Best Battery Sector Stocks in India for 2022: Batteries are considered the most essential component in any vehicle.

Batteries are generally used in each and every sector, like automotive, industrial, UPS systems, submarines, etc.

An Overview of the Battery Industry in India:

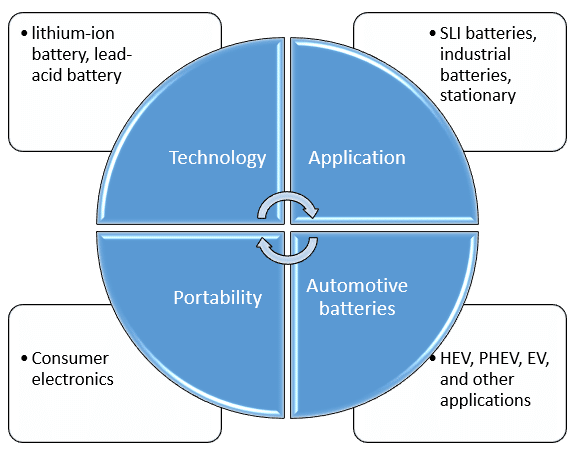

The Indian battery segment is classified into the following segments:

As per the reports, the battery sector stocks in India are about to see growth at a CAGR of more than 15% by 2030.

Today, the batteries represent at least 40–50% of the cost of the typical electric vehicle.

The government of India in the recent budget of 2022 has announced a battery swapping policy that will boost the adoption of EV vehicles.

Best Battery Sector Stocks in India for 2022

The list of the battery sector stocks is consolidated and is as described.

The following is the list of the battery stocks in India for 2022:

| Sr. No. | Stock Name |

| 1 | Exide Industries |

| 2 | Amara Raja Batteries Limited |

| 3 | Minda Industries Limited |

| 4 | Tata Power and Tata Chemicals |

| 5 | Maruti Suzuki |

| 6 | Himadri Specialty Chemical Limited |

| 7 | Hero Motor Corporation |

| 8 | Standard Batteries Limited |

| 9 | HBL Power Systems Limited |

| 10 | High Energy Batteries India Limited |

#1. Exide Industries:

- The company is primarily engaged in the manufacturing of storage batteries as well as allied products.

- The company, along with Amara Raja, contributes to around 70% of the market share in the entire battery segment in India.

- In 2018, the company entered into the domestic lithium battery business by forming a JV with Leclanche SA in the ratio of 75:25.

- The JV was established with the aim of assembling lithium-ion batteries in India in FY21.

- The main focus of the JV was on the e-transport, stationary, and specialty storage markets, as well as energy storage systems.

- As per the JV, Leclanche will provide its know-how as well as the intellectual property for the lithium-ion cells, battery management systems, and modules, and Exide Industries will leverage its sales network and its brands.

- The company has also acquired an additional stake in Leclance SA through its subsidiary Exide Leclanche Energy Private Limited.

- The same company has also acquired a 7.7% stake in its partner for 106 crores between August, 2020 and April, 2021.

- The company is totally debt-free and has tie-ups with around 100 original equipment manufacturers (OEMs) as well as carries out the testing for different prototypes.

| Stock Price | 149.20 |

| Revenue | 12,462.03 |

| Net Profit | 4683.53 |

| Earnings Per Share (EPS) | 55.10 |

Latest Price & Info: Exide Industries Ltd.

#2. Amara Raja Batteries Limited:

- Amara Raja Batteries Limited is the flagship company of the Amara Raja group.

- The company is the technology leader and is the largest manufacturer of lead-acid batteries for both industrial and automotive applications in the Indian storage battery industry.

- The batteries of the company are exported to over 32 countries across the globe.

- The company is the leading manufacturer of automotive batteries and home UPS/inverter batteries under the following brands:

- The company has also had a technology transfer agreement with the Indian Space Research Organization (ISRO) since early 2019.

- In January 2019, ISRO proposed to transfer the technology to manufacture the lithium-ion cells as a part of the government’s efforts to push electricity mobility to the Amara Raja.

- Under this transfer, ISRO will help the company to set up the lithium-ion cell manufacturing units as well as train the staff. These cells were originally developed for use in launching their vehicles as well as satellites.

- The company has the largest distribution network in India, comprising of more than 30,000+ retailers.

- With the help of the battery segment growing rapidly, the company is anticipated to be the leading player in the upcoming years which will make it one of the best battery sector stocks in India for the year 2022.

| Stock Price | 480.85 |

| Revenue | 8773.80 |

| Net Profit | 511.25 |

| Earnings Per Share (EPS) | 29.93 |

Latest Price & Info: Amara Raja Batteries Ltd.

#3. Minda Industries Limited:

- Minda Industries Limited is the flagship company of the NK Minda Group.

- The company is considered the most versatile auto component producer.

- The company is the tier-1 supplier of the patented automotive solution to the OEMs, as well as the technical leader in the automotive business component.

- The company is the first car component producer to supply electric vehicle manufacturers.

- The company is primarily focused on R&D and has a prestigious roster of EV vehicle clients.

- Minda Corporation has two separate divisions for the EV segment in the form of the EME division (Electronic Manufacturing Excellence) and the Spark Minda Green Mobility Company.

- Spark Minda Green Mobility Solutions has acquired a 26% equity stake in the charging solution’s startup EVQPOINT Solutions.

| Stock Price | 538.25 |

| Revenue | 5039.65 |

| Net Profit | 196.03 |

| Earnings Per Share (EPS) | 6.97 |

Latest Price & Info: Minda Industries Ltd.

#4. Tata Power and Tata Chemicals:

- The Tata group companies are poised to benefit from the boom in the battery space for EVs.

- Tata Power and Tata Chemicals will both derive synergy from each other to be the market leaders.

- Tata Power is fully committed to developing the EV eco-system, with the help of group companies Tata Chemicals and Tata Motors.

- Tata Power will also bring in the know-how while Tata Chemicals will henceforth provide the battery technology.

- It is also found that Tata Power has partnered with Macro Tech Developers to provide an end-to-end EV charging station in all its residential as well as commercial projects across Mumbai and Pune.

- The chargers will be accessible to all the residents and visitors who are EV owners.

- Tata Chemicals has also launched a lithium-ion battery recycling initiative as a part of its commitment to sustainability.

- The company also aims to recycle around 500 tonnes of the used Li-ion batteries to recover valuable metals such as lithium, cobalt, manganese, and nickel.

- The same has signed an MOU with the ISRO for the transfer of the lithium-ion cell technology.

- The company will soon start building the manufacturing facility for the lithium-ion cells in Gujarat.

| Company | Tata Power | Tata Chemicals |

| Stock Price | 228.45 | 858.95 |

| Revenue | 14,095.04 | 3998.86 |

| Net Profit | 2782.93 | 801.56 |

| Earnings Per Share (EPS) | 8.61 | 31.46 |

Latest Price & Info: Tata Power and Tata Chemicals

#.5 Maruti Suzuki:

- The company is the largest four-wheeler manufacturer in the country.

- It is a subsidiary of the Japanese automotive company, Suzuki.

- The company has signed a JV with Toshiba and Denso.

- In a world where everyone is going after the lithium-ion batteries for EVs, the company is looking forward to introducing hybrid cars whose batteries have a very different chemical composition to that of the lithium-ion batteries.

| Stock Price | 8739.80 |

| Revenue | 90,089.10 |

| Net Profit | 3766.30 |

| Earnings Per Share (EPS) | 124.68 |

Latest Price & Info: Maruti Suzuki India Ltd.

#6. Himadri Specialty Chemical Limited:

- HSCL is said to be indirectly associated with the EV battery stocks as it is considered to be the largest producer of advanced carbon, which is useful in making the anodes for lithium-ion batteries.

- As the acceptance of EVs is increasing, the company is also planning to increase its production capacity by 20,000 at its ACM factory, which will be used in the manufacturing of the li-ion batteries.

| Stock Price | 84.70 |

| Revenue | 1693.28 |

| Net Profit | 46.67 |

| Earnings Per Share (EPS) | 1.11 |

Latest Price & Info: Himadri Speciality Chemical Ltd.

#7. Hero Motor Corporation:

- The company is the largest two-wheeler manufacturer in the country.

- The company has now launched EVs.

- The company has signed a JV with Ather Energy for the manufacturing of lithium-ion batteries.

- The company has already acquired a 34% stake in Ather Energy.

- The company has also filed many patents regarding the design as well as the manufacturing of the batteries.

- The company has recently purchased a new EV plant in Tamil Nadu through which it can manufacture 110,000 EV scooters annually.

| Stock Price | 2813.50 |

| Revenue | 29,802.38 |

| Net Profit | 2473.02 |

| Earnings Per Share (EPS) | 123.78 |

Latest Price & Info: Hero Motocorp Ltd.

#8. Standard Batteries Limited:

- SBL is into the manufacturing of lead storage batteries for the automotive industry, as well as submarine applications and for miner cap lamps.

- Technical collaborations have been established with Furukawa Battery Company Japan, Oldham France, Oldham Batteries UK, and Hagen Batteries Germany.

- The company also supplies OEs to automotive and tractor manufacturers, where Maruti Udyog is its leading client.

| Stock Price | 32.70 |

| Revenue | 0.09 |

| Net Profit | (0.75) |

| Earnings Per Share (EPS) | (1.45) |

Latest Price & Info: Standard Batteries Ltd.

#9. HBL Power Systems Limited:

- HBL NIFE Power Systems Limited, also known as Sab Nife Power Systems, is the leading battery and power systems company in Hyderabad.

- At present, the company has three subsidiaries.

- In the year 1992, the company diversified into the manufacturing of uninterrupted power systems, which was financed by a public issue.

- In the years 1993–94, the company started manufacturing storage batteries, including sealed lead acid SLA batteries.

- In addition, the company has established 100 EOUs for the export of Nickel Cadmium batteries and another for lead acid products.

| Stock Price | 95.85 |

| Revenue | 1235.77 |

| Net Profit | 89.40 |

| Earnings Per Share (EPS) | 3.19 |

Latest Price & Info: HBL Power Systems Ltd.

#10. High Energy Batteries India Limited:

- The company is an Indian-based battery manufacturing company.

- The company operated through two segments: Aerospace Naval and Power System Batteries as well as Lead Acid Storage Batteries.

- The main products of the company include aerospace, naval, and power system batteries; lead acid storage batteries; nickel-cadmium batteries; silver chloride magnesium, etc.

- The hi-tech batteries of the company are used in the army, navy, air force, and launch vehicles.

- Its commercial batteries are useful for defense, VRLA applications, automotive, and others.

| Stock Price | 1328.90 |

| Revenue | 79.73 |

| Net Profit | 17.95 |

| Earnings Per Share (EPS) | 100.12 |

Latest Price & Info: High Energy Batteries (India) Ltd.

Conclusion:

The above is the list of the battery stocks that are all exhaustive. We hope that this will help you make better investments.

Frequently Asked Questions (FAQs)

About Us:

Trading Fuel is our official blog website where we intend to provide you with the know-how about economics, finance, stock market, and technical analysis.

~Stay tuned with us for more such stock-related blogs~