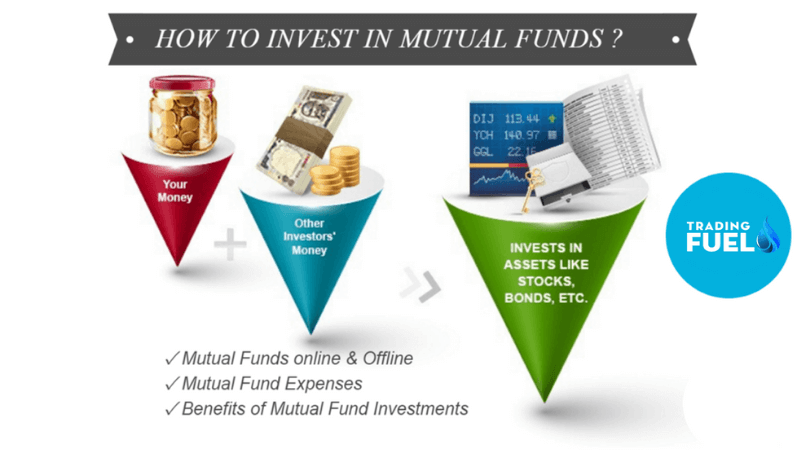

Do you know How to Invest in Mutual Funds for Beginners? If you are an active investor or beginner, you would surely look to diversify your investment portfolio for maximum returns. However, stock market investment requires tracking the ups and downs of the shares. A lot of considerations are required to decide which share you should buy and which you should sell off. Hence, when you want to invest for good returns without giving your significant time, mutual funds are the best option.

Mutual fund investment is a process where an Asset Management Company brings money from several investors and invests in various instruments. It generally invests in securities, money markets, equity, and debt.

How to Invest in Mutual Funds Online:

Online Mutual Funds investments save your time spent on the paperwork and research. The online process of a mutual fund is to be carried out at the website of the mutual fund company. Here is a step-wise procedure to invest online in mutual funds.

- Complete your KYC formalities.

- After applying for MF with the company, complete the registration process.

- Get your unique login name and password.

- Select the scheme online and provide your basic details.

- Complete the application form and submit it.

- Confirm the new purchase and complete the payment transactions.

However, remember that all mutual funds do not allow investors to invest through the online mode. You need to complete the registration process first.

You also like: How to Choose the Best Mutual Fund?

How to Invest in Mutual Funds Offline:

The offline investment in mutual funds requires you to submit the physical form.

- Select the scheme to invest

- Download a form from the official website or get it manually from the mutual fund company.

- Provide all your details in the related fields.

- Enclose a payment cheque.

- If KYC is not complete, provide KYC details.

The mutual fund company will allot you the MF account number or the portfolio number.

What Are The Mutual Fund Expenses :

For easy understanding, we elaborate mutual fund expenses in two types; namely one-time charges and recurring charges.

One Time Charges

- Entry load – This is charged when you purchase the units. Currently, it is not charged.

- Exit load – It is charged when the mutual fund company buy back the units. The charges depend on the scheme and the holding period.

- Transaction Charges – One-time charges applicable only for the investment above Rs. 10,000/-

Recurring Charges

The recurring charges are ongoing fund-running expenses charged on your daily net assets. It is charged as per the prescribed structure for rates.

Benefits of Mutual Fund Investments :

Right from their inception, mutual funds are a popular instrument of investment. It allows investors to invest with minimum time, money, and knowledge. The mutual funds offer benefits of economies of large-scale investment by the company. Your portfolio is managed by a professional manager and you don’t need to analyse and research the stocks. Mutual funds are less expensive compared to the services of the brokerage firm. A little careful management will let you keep your expense on mutual funds low. With mutual funds, it is much easier to diversify your investment portfolio.

The profit earned by the AMC is later on dividends among the investors according to their portfolio after certain deductions. Since it is a regulated body under the Association of Mutual Funds of India, it is a safe way to invest.

Blog By, Trading Fuel