Why New Traders Should Start With Price Action Trading

- In price action trading all the trading decision is based on the chart analysis only.

- A chart for a specific time frame reflects the market sentiment in the form of price action.

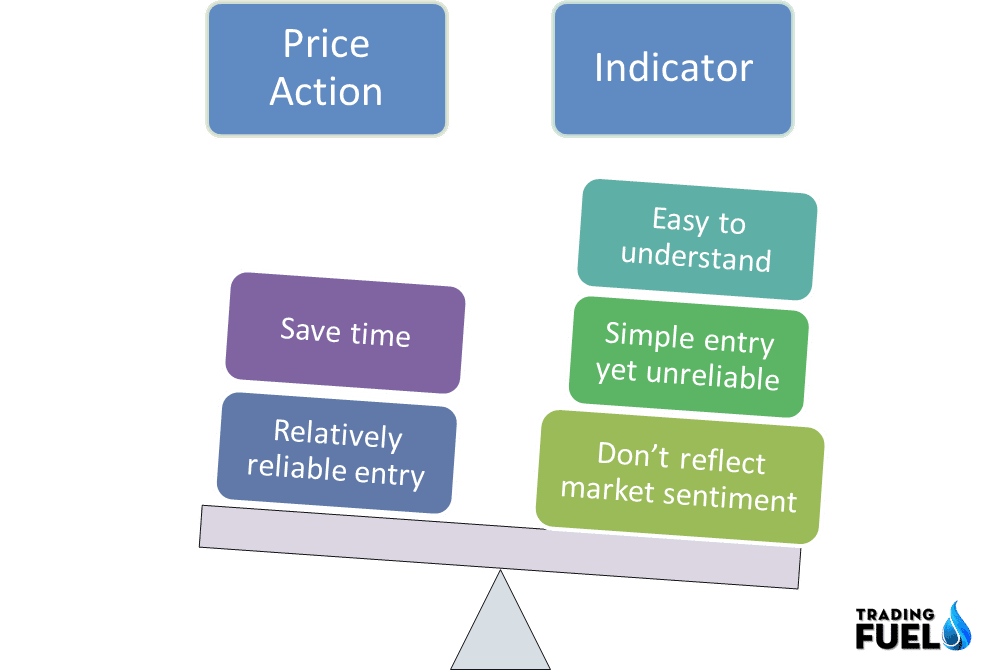

- Price action trading vs. An indicator which is a better trading indicator is discussion as old as trading itself.

- Technical believe that news and economic data are a key catalyst for price action movement.

- Technical trader assumes that there is no need for fundamental analysis, to judge the price movement.

Price Action Trading save time:

- Becoming a professional trader is a long journey it takes many years to develop the required skill set.

- Initially one must focus on analyzing and studying the market price action allows you to just do that.

- Price is simple to understand and it helps you to avoid the necessary distraction of the Holy Grail system of the indicator.

- If you are focusing only on the price to analyze the market behaviors it will speed up your process.

- If you start with indicator first you need to understand the mathematical formula behind them and then to subscribe to the charting platform having that particular indicator.

- A new trader will waste his time trying to learn different indicators and trying to find a perfect setting for his indicator.

- With indicator trading, a beginner wastes much of his time in finding a Holy Grail system rather than focusing on how to learn market behaviors.

Price Action Trading encourages the correct attitude:

- For beginners, the technical indicator may look easy as it gives simple buy and sell signals.

- Example trading with RSI, as RSI gives buy signal below 30 which is an oversold state of price. The next step is to sell then RSI reaches the level of 70.

- The technical indicator strategy may seem simple and neat but it is not.

- Beginner using indicator cause them to focus on trading signal, rather than focusing the market behaviors it is a wrong start in the trading profession.

- For beginners, the first thing to learn is not when to trade but to develop an understating about the market, as indicators give straightway buy and sell signal without giving any clue about the market condition.

- New trader must-have skills to observe and analyze the market so that he can recognize the market condition.

- To be a successful trader you must develop the skill to read the market.

- Indicator give selected entry at some definite level, whereas price action trader knows if he gets the market trend right there are dozens of ways to take entry at the market.

Price Patterns highlight trade risk.

- A price action trader use some particular price pattern to enter the market such a pattern has implied stop loss level

- Example: a bearish price pattern suggests that the market will fall, hence the market should not rise above high, and such specify levels are taken as stop loss level.

- Here when the market rises above the high of our pattern, we knew that our pattern has failed and it’s time to cover our position.

- Each price pattern has a stop loss level based on its construction.

- However, indicators do give an entry signal but fail to give us an invalidation point, at which our stop loss be triggered.

- Example: if you have brought an asset at an oversold level, then there is no invalidation point which tells us that our trade is in the wrong direction.

The indicator is lagging in nature.

- The technical indicator is lagging in nature.

- An indicator takes past price action and applies a formula to it, then graphically represents its result.

- As indicator oscillates between the upper and lower level and fetches data form a predefined period in setting, so it fails to reflect the overall sentiment of the market and represents the data for that selected period only.

- You have the advantage of spotting a new tend at its initial phase while trading with price action.

- If you are using indicator they tend to give delay signal because of their lagging nature.

- Only after a trend has shown a significant move, the indicator will give a trend reversal signal.

Know More About: Best Intraday Trading Indicators

Trading Fuel Lab

Positive Point regarding indicator.

- The professional trader did use indicator it is a wrong statement, using an indicator or not is a personal preference.

- Indicators can save time and they look at a very specific aspect of chart like momentum indicator will only focus on analyzing the momentum as it helps a trader to process data faster.

- There is no better or worse if you compare price action vs. technical indicator it all depends on how a trader utilizes his trading tools.

Conclusion:

In this article of ” Why New Traders Should Start With Price Action Trading” we have discussed the major difference between pure price action trading and trading based on indicator.it is better for a beginner in the long run if he develops the skill of price action trading as it gives us insight about the market condition. An indicator is not useless one can use them in conjunction with the price action and enhance their accuracy .but as always the trader himself is the most important part of a profitable trading system, as he is the one who analysis and study the market so he must have a right mind-set.

Contain & Image ©️ Copyright By, Trading Fuel Research Lab