How to invest in the share market for Beginners?:

- Investing in the share market is a very long-term process, which will indirectly help us in managing our finances.

- In the very initial phase, investing in the stock market might look scary or risky as we have no knowledge of the same.

- When we compare stock investments with those of fixed deposits, we know that investing in stocks has resulted in a higher rate of return.

- This blog will give a beginner’s guide to understanding the share market as well as help you with investing.

What is the Share Market?

- A share market is a market where there is an ample exchange of financial instruments like bonds, equities, stocks, commodities, etc.

- There are two primary share markets in India: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

- The NSE is for 90% of cash traders.

- For powerful trading, there are several other exchanges in India like the Indian Energy Exchange (IEX) or the Multi Commodity Exchange (MCX).

- All the activities of the stock market, such as financial trading, are regulated by the Securities and Exchange Board of India (SEBI).

- Apart from this, these exchanges will also manage the indices like the NIFTY and the SENSEX.

- If we look at the general meaning of an index, then an index is nothing but a basket of stocks that tend to represent their particular sector or industry.

- The NIFTY is a basket of the top 50 stocks by market capitalization that are listed on the NSE, and the SENSEX is a similar index but owns 30 stocks that are listed on the BSE.

- Our share market indices are often used to benchmark the performance of fund managers and other stocks.

- If we take an example where a mutual fund that benchmarks its performance to NIFTY did 15% returns this year and NIFTY did a total of 25% returns, then the mutual fund actually underperformed against its benchmark. This also means that it is better to just buy those 50 stocks from NIFTY instead of relying on the fund manager’s expertise.

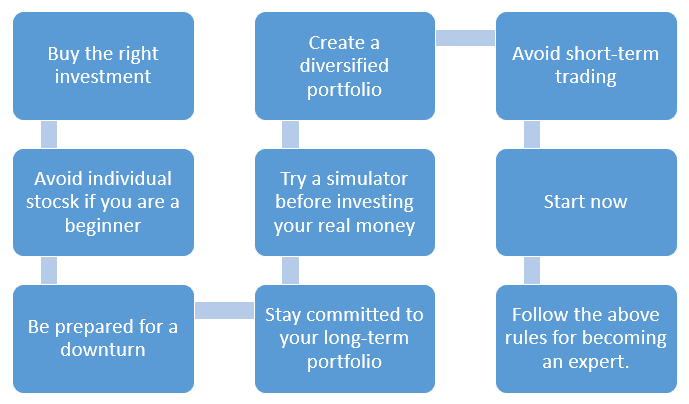

How to Invest in the Share Market for Beginners?

You are not directly allowed to buy or sell in the share market directly.

For trading in the share market, you might need a broker, or you can rely on the stock brokerage companies that allow you to trade using their platform.

The entire process is very simple:

- To start the investments, you have to first open a trading account with a stock broker or any stock brokerage platform. A trading account will help you to actually “trade”, or simply where you can buy or sell orders.

- The broker or the stock brokerage firm will in turn open a demat account for you where you can hold all of your financial securities in your own name.

- The demat account is then linked to your bank account so as to have an easy free flow of money.

- To open a trading or a demat account, all you need to do is provide your Know Your Customer (KYC) document that will include verification through government-authorized identity cards such as PAN Card or Aadhar card.

- In recent times, all the brokers or brokerage firms have an online KYC platform where your account can be opened in just a couple of minutes or at most within a day after digitally verifying every document you upload.

- After you open your account, you can trade online in person, through your broker via a portal, or through phone calls.

What are the ways through which you can start investing in the share market?

There are several ways through which you can invest in the share market.

The following are the ways you can invest in the share market:

#1) Buy the right type of investment:

- It is very easy to say that you need to buy the right stock.

- Everyone can check that a particular stock has underperformed in the past.

- But it is very difficult to anticipate the performance of a stock in the future.

- If you wish to succeed by investing in individual stocks, you should be prepared to do a lot of homework regarding analyzing the company and managing the investments.

- If you start to analyze the company, you will have to look at the company’s fundamentals like earnings per share (EPS) or the price-earnings ratio (P/E Ratio).

- Your analysis should not stop here because, over and above this, you will need to evaluate the company’s management team, study its financials like the income statement and balance sheet, and evaluate its competitive advantage.

- You cannot invest in any company because that company is your personal favorite.

- Putting a lot of faith in the past performance of the company won’t always fetch you good returns.

- What you really need to do is to study the company and study the same for what will come next.

#2) Avoid individual stocks if you are a beginner:

- A very good alternative for individual stocks is an index fund, which can either be a mutual fund or an exchange-traded fund (ETF).

- These funds tend to hold dozens or even hundreds of stocks.

- And every share you purchase will own all the companies included in the index.

- Sometimes, people have got a very unrealistic opinion about the kind of returns in the stock market, while sometimes they confuse luck with skill.

- You can be lucky sometimes if you pick an individual stock, but that is not possible all the time.

#3) Be prepared for a downturn:

- The most difficult issue for investors is to bear the loss that will occur in their investments.

- The stock market is continuously fluctuating, so there are chances that you have to bear a loss from time to time.

- It is a very common factor that from your 100% investment, you have to give 30% to the share market and the remaining 70% is your profit.

- In the year 2020, during the COVID time, the entire market went down, and so like this, you need to prepare yourself for a downturn that can come out of nowhere.

- The concept of market volatility is difficult for new and, at times, experienced investors to understand.

#4) Create a diversified portfolio:

- Diversification is very important because it will reduce the risk of any one stock in the entire portfolio, which is hurting the overall performance, which in turn will improve your overall return.

- For example, if you invest in funds based on the S&P 500 index, you will own stocks in a variety of industries.

- What diversification actually means is that the investments can be spread among different asset classes because stocks in similar sectors may tend to move in a similar direction for the very same reason that particular stock is moving.

#5) Try a simulator before investing real money:

- One of the best ways to enter the share market without any risk is to use a stock simulator.

- A stock simulator is nothing but an online trading account with virtual money where your real money won’t be put at risk.

- The best stock simulator app that is often used is Neostox.

- You can get the same stock simulator from here- https://bit.ly/3Imiq91.

- After practicing in simulators, you can definitely ask yourself whether investing is your cup of tea or not.

#6) Stay committed to your long-term portfolio:

- Investing should always be a long-term activity.

- For the long-term investment, you will need patience.

- A pro-tip for investing in the long term is to never look at your portfolio quite often because continuous viewing might make you nervous or delighted.

- It is very important for beginners to mark a date on the calendar to evaluate their portfolio.

#7) Avoid short-term trade:

- Short-term investors have a very unrealistic opinion about how they should grow their money.

- Most short-term traders or day traders tend to lose money quickly because they are competing against high-powered investors that understand the market in a far better way.

- When you are investing in the short-term, it is possible that you won’t get the money when you most need it.

- All beginners should understand that frequent buying and selling of stocks can be expensive, even if their broker’s tagline states that the brokerage commission is zero.

#8) Start now:

- You will never know when the right time to invest in the market is.

- One of the main aspects of investing is to not think about it but to just get started.

- It is very essential to get started with a savings program so that you can reach your goal on time.

#9) Follow the above rules for becoming an expert:

- For beginners, all you have to do is to follow the above criteria which will one day make you an immediate expert in your own field.

How does the stock market work?

- Stock prices in the market fluctuate due to the demand and supply for the stocks that arise.

- Here, buyers are expecting their stocks to rise, whereas sellers expect their stocks to fall, or at least not rise more.

- A company with increasing sales and a large profit margin will most likely see its stock price rise, whereas a company in decline will see its stock price fall over time.

- The key point here is that investors will price the stocks according to their expectations of how the company will perform.

- The market is forward-looking; some experts say that the market is anticipating events that are about 6–9 months away.

Pros and cons of investing in the share market:

It is very important for beginners to know the pros and cons of investing in the share market.

The main advantages and disadvantages are as below:

| Pros | Cons |

| Easy to buy | Takes a lot of research time |

| Liquidity | It competes with institutional and professional investors |

| Grows with economy | Risky like COVID fall |

| Stay ahead of inflation | Shareholders of all the falling companies are paid last |

| Income is generated from price appreciation and dividends | There are emotional ups and downs |

| Won’t require a lot of money to start investing | Taxes are applied to all the profitable stocks. |

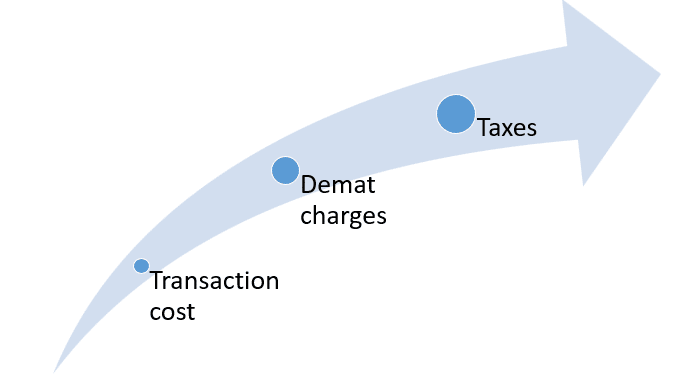

What are the charges that you need to bear while investing in the share market?

Typically, there are a few changes that we need to bear.

The following are the charges that we need to pay while investing in the share market:

1. Transaction cost:

- All the brokers are paid a fixed brokerage, which is nothing but a fee they charge to facilitate the trade.

- Apart from these fees, on every transaction, you are required to pay government charges like the STT, GST, SEBI charges, etc.

2. Demat charges:

- Demat accounts are operated by the central securities depository like the CDSL or the NSDL.

- They charge a very nominal fee that ranges from INR 100 to INR 750.

3. Taxes:

- You are charged a percentage of tax on all your profits.

- For long-term stocks, you are required to pay long-term capital gain tax, which is at 10%.

- Short-term stocks bear the short-term capital gain tax, which is at 15%.

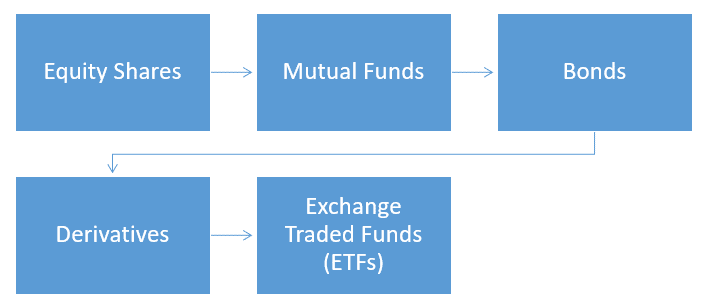

What can you invest in the share market?

There are multiple options available for investment.

You can invest in any of the following:

How are the stocks categorized?

Based on the market capitalization, stocks are categorized into 3 broad areas.

They are as follows:

1. Large-cap stocks:

- SEBI has defined large-cap stocks as the top 100 stocks by market cap.

- These companies are the largest in the country by revenue and are well-established market leaders in their own respective industries.

- They are less risky, but they don’t grow as fast as the mid and small-cap stocks.

2. Mid-cap stocks:

- SEBI has defined mid-cap stocks as stocks ranked among 101–250 by market cap.

- They are considered risky as compared to large-cap stocks but less risky as compared to small-cap stocks.

- These companies have high growth potential, and they might disrupt the large company or grow into a large-cap.

3. Small-cap stocks:

- SEBI has defined small-cap stocks as those stocks that are ranked below 251 by market cap.

- These stocks are quite risky compared to the above two.

- These stocks are also considered less liquid because there aren’t many buyers or sellers as compared to those of large or mid-cap stocks.

Conclusion:

It is a lifelong skill to invest in the share market. For all beginners, it requires a lot of patience, time, and study. You can work for your own money and achieve your goals.

Frequently Asked Questions (FAQs)

About Us:

Trading Fuel is our blogging website where we enrich you with details about the stock market, intraday trading, economics, and finance. We hope that you like our blog “How to invest in the Share Market for Beginners?”.

~Stay tuned with us and happy reading our blogs~