- In India, around 85–90% of the traders lose their money in intraday trading.

- Those who are new to the market end up losing half of their capital because they are less aware of how the market functions.

- They are also not aware of what intraday trading is.

What is intraday trading?

- Intraday trading is the type of trading where traders buy and sell stocks on the very same day.

- Here, deliveries of stocks are not taken.

- Traders will only make money when they buy at a lower price and then sell at a higher price.

Why do traders lose money in intraday trading?

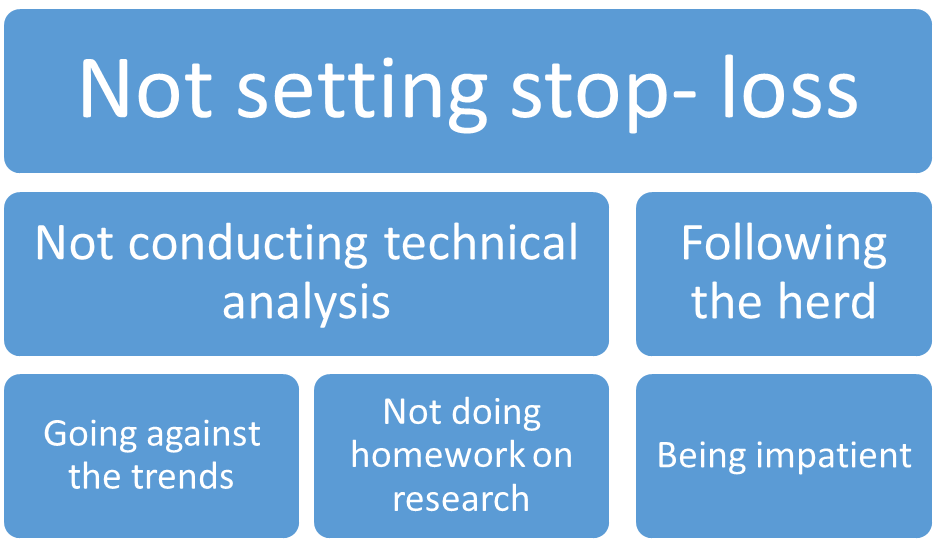

The following are the main reasons for losses in intraday trading:

Not setting stop-loss:

- Setting up the stop-loss is the most important factor in intraday trading.

- This will help you save a lot of money in one go.

- It is advisable to set a stop loss in every trade you take to minimize the risk of losses.

Not conducting technical analysis:

- Technical analysis will help you predict the future movement of stocks and the stock market as well.

- Without technical analysis, it is difficult to make profits from the market.

- Technical analysis will help you make better decisions regarding the buying and selling of stocks and, hence, save us from major losses.

Following the herd:

- Any trader who follows the herd tends to incur losses and remain unsuccessful in their trading career.

- This path is the least resistant and is typically the one that has the highest chance of losing.

Going against the trend:

- Trends are important in intraday trading because they help the traders set entry and exit points for their trades.

- All the entry and exit points are determined by the support and resistance levels.

- Hence, going against the trend means incurring losses.

Not doing homework on research:

- Not doing proper research can lead to disaster if you have no idea what your trade is or why it is moving up or down.

- This will lead to discrepancies in placing orders, leading to huge losses.

Being impatient:

- Impatient traders will often rush to take a trade without proper research and analysis of the market.

- They might feel that they will probably miss out on some big moves, and in the greed of making more money, they end up making losses.

How to avoid losses in intraday trading:

If you wish to avoid losses in intraday trading, then you will have to do proper analysis and research.

The following are the main points that help you avoid losses in intraday trading:

Keep the stop-loss discipline as part of your strategy:

- Stop losses are a key part of any trade, and it is advisable for every trader to use them.

- In simple terms, it is known as leverage.

- If you are trading a financial instrument, you set a suitable amount as leverage for risk tolerance based on your experience level.

- Too much leverage can also lead to a loss on the initial investment.

- You have to use an appropriate position size based on the capital strategy we own.

- This size has to be determined based on the capital available for trading and not based on greed.

Nobody made money by overtrading:

- When you trade too much, that does not mean that you will earn more profit.

- Markets are highly unpredictable, and nobody gets exact returns as per their needs.

- Hence, overtrading is nothing but more loss.

Timely exit from losing positions:

- On-time exit from a trade is the most important factor in intraday trading.

- This will help you take an exit from the stock at the earliest possible time.

- For example, if you think that the stock has moved against your position by a mere 2%, then it is time for you to book a loss and get out of that trade.

Conclusion:

If you follow the above points thoroughly, then there are only minimal chances for you to have a loss in the market.

Frequently Asked Questions (FAQs)

Intraday trading means buying and selling shares on the same day.

A stop-loss order is an order where the trader asks the broker to sell the stock when it falls below a predetermined level to avoid further loss.

Intraday trading without losing can be done with the help of the stop-loss technique.

Rule 90% in trading simplifies that 90% of novice traders will lose 90% of their initial capital in their first 90 days of trading.

The best rule for trading is to have a trading plan.

About Us:

Trading Fuel is our website for blogs, where we upload blogs about market conditions, taxation matters, and other economic matters in our country. Do read and comment on your experience.