For the mutual fund houses in India, it is mandatory by the SEBI in the year 2013 to use two versions for each scheme that is direct and regular plans. In a direct plan, it helps to incur low costing while investing in a mutual fund directly. Direct and regular plans vary in returns and the long term this returns reflect a good amount of differences and so it is advisable to invest by direct plans in mutual funds.

5 The Best Mutual Fund Apps – 2022

• MyCAMS Mutual Fund

• KFinKart-Investor Mutual Fund

• ETMoney Mutual Fund

• Groww-Mutual Fund

• PayTM Money Mutual Fund

1. MyCAMS Mutual Fund App

MyCams is a type of direct investment plan application for the mutual fund. It has been awarded as the Best Financial App for the year 2015 and 2016. It is a single gateway to multiple mutual fund companies in which an individual can easily find the topmost firms for mutual funds. This platform provides zero brokerage fees and can be opened by using the Aadhar Card with having KYC. It provides safety in one’s account by providing a pin or pattern system to use it and to protect it. It takes seven days to start the digital SIP after the registration and it is not possible in any other application.

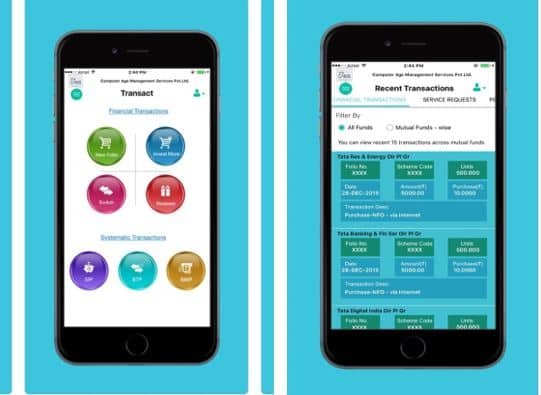

2. KFinKart-Investor

This application provides easy access to the live market news, latest news and gives complete control for trading. In this app, it is easy to manage, track and invest in multiple Mutual Funds. You can easily find the detailed information on the market, strategies and analysis, provides technical and fundamental reports making is one of the best platforms for investing. It also provides the feature to know the daily profit and loss of the trades. Another facility is that the individual can link the family’s portfolio by linking the family members PAN card number. It is also easy to track NAV of different Mutual Funds from the single platform.

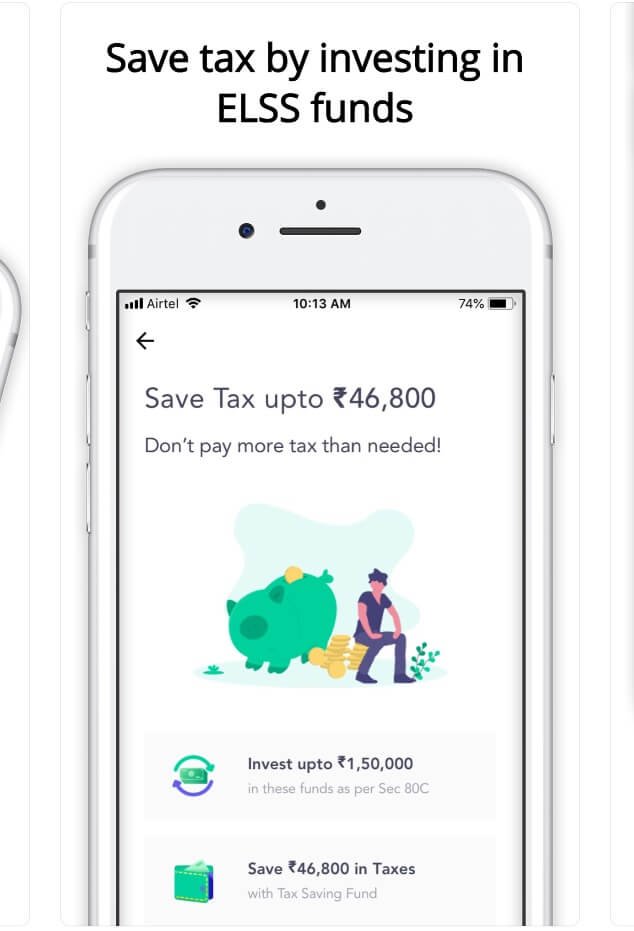

3. ETMoney Mutual Fund Apps

ETMoney is initiated by Times Of India Group, one of the best mutual fund apps. It helps you to invest in direct plans of mutual fund and also provide the facility to manage the entire spending from a particular platform. It provides zero brokerage fees for investment in the direct plans. Facilities like analysing the expenses of multiple bank account and credit cards are provided. Another option is available to invest in the gold deposit scheme and also to purchase insurance products.

4. Groww

Groww app is the fastest-growing application in the Indian Mutual Fund. In this mutual fund, it provides zero-commission in investment and also gives the option to switch the regular investment funds to direct completely free investment funds. In the app, it also gives them opportunities to buy or redeem multiple mutual funds and create a new SIP. The dashboard is provided to give track of your entire portfolio and also annualized returns and total returns. It is also recommended for the beginners as it is simple to use because it is free of cost and gives chance to complete minimum paperwork and no hassles. A wallet system is provided by the application and it requires to add fund and withdraw without signing the bank’s website.

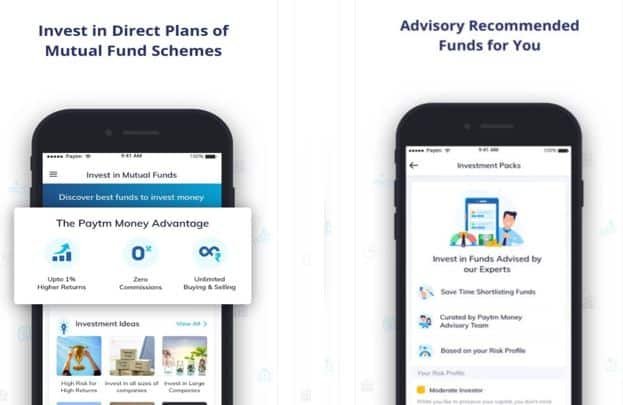

5. PayTM Money Mobile App

PayTm Money has been launched by the PayTm, which is India’s number one mobile wallet services provider company. This allows providing the direct investment plans for the mutual fund which gives chance to invest without any commission or advisory fees. The account can be opened in the existing registered mobile number and new KYC should be registered according to the scheme. It offers another feature to the customer in which it includes fully transparent tracking, manages and automates SIP investments and track etc.

About Us

We at trading fuel provide different material that covers the vast topics of finance. In trading fuel, we provide free services of many topics for which many institutions charge fees. The topics that we had cover so far includes many things about stock market which will help an individual to make decisions by practicing. For more updates and interesting topics read Trading Fuel.