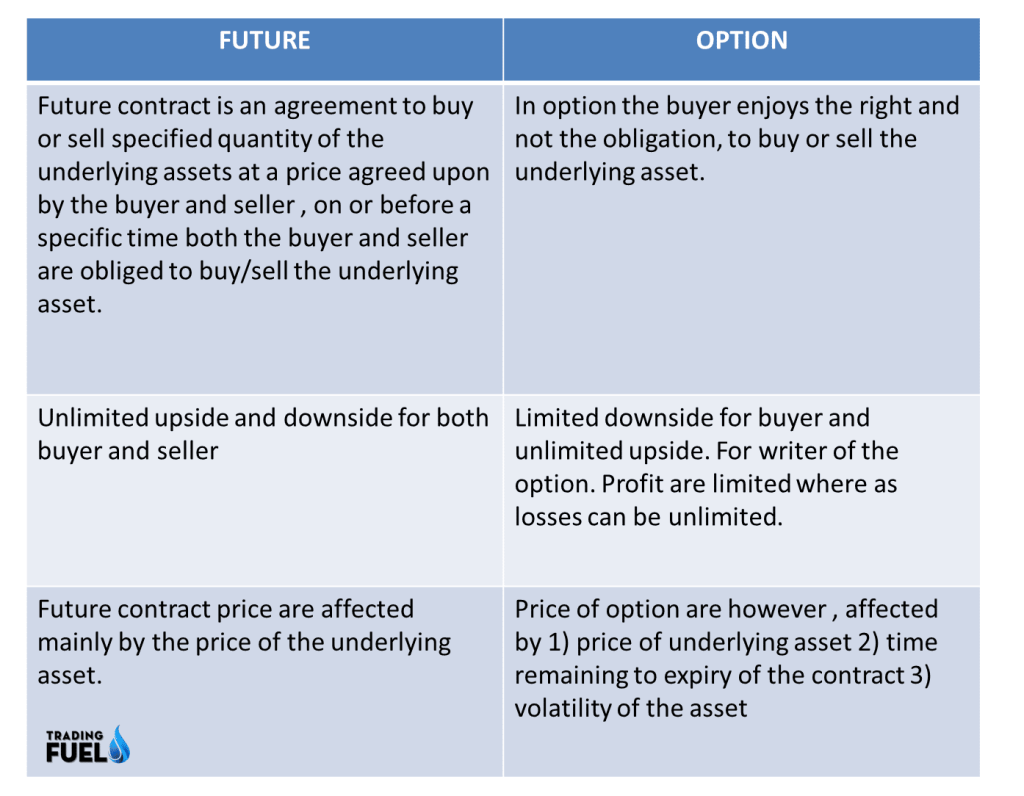

2. Future:

It is similar to a forwarding contract except that it is an exchange of trade products.

It is a contract between two players (buyer and seller) to buy or sell an asset at a specific time in the future at a pre-defined price.

Future contracts are special types of forwarding contract in contract in the sense that the former are standardized exchange-traded contracts.

3. Options:

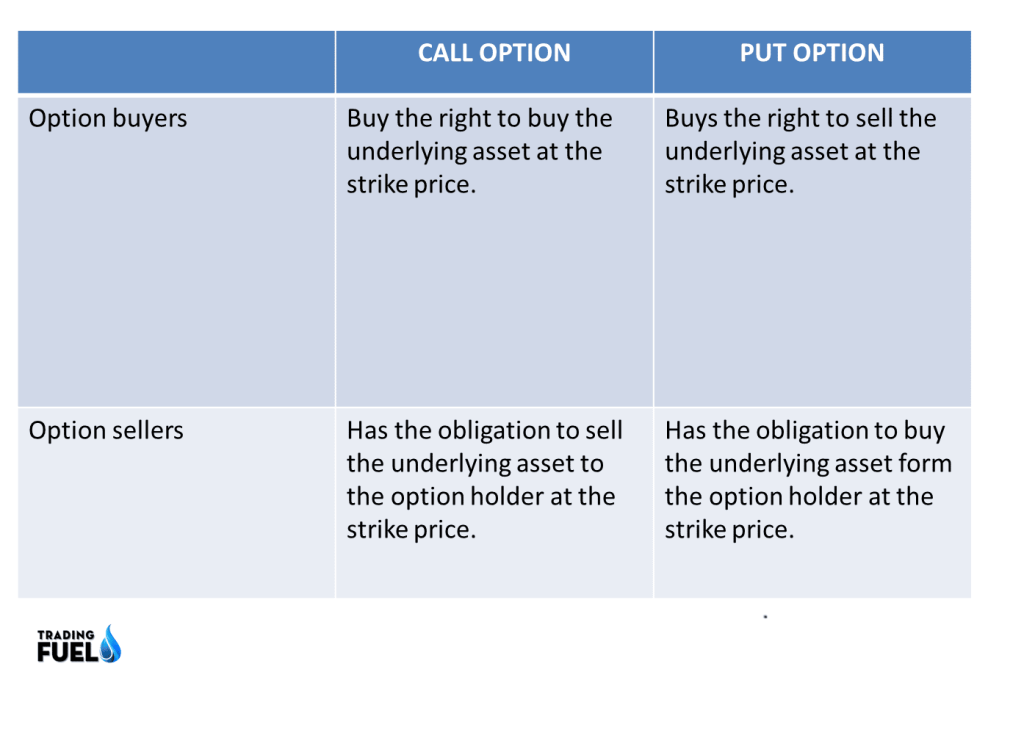

- Call and put –

A call gives the buyer the right but not the obligation to buy a certain quantity of the underlying asset, at a certain price on or before a pre-defined.

Put gives the buyer the right, but not the obligation to sell a certain quantity of the underlying asset at a certain price on or before a pre-defined period.

- Expiration date – Final date option can be exercised.

- Volatility – Risk factor of an option that determines the premium.

- American option – Option can be exercised before expiry.

- European option – The option can only be exercised at expiry.

Must Read: Is Options Trading Profitable?

Options

The option is the instrument whereby the right is given by the option seller to the option buyer to buy or sell a specific asset at a specific price on or before a specific date.

Option seller- one who writes the option. He must perform, in case the option buyer desires to exercise his option.

Call option – option to buy

Put option – option to sell

1. American option –

An American option is a kind of option that can be exercised anytime on or before the expiry date.

Strike price/exercise price – the price at which the option is to be exercised.

Expiration date- date on which the option expires.

2. European option –

The European option is a kind of option which can be exercised only at the expiry date.

Exercises date – date on which the option gets exercised by the option holder/buyer.

Option premium – the price paid by the option buyer to the option seller to acquire the right to exercise the option at his will.

Most Like: Options Strategies for Bullish Market

3. In the money option –

A call option is in the money if its strike price is below the current market price of the underlying, for example, if you brought a 14000 stick nifty call option and nifty is trading at 14200 the call option is in the money.

A put option is in the money when its strike price is above the current market price of the underlying, For example, if you brought a 15000 nifty put option and nifty is trading at 14900 the put option is in the money.

“Amateurs think about how much money they can make. Professionals think about how much money they could lose.”

–Jack Schwager.

What are out-of-money options?

A call option is out of money when its strike price is above the current market price of the underlying. For example, if you brought a 15000 nifty call option and nifty is trading at 14900 the call option is out of money.

A put option is out of money when it strikes a price below the current market price if the underlying stock. For example, if you brought 15000 nifty put option and nifty is trading at 15100 the put option is out of the money.

At the money option:

An option is at the money if the strike price of the option equals the market price of the underlying security.

The intrinsic value of the option:

Intrinsic value can be defined as the difference between the spot price and strike price, or it is also defined by the value by which the strike price of an option is in the money.

The time value of the option:

The difference between the option premium and intrinsic value is the time value of the option. Time value if directly proportional to the length of time to the expiration date of the option. Longer the time to expire high the option value.

Time value reflects the probability that the option will gain intrinsic value of profitable to exercise before its maturity.

For a call option,

Intrinsic value = current stock price- strike price

For a put option,

Intrinsic value = strike price – current stock price.

Note intrinsic value cannot have a negative value so the minimum intrinsic value is 0 for an option.

Time value = option price – intrinsic value

Let’s take an example:

If stock ABC is trading at RS 110 and the ABC 100 call option is trading at RS 15,

Premium = intrinsic value + time value

Intrinsic value = stop price – strike price

Intrinsic value = 110 – 100= 10

Premium= 15

Time value = 15-10=5:

So we would say that this option has a time value = 5 RS.

Learn Options Trading Strategies

Option trading nifty strategy

Sell ATM (call put both together) at every strike price and cover the same at the next strike price while entering into a fresh one by selling the current strike.

For example- if the nifty spot price is a 15328

Then one should wait for the level of spot price to come near the range of the strike price of either 15300 or 15400. Whichever side spot price moves first supposedly, 15300 comes first then at that point of time when the spot is at 15300 (15295-15305) range one should short sell both 15300 calls and 15300 put together.

Then one should wait for the next strike price to come. Whether the nifty price moves towards 15200 or 15400. Whichever side it reaches first say 15400. Close or cover the previous position of 15300 short sell call put both together and short sell 15400(call and put both together) and continue this cycle till the next strike price comes. Either 15500 or 15300 to take any further action.

Sell ATM (call put both together) at every strike price and cover the same at the next strike price while entering into a fresh one by selling the current strike.

For example– if the nifty spot price is at 15328

Then one should wait for the level of spot price to come near the range of strike price of either 15300-15400, whichever side spot price moves first supposedly. 15300(comes first)- then at that point of time when spotting 15300 (15295-15305)range one should short sell both 15300 calls and 15300 put together.

Then one should wait for the next strike price to come. Whether the nifty price moves towards 15200 or 15400, whenever side it reached first (say 15400) close or cover the previous position of 15300 short sell call put both together and short sell 15400(call and put both together) and continue this cycle till next strike price comes. Either 15500 or 15300 to take any further action.

Expiry day strategy

On the expiry day whenever the nifty spot price comes in a range of any strike price and likely to become ATM till the spot price comes either at 15000 or 15100. Strike, and when it reaches either of the levels, one has to buy both call and put together of that same strike price.

Premium should be in the range of 22-28 (including both call and put price together). Then one has to wait till the nifty spot moves either side up or down at least 30-35 points after entering into the trade.

Close the trade before 3:25. Don’t let exchanges close your trade on expiry day.

Big event strategy

Whenever some big event like elections, budget or announcement by some company or organization is about to happen in a day or two.

One has to buy the call and put together of the same strike price either at ATM or at ITM.

Supposedly, if the nifty spot is at the level of 15239. One has to buy a nifty call and put both together either of 15200 (call and put both) level or 15300 (call and put both) at the same time.

Wait for a day or two.

Also Like: How can I Learn to Trade in Nifty?

Either side movement can be heavily expected and exit both positions after 2-3 days.

If you are searching for an option trading beginners guide or basics of options trading then your search ends here!