NR7 Bar Scanner and Strategy: The Narrow Range 7 bar (NR7) is a technical analysis pattern that traders use to identify significant price moves in the market.

It is formed by identifying seven consecutive bars (candlesticks or bar charts) with the narrowest range of any seven consecutive bars over a specified period of time.

The narrow range of these bars signals indecision among traders and little buying or selling pressure, which could indicate a potential move in the market.

Traders look for a break of the high or low of the NR7 bar to confirm the breakout, with a break of the high signalling a bullish trend and a break of the low signalling a bearish trend.

The NR7 trading strategy allows you to profit from market volatility by identifying the narrow range bar (NR7) that precedes a significant price movement.

This is similar to finding the calm before the storm, as the quiet period before an explosive market move can be used to your advantage.

By adding a trend rule to this strategy, you can also find low-risk trades with a higher potential for success. The NR7 is a bar with a smaller range than the preceding six bars, indicating a range contraction before a potential range expansion.

How to Identify NR7 bar?

Finding the Narrow Range 7 bar (NR7) pattern involves the following steps:

1. Determine the time frame:

Choose the time frame for which you want to analyse the NR7 pattern. It can be any time frame, such as 1 minute, 5 minutes, 1 hour, or daily. A daily time frame is an ideal selection.

2. Identify the seven bars:

Look for seven consecutive bars that have the narrowest range of any seven consecutive bars over the selected time frame. The narrow range is defined as having a smaller difference between the high and low prices compared to the previous six bars and the next six bars.

3. Measure the range:

Measure the range of each of the seven bars by subtracting the low price from the high price.

4. Compare the ranges:

Compare the range of each of the seven bars to the ranges of the previous six bars and the next six bars. If the range of the seven bars is narrower than any of the other ranges, it qualifies as an NR7 pattern.

You also like: Top 10 Intraday Trading Techniques

Confirm the trend reversal:

Once the NR7 pattern is identified, look for a break of either the high or low of the NR7 bar. If the high is broken, it signals that the trend is bullish and that prices are likely to rise. If the low is broken, it signals that the trend is bearish and that prices are likely to fall.

Nowadays tools and indicators are available online that directly tell you the NR7 bar is formed.

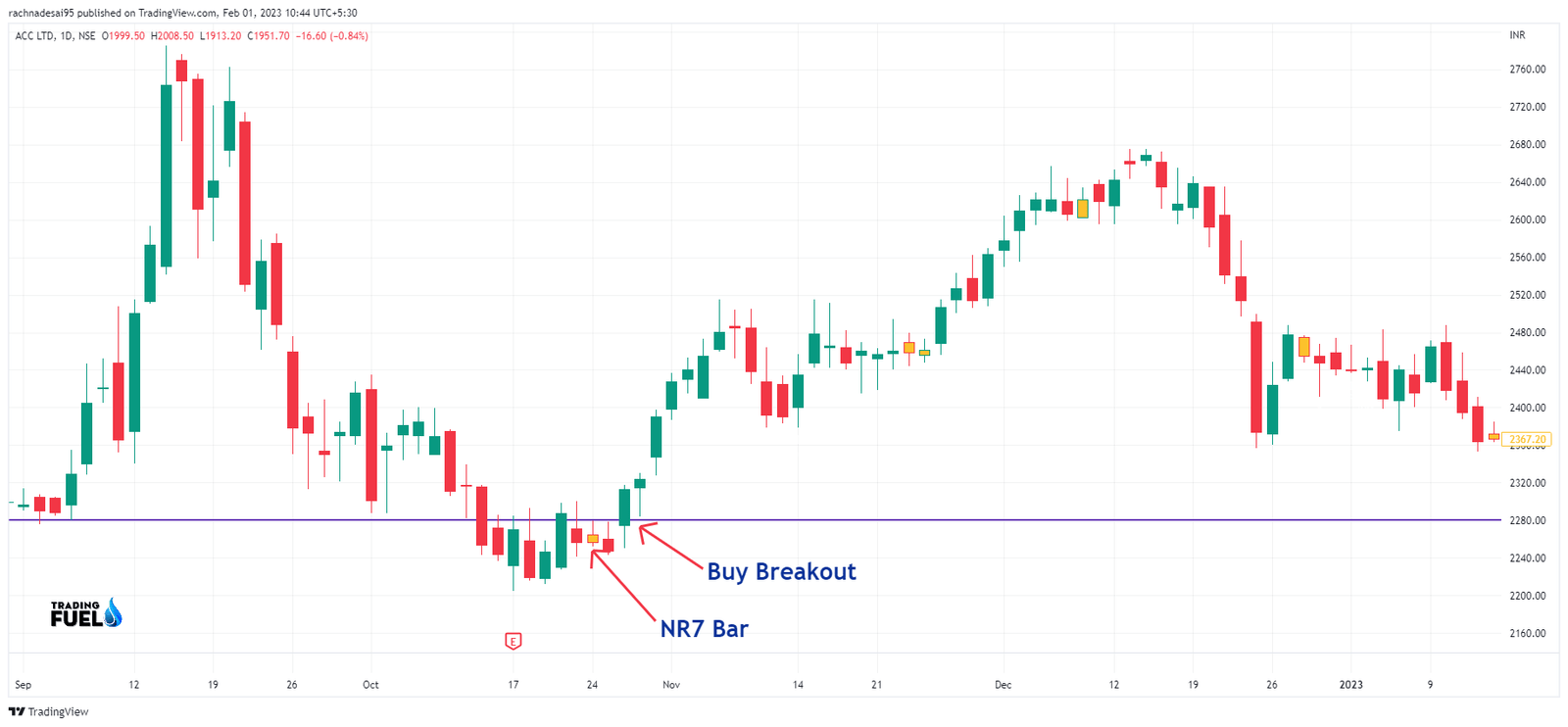

NR7 Bar Buy Example:

- Find NR7 bar. Here the yellow candle is NR7 bar

- If the price breaks above the bar go for a long.

- Put stop loss below the low of NR7 Range or low of the breakout candle.

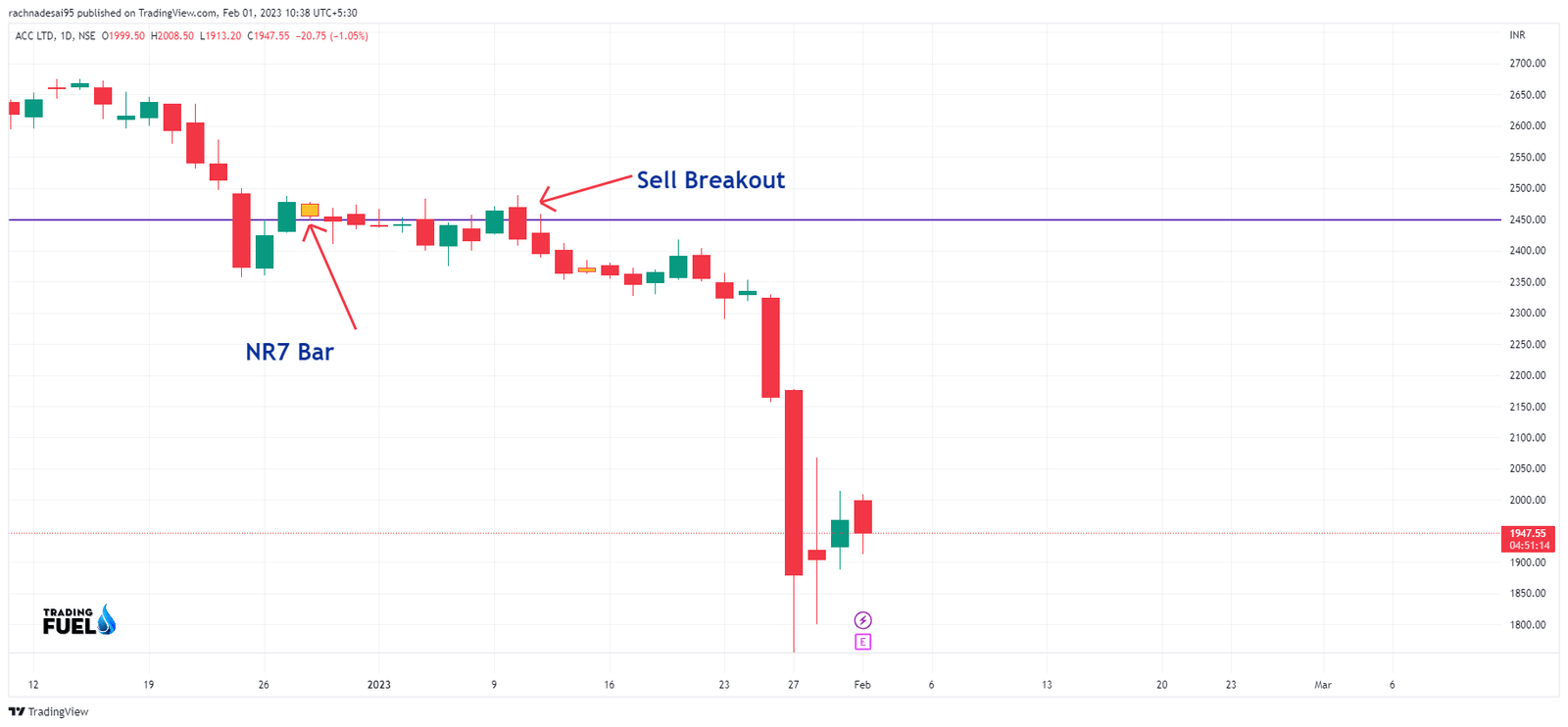

NR7 Bar Sell Example:

- Find NR7 bar. Here the yellow candle is NR7 bar

- If the price breaks below the bar go for short.

- Put stop loss above the low of NR7 Range or High of the breakout candle.

NR7 Scanner without Software

=> Click to Scan (NR7IB Webbase Scanner): http://bit.ly/3nOEwe7

You also read: Top 3 Intraday Trading Strategies

Download NR7 Scanner For Amibroker (AFL)

// Downloaded From https://www.TradingFuel.com

_SECTION_BEGIN("NARROW RANGES");

//Written by: PvR

//==================================================================================

//NR 4, 7 & 21 RANGES

TimeFrameMode(0);

//switch Timeframe

TimeFrameSet( inDaily );

//==================================================================================

//NR4 RANGE IDENTIFICATION

range = H-L;

Condition = range<Ref(range,-1) AND range<Ref(range,-2) AND range<Ref(range,-3);

NR4 = IIf(Condition,True, False);

//==================================================================================

//NR7 RANGE IDENTIFICATION

range = H-L;

Condition0 = range<Ref(range,-1) AND range<Ref(range,-2) AND range<Ref(range,-3)AND range<Ref(range,-4)AND range<Ref(range,-5)AND range<Ref(range,-6);

NR7 = IIf(Condition0,True, False);

//==================================================================================

//NR14 RANGE IDENTIFICATION

range = H-L;

Condition1 = range<Ref(range,-1) AND range<Ref(range,-2) AND range<Ref(range,-3)AND range<Ref(range,-4)AND range<Ref(range,-5)AND range<Ref(range,-6)AND range<Ref(range,-7)AND range<Ref(range,-8)AND range<Ref(range,-9)AND range<Ref(range,-10);

Condition2 = range<Ref(range,-11) AND range<Ref(range,-12) AND range<Ref(range,-13);

NR14 = IIf(Condition1 AND Condition2,True, False);

//==================================================================================

//NR21 RANGE IDENTIFICATION

range = H-L;

Condition3 = range<Ref(range,-1) AND range<Ref(range,-2) AND range<Ref(range,-3)AND range<Ref(range,-4)AND range<Ref(range,-5)AND range<Ref(range,-6)AND range<Ref(range,-7)AND range<Ref(range,-8)AND range<Ref(range,-9)AND range<Ref(range,-10);

Condition4 = range<Ref(range,-11) AND range<Ref(range,-12) AND range<Ref(range,-13)AND range<Ref(range,-14)AND range<Ref(range,-15)AND range<Ref(range,-16)AND range<Ref(range,-17)AND range<Ref(range,-18)AND range<Ref(range,-19)AND range<Ref(range,-20);

NR21 = IIf(Condition3 AND Condition4,True, False);

//============================================================================

//TWEEZER TOP & BOTTOM

TT = (H == Ref(H,-1)) OR (H == Ref(H,-2) AND H > Ref(H,-1)) OR (H == Ref(H,-3) AND H >= HHV(H,-2)) OR (H == Ref(H,-4) AND H >= HHV(H,-3));

TB = (L == Ref(L,-1)) OR (L == Ref(L,-2) AND L < Ref(L,-1)) OR (L == Ref(L,-3) AND L <= LLV(L,-2)) OR (L == Ref(L,-4) AND L <= LLV(L,-3));

//=======================================================================================================

NRSTATUS =

WriteIf(TT,"TWEEZER TOP",

WriteIf(TB,"TWEEZER BOTTOM",

WriteIf(NR21,"NR21",

WriteIf(NR14,"NR21",

WriteIf(NR7,"NR7",

WriteIf(NR4,"NR4"," "))))));

NRCOLOR = IIf( TT, colorOrange,

IIf( TB , colorBrightGreen,

IIf( NR4 OR NR7 OR NR21 OR NR14, colorLime, colorGold)));

//===============================================================================

Filter = NR4 OR NR7 OR NR21 OR NR14 OR TT OR TB ;

AddTextColumn(NRstatus, "DLY NR/TWEEZER", 1,colorDarkRed, NRcolor,120);

TimeFrameRestore();

_SECTION_END();In conclusion,

the Narrow Range 7 bar is a useful tool for traders to identify potential moves in the market. However, it’s just one tool in a trader’s arsenal and should not be relied upon. Traders should use the NR7 pattern in conjunction with other technical analysis techniques and indicators to increase the accuracy of their trades.

Contain & Image ©️ Copyright By, Trading Fuel || Research Lab