What is Face Value of Share? – Full Explanation & Example:

- When you are planning to invest in the stock market, the first thing that comes to mind is the share to invest in.

- To buy any share, you will need to know its face value.

What is the face value of a share?

- The face value of a share is the value assigned to that particular share when it was issued in the market.

- Generally, the face value of any share in the Indian Stock Market is printed on the certificate of the share.

- In stock market language, face value is the financial term that is used to describe the nominal value of any selected share.

- The face value of a share is fixed when any public firm plans to offer shares through initial public offerings (IPOs).

- Face value also refers to the price at which the shares of the company can be bought.

- Face value can also be termed the price of the share on its first day on the stock market.

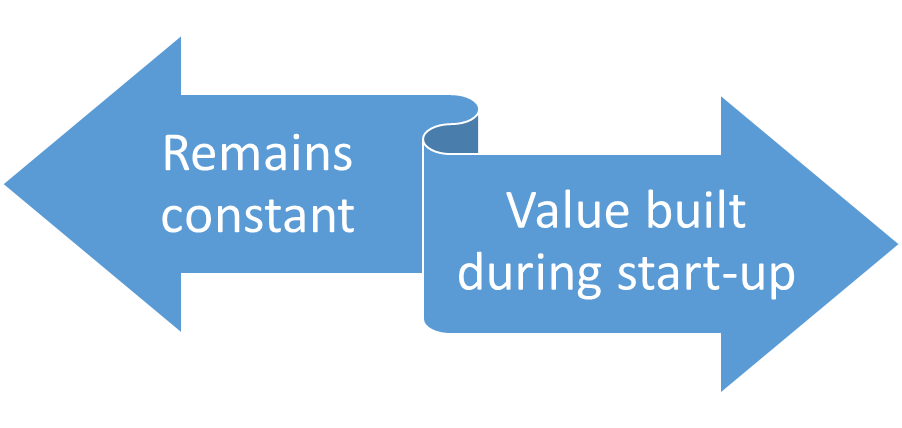

- The face value of any share can be characterized as follows:

Importance of Face Value:

- The face value of any share holds very high significance when investing in shares and bonds.

- It has high significance because it is useful in determining financial ratios as well as measurements such as earnings per share (EPS), price-to-earnings ratio (P/E), and return on equity (ROE).

- The face value is also helpful in determining the initial capital raised by the company through shares.

The following are the main important points portraying the importance of face value:

The formula of the Face Value:

- The face value of any share can be calculated as follows:

- Face Value of a Share = Equity Share Capital/Outstanding Share Numbers.

How does the face value of a share affect stock market decisions?

- When the company is issuing shares, it sells them to the investor.

- In return, the investor will get a few rights, such as the right to vote and the right to receive dividends.

Nowadays, stocks come in two forms:

- A common stock will give you a right to the assets as well as the earnings of the company.

- So if all goes well with the company, you might get rich, and if things go bad, you might end up losing your investment.

- On the other hand, preferred stock has a fixed value and will pay you a fixed dividend, so no matter what happens to the company, you will get your share.

- So if your share price is higher than its face value, many investors will tend to invest in your stocks.

Difference between Face Value and Market Value:

The common differences between the face value and the market value are as follows:

| Particulars | Face Value (FV) | Market Value (MV) |

| Meaning | The nominal value of the share at the time of issue | Current price of the share as quoted on the stock exchange |

| Price determination | Pricing of share and face value of the bond | Changes due to the trades in the stock exchange |

| Calculation | Equity share capital divided by the number of outstanding shares | Multiplying the current stock price with the number of shares outstanding |

| Price fluctuations | Market conditions will never affect the FV | Market conditions will affect the MV and this will occur due to changes in government policies, global events, and other macroeconomic data |

Conclusion:

The face value of a share is nothing but the value of the share on the day it is issued.

Frequently Asked Questions (FAQs)

The minimum face value of a share is INR 10, but most of the shares have a face value of INR 100.

The net value of the company, or the difference between its assets and liabilities, is divided by the number of shares issued, which is the face value of a share.

The par value of the bond is its face value.

In simple words, the face value is the net worth of the company at the price of the share on its first day in the stock market.

Yes, a dividend is always declared on the face value of a share, regardless of its market value.

About Us:

Trading Fuel is our learning website, where you can visit our blogs and articles and learn them free of charge. We also update them regularly with the passage of time, and we wish you happy reading.