Groww Review: Groww is a Bangalore-based brokerage firm.

It offers online flat-fee discount brokerage services so as to invest in equities, IPOs, and direct mutual funds.

It is a brand name for Nextbillion Technology Private Limited, which is a SEBI registered stockbroker and also a member of NSE as well as BSE.

What is Groww?

- Groww was established in 2016 and started as a direct mutual fund investment platform.

- In the mid-year of 2020, it expanded and began offering equity trading.

- The company, along with that, also offers the following as an investment option for its customers:

Don’t forget to check: 5 The Best Mutual Fund Apps in India

Key highlights of Groww:

The main highlights of the Groww broker firm are as follows:

- The maximum brokerage charged per trade is Rs. 20.

- Zero commission on direct mutual funds.

- It also provides investment in US stocks, digital gold, and corporate FDs.

- It has a feature to switch from a regular mutual fund to a direct mutual fund.

- It also has customer awareness through educative as well as informative blogs and eBooks.

- Instant and paperless online account opening.

Groww Charges:

The brokerage plan for Groww is as follows:

| Trading Segment | Brokerage Charges |

| Equity Delivery | RS. 20 per trade (or 0.05%, whichever is lower) |

| Equity Intraday | RS. 20 per trade (or 0.05%, whichever is lower) |

| Equity F&O | RS. 20 per trade |

- Here, you are also required to pay for other transactions as well as regulatory charges, Demat charges, and other charges in addition to the minimal brokerage.

- Other charges that Groww levies are as follows:

- Account Square Off Charges: Rs. 50.

Groww Online Account Opening:

- The company offers online account openings to its members.

- This process is simple, instantaneous, and paperless.

- Groww’s account opening is free and also has zero maintenance charges.

- It is an online broker with no branches.

Groww Trading Software:

- Groww provides its customers with the option to trade via the web and mobile.

- A trader at Groww can transact seamlessly by switching between the Groww App and the website.

- The company does not have an installable trading terminal on your personal desktop.

- It will also not offer call and trade services.

- The company initially started as a mutual fund investment platform, but in June 2020, it launched equity trading.

- The company is also working on new products such as US stocks, digital gold, and fixed deposits to be added to the web application.

- The following are the two trading programs provided by Groww:

Also Check: How to Open a Demat Account in SBI?

Groww Mobile App:

- It will allow you to trade at any time from anywhere.

- It is also offered free of charge to its customers to invest in equity and mutual funds.

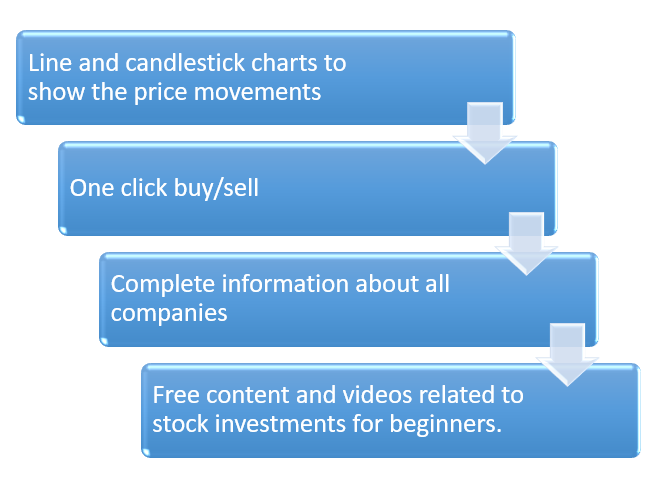

- It is a very safe and secure application with a host of features, such as the following:

Groww Website Version:

- The Groww website platform is an online, web-based trading platform.

- It provides customers with an enriching online trading experience.

- This platform will allow its clients to explore the following:

The website also has resources, eBooks, and blogs that will provide educational and general information on the stock markets.

Must Know: Top 7 Best Stock Market App

Pros and Cons of Groww:

The main advantages of Groww are as follows:

- A simple pricing model

- Direct mutual fund platform that will help you earn an extra 1.5% returns

- Zero account opening fee

- Zero Demat AMC charges

- Online IPO application

- Trading in SME shares is available.

- The option to invest online in digital gold

- Instant, paperless account opening.

The main disadvantages of Groww are as follows:

- Does not provide stock tips, research reports, or recommendations.

- Do not offer to invest in SME shares, only trading is permitted.

- Advanced order types such as BO, CO, AMO, and GTT are not available.

- Limited investment options with no other options to trade in commodity and currency segment

- No call and trade services

- No branch support.

- No margin trading facility

- No margin against shares.

- Trailing stop loss orders are not available here.

- It does not offer NRI trading.

- SME IPOs are also not available.

Conclusion:

We hope the above blog has given you an idea of the Groww reviews.

About Us:

Trading Fuel is our blog website where we give you know-how about finance, economics, the stock market, and intraday trading. Stay tuned with us for more such blogs.