Ichimoku Cloud Indicator

What Is the Ichimoku Indicator? In Japanese the meaning of Ichimoku kinko hyo is “one glance equilibrium chart”, it was […]

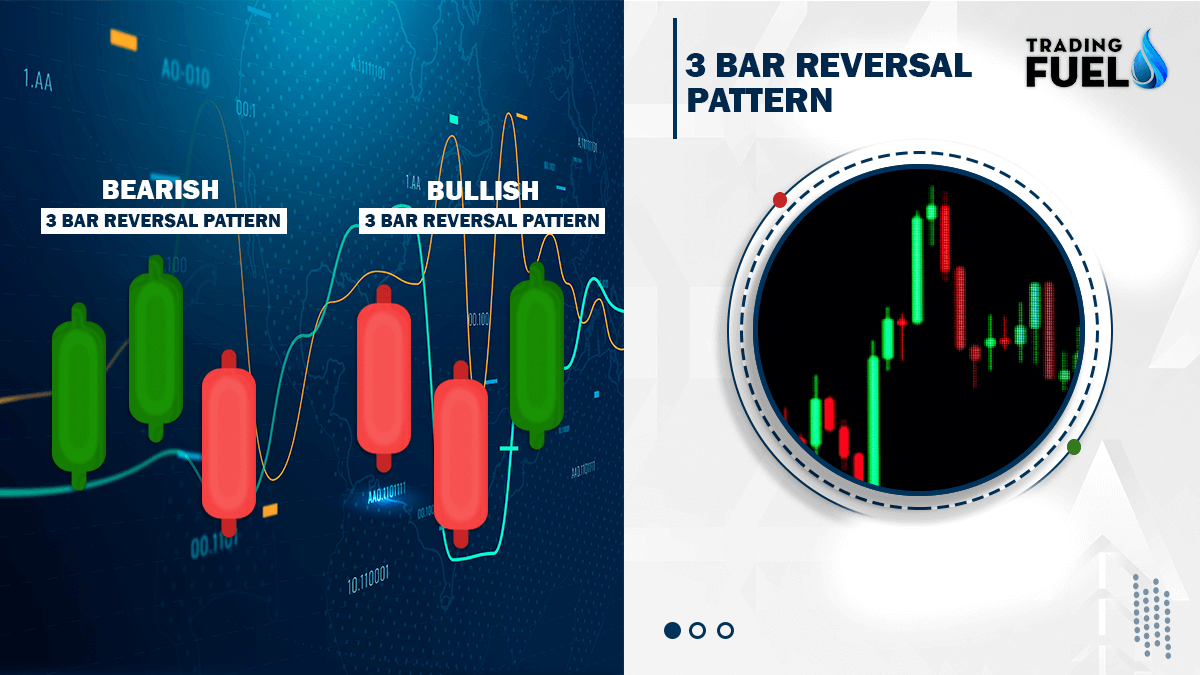

Read More3 Bar Reversal Pattern

The Three-Bar Reversal Pattern can be adapted easily for day trading. When combined with other analysis, it gives an excellent entry point for day traders.

Read MoreWhat is RSI in Stock Market?

What is RSI in Stock Market?: Relative Strength Index (RSI) is a momentum oscillator used in the analysis of financial […]

Read MoreNR7 Bar Scanner and Strategy

NR7 Bar Scanner and Strategy: The Narrow Range 7 bar (NR7) is a technical analysis pattern traders use to identify […]

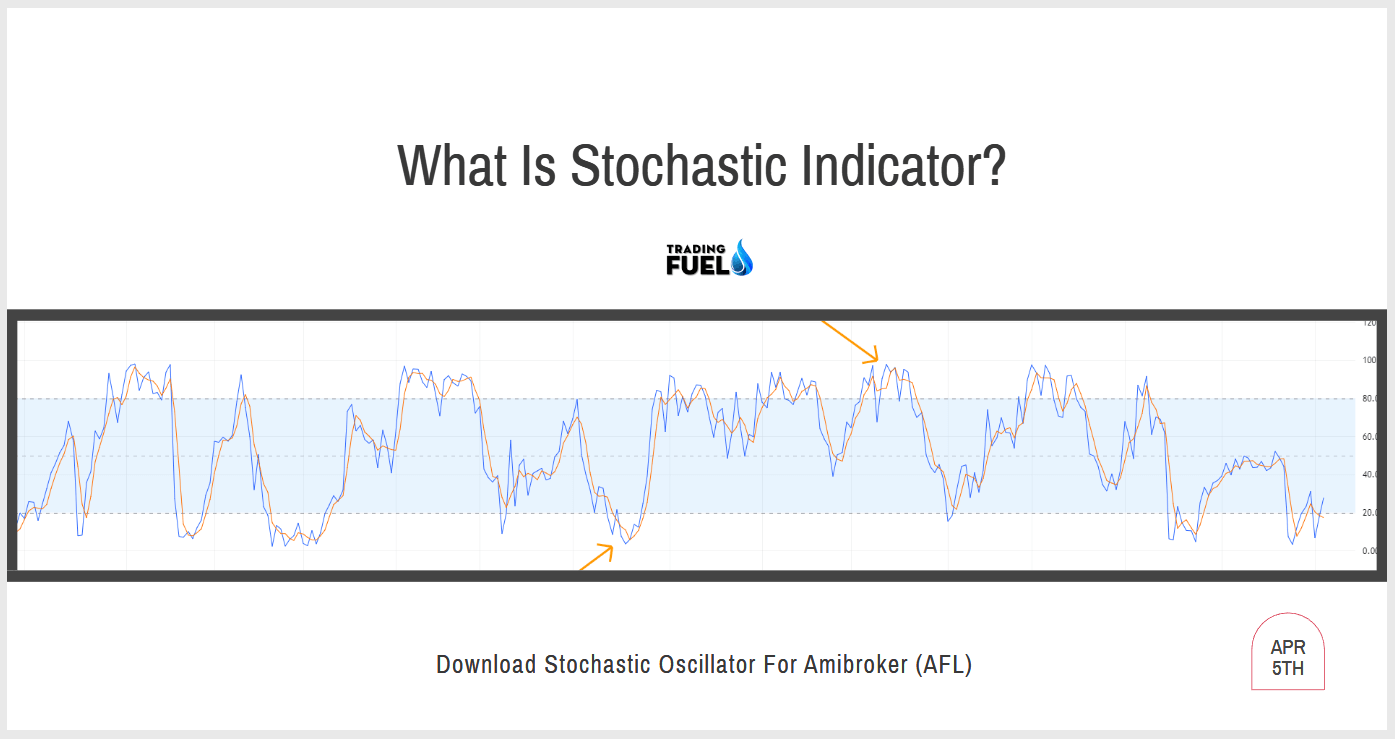

Read MoreWhat Is a Stochastic Indicator?

The Stochastic Oscillator is a momentum indicator that measures the relationship between the closing price and the range of an […]

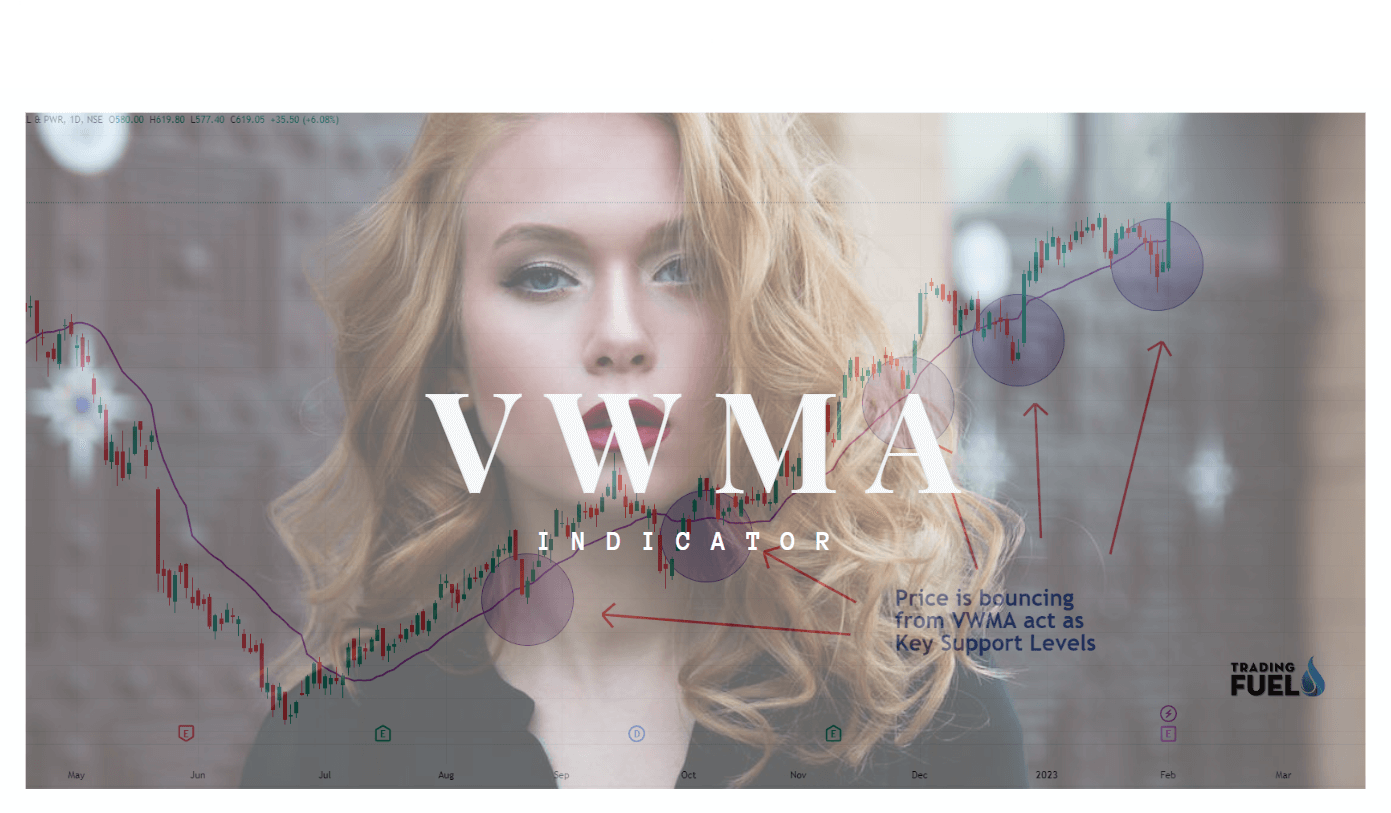

Read MoreVolume-Weighted Moving Average (VWMA)

The Volume-Weighted Moving Average (VWMA) is a popular technical analysis indicator that helps traders identify trends and reversals.

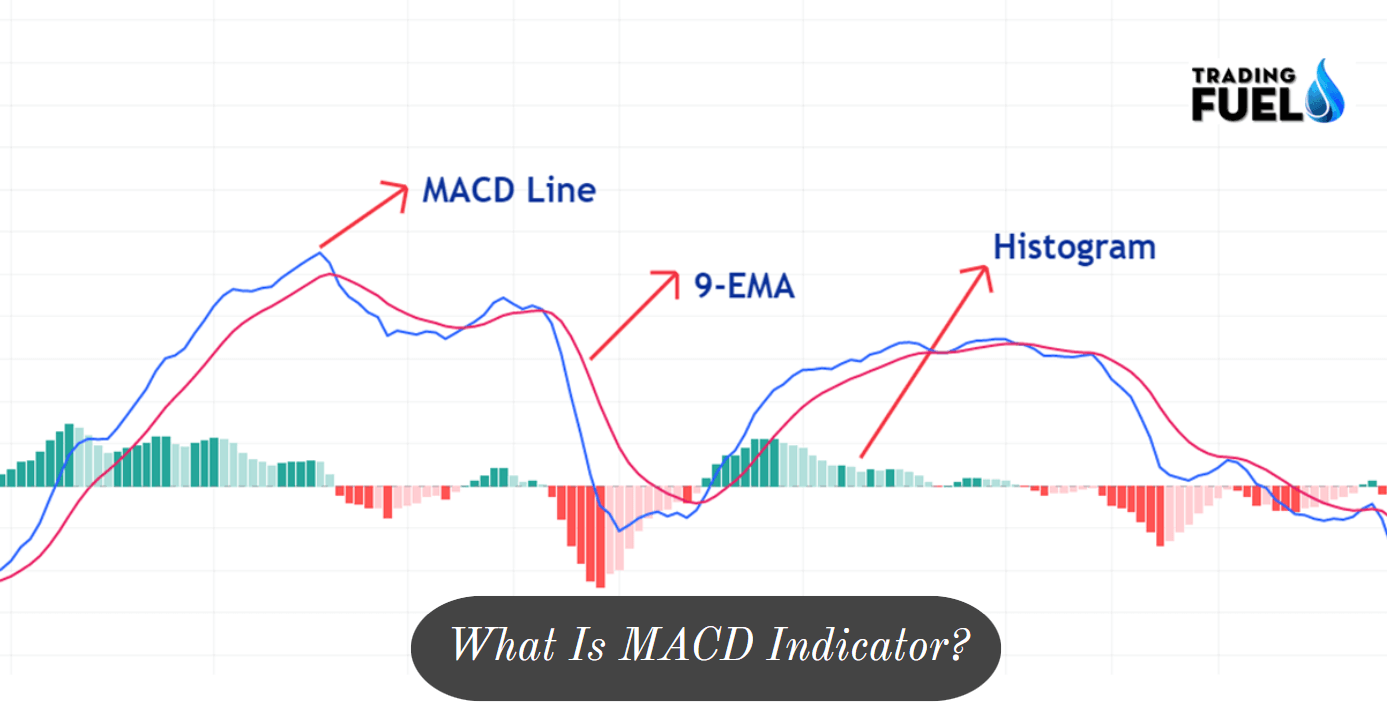

Read MoreWhat is MACD?

This guide provides you with an understanding of the MACD indicator and how to use it in your trading portfolio.

Read More