Mutual Fund Sahi hai.…Bhai….

The famous advertisement for the mutual fund right.

Is Mutual Fund really a good investment opportunity?

From the advertisement and the hoardings, mutual fund house had gained a lot of attention in the finance industry.

So, are you also get attracted by the returns or the advertisement they had presented.

No worries mutual fund is safe investment method if you invest in it properly.

Many traders or the investor is not so familiar with mutual fund but to match with the competitive world in order to generate income they also want to know terms for investing.

Your problem got the solution here because this article is on “How to Buy Mutual Fund Online?”

“Mutual Fund is subjected to market risk.” Please read all the documents carefully – Every commercial of mutual fund contains this phrase and the same is implemented for our article also read carefully.

Are you ready to read the documents carefully! Okay then moving further,

If you want to know about the detailing on Mutual Fund you can also read our article on: “What is a Mutual Fund in India?”

Checklist for Online buying of Mutual Fund:

“How to Buy Mutual Fund Online?” – For the online investment in Mutual Fund, it becomes very easy and effortless procedure. Opening an online account is just a five-minute process now. Before buying the mutual fund online you need to check a few documentation beforehand like:

- PAN Card

- KYC

- Bank account

- KYC Compliant

- Personal account cancelled cheque leaf with MICR and IFSC code or bank account statements or passbook.

Now, it is mandatory for any trader or the investor to be a KYC compliant to start the investment in Mutual Funds. So the description of KYC is provided below:

- KYC stands for Know your Customer

- There is a need that it be in accordance with SEBI in order to Prevention of money laundering Act, 2002.

- The requirement for the KYC changes from time to time.

- The KYC procedure has been followed by the Mutual Fund AMC, distributors, Depositories, Stockbrokers is the same in every industry.

- KYC has to get registered with KRAs.

- KRAs is KYC Registration Agency, registered with SEBI and KRA will manage all the KYC records of the traders or investors on behalf of SEBI.

Documentation for Online Buying of Mutual Fund:

- Recent passport size photograph

- Proof of identities such as a copy of PAN Card or Aadhar Card or Passport or Voter ID or driving license. Apply Online Pan Card & Aadhar Card

- Proof of Address (POA) passport or driving license or ration card or registered lease/sale agreement of the residence or latest bank A/C statement or passbook or latest telephone bill or latest electricity bill or latest gas bill, which should be older than three months.

- These copies have to be self-attested and then an IPV, in-person verification is done where these documents are verified with the originals.

Once that you had registered your KYC either physical or electronic mode, the next step is to choose where you want to invest in online or offline.

As the online mode is very popular among these days still few people believe and has trust in the offline process while filing up the form and submitting the documentation.

The disadvantage for investing offline is that every time you need a statement to know the current value of the investment or to want to redeem the funds for any of the small requests you need to approach the nearest branch.

Most of the times, when people don’t keep a track on their investment through the online process they end up losing money as for them the offline process becomes difficult and inefficient.

Benefits of Online Investments in Mutual Fund:

- Secured way of Investment

- Online Tracking of the investment

- Can check the status of the investments

- Easy to use

- Purchase NFO and NPS online

- Easy to transfer money

- Investment statement

How to Buy and Sell Mutual Funds?

We had already made the checklist in the start, so let’s begin investing in the mutual fund.

You have two ways to invest in the mutual fund

- Through Net Banking

- E-mandate

Net-banking is the procedure that is useful for both the SIP and lump-sum and for this it is mandatory to have the net banking and for the bank, it is mandatory that they have the SIP facility for ECS.

The first payment should be done with net banking login however for the funds to the deduction from the account it is necessary to register the Unique Registration Number (URN) in your net banking.

How to register URN?

Below is the process to register the URN number in the bank account:

- Login to your net banking account

- Click on Bills/Biller/Bills and Pay

- Register New Biller

- Choose the business category as Mutual Fund

- Choose the mutual fund AMC used for the investment

- Enter the URN number received in the e-mail id and mobile number in the message box

- Select “Auto Pay” option and enter the amount that will be deducted automatically debited every month

- Enter the User Id and transaction password, click on add to complete the process.

What is E-mandate?

E-mandate allows to electronically authorize the debit order to the bank. In short, it helps you to allow the bank online for the debiting of the SIP investments.

It uses an electronic validation instead of a physical signature and is offered directly by the individual banks.

Benefits of E-mandate

- It is an online and paperless process of registering Online One Time Bank Mandate.

- This registration can be done by all the individual traders or the investors through the Aadhar Card with the help of One Time Password (OTP)

- This facility will be available with your bank account that should be linked with Aadhar card.

- The traders or the investors signature will be captured digitally

- This is the quick and hassle-free online one time Bank Mandate Registration.

How to Buy Mutual Fund Online?

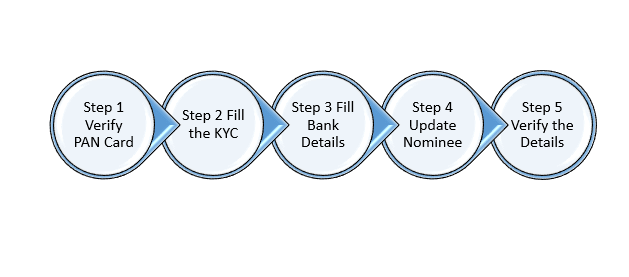

There are 5 steps for buying Mutual Fund Online:

Step. 1

Verify the PAN Card for KYC if you are not KYC registered then first complete your KYC.

Step. 2

Fill the KYC and Foreign Accounts Tax Compliance Act details

Step. 3

Bank details: Be careful and fill the correct details as this bank account will be used for future payment.

Step. 4

Update nominee

Step. 5

Verify the details and then confirm and after that, you can start investing.

About Us

This blog is about “How to Buy Mutual Fund Online?” and we had written this in brief and in easy language. This article has brief detailed information about the steps of buying the mutual fund online. Trading Fuel is the leading pioneer for one of the site that is regularly updating on the topics of the financial world. Hope you liked our blog and you can share your feedback through the e-mail id. Stay updated and read more from our site.