Option Trading For Beginners ( The Ultimate In-Depth Guide ):

Option Trading Definition:

A stock option is a contract between two buyers and sellers, in which the option buyer purchases the right (but not the obligation) to buy/sell the underlying asset at a fixed price from /to the option seller at the expiry of the contract.

There are two major types of options that are practiced in most of the trading markets.

- American option: the option can be exercised anytime between the purchase and the expiry date of the option.

- European option: the option can be exercised only at the expiry date.

In India, only the European style of option is traded in exchanges.

Factor Affecting Option Price:

1. The Stock and Strike Price:

- If a call option is to be exercised, the payoff will be equal to the amount by which the stock price exceeds the strike price.

- The call option will be more valuable if the stock price increase and less valuable if the stock price decrease.

- A put option will behave opposite to the call option.

2. The Time to Expiration:

- Time for expiration directly affects the option premium.

- Longer the time period of the option, higher will be its premium.

3. The Volatility of The Stock Price:

- The volatility of the stock is the measure of the uncertainty of the future price movement.

- Both the call and put option price increase if the volatility of the underlying asset increases.

4. The Risk-free Interest Rate:

- A risk-free interest rate affects the option price in an unclear way.

- Theoretically increase in the interest rate will increase call option value, but decrease the put option value.

- But practically its opposite can happen as there are many factors affected by interest rate.

5. The Dividend is Expected to be Paid:

- The dividend has the effect of reducing the stock price.

- This is bad news for the value of the call option and good news for the value of the put option.

Option Trading Terminologies:

a. Strike Price:

The strike price is the anchor price at which the two parties agree to enter into an option agreement.

Example: If a buyer is willing to buy the HDFC call option of RS 1200 (1200 being strike price) it indicates that the buyer is willing to pay a premium today to buy the right of buying HDFC at 1200 on expiry.

b. Premium:

Premium is the money required to pay by the option buyer to the option seller/writer. Against the payment of premium, the option buyer buys the right to exercise his desire to buy the asset at the stick price upon expiry.

c. Expiration Date:

Just like a futures contract, the option contract expires on the last Thursday of every month. Just like future contract option contracts also have three consecutive months of expiry option (current month, min month, and far month).

d. Spot Price:

The spotprice is the price at which the underlying asset trades in the spot market.

For example, in the above example, we have brought 1200 calls of HDFC while the HDFC stop price was 1100, so 1100 is the underlying price .underlying price has to increase for the buyer of the call option.

e. Moneyness(ITM,OTM & ATM):

When is an option in the money?

- Call option: when the spot price is higher than the strike price.

- Put option: when the spot price is lower than the strike price.

When is an option out of the money?

- Call option: when the spot price is lower than the strike price.

- Put option: when the spot price is higher than the strike price.

When is an option at the money?

- Call option: when the spot price is equal to the strike price.

- Put option: when the spot price is equal to the strike price.

f. Exercising Option Contract:

Exercising an option is an act of clamming your right to buy the option contract at the end of the expiry. Exercising an option means one is claiming the right to buy the stock at the agreed strike price. Exercising can only be done if the stock is trading above the strike price. The option can only be exercised at the end of the expiry day.

g. Types of Option Trading:

Short call: short call means we are selling a call option expecting the market to fall.

Short put: short put means we are selling a put option expecting the market to rise.

Long call: long call means we are buying a call option expecting the market to rise.

Long put: short put means we are buying put expecting market to fall.

h. Breakeven Point:

It is a point at which you make no profit or no loss.

The breakeven point is different for option sellers and buyers.

i. Open Interest:

Open interest indicates the total no of contracts that are out there.

These are the option which is a trader but no exercised.

Higher the open interest more the interest among trader for that particular strike price of an option.

If you buy 50 call options of stock then the open interest is increased by 50.

Option Pricing:

Option premium= time value + intrinsic value

1. Intrinsic Value:

- The intrinsic value for a call option is the difference between the spot price – strike price.

- The intrinsic value for a put option is the difference between the strike prices – spot price.

- OTM option has zero intrinsic value only time value.

- ATM option has intrinsic value.

2. Time Value(extrinsic value):

- Time value is equal to the option premium – intrinsic value.

- The more the time remains for expiry more the time value.

If you subtract the amount of intrinsic value form an option price, you are left with time value.

It is based on time to expiration.

We now know the moneyness and intrinsic value & time value of the option but how can we know which option is better than others? For this, we will take the help of the option Greek.

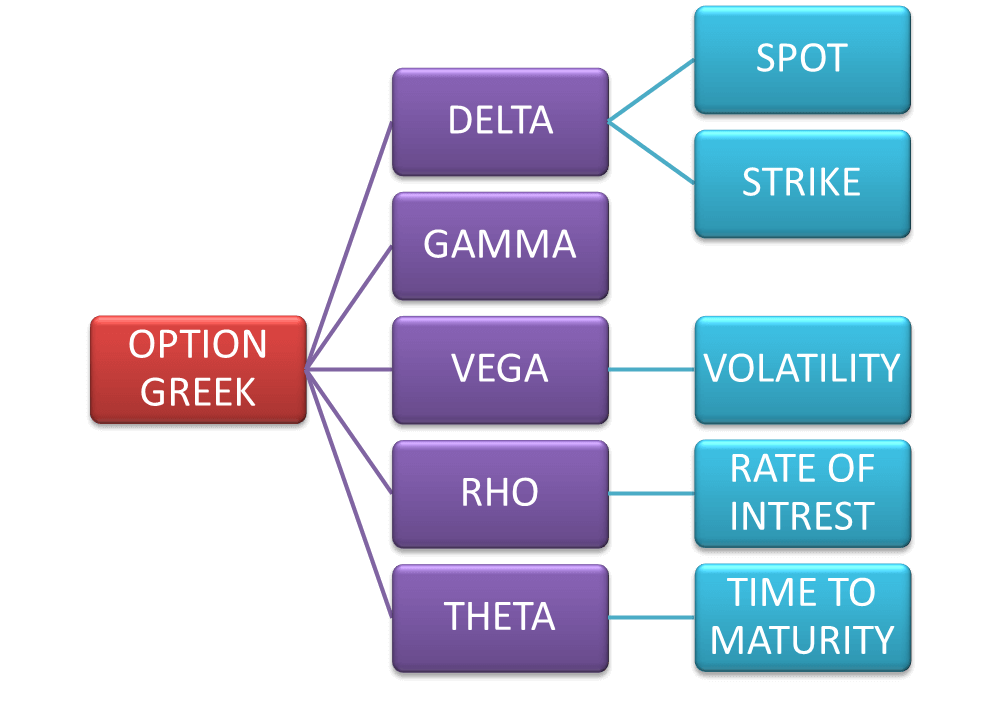

Option Trading Greeks:

Greeks are the risk measure associated with the various positions in options trading. Greeks will help you to understand how various factors like price, volatility, time decay affect the option pricing.

- Delta:

It is defined as the rate of change of option price to the price of the underlying asset.

If delta of a call option on a stock is 0.5 it means when the stock price change by a small amount the option price will change by 50% of that amount.

- Gamma:

Gamma of an option on a stock is the change in option delta per unit change in the stock price.

If the gamma is small, delta will change slowly.

If the gamma is high, delta will be highly sensitive to option prices.

Out of the ATM, ITM, OTM options ATM option has the highest gamma.

Gamma and delta changes with change in stock price.

- Theta:

Theta is the decline in the option premium due the time.

Theta is measured in days.

So theta is the change in the option price value when one day pass with all the else remain the same.

- Vega:

The Vega of an option of the stock is the rate of change of the value of the portfolio to the volatility of the stock

If the Vega of the option is highly negative or highly positive, the premium values are very sensitive to a small change in volatility.

If it is zero volatility change will have little impact on the portfolio.

- Rho:

Rho of an option is the rate of change of price of the stock to the interest rate.

| Buyer | Seller | |

| Premium | Pays premium | Receives premium |

| Risk | Risk is limited to premium | Unlimited risk |

| Reward | Unlimited | Limited |

Reading Option Trading Chain:

An option chain is a listing of call and put option of an underlying asset for a particulate expiry date. In an option chain, we have separate columns of calls and puts with strict price columns in the middle. Each column consists of the various term related to option price, which we will discuss here. Call option details are on the left-hand side and put option details are on the right-hand side of the strict price columns.

View contract for The underlying asset whose call and put data we are looking at.

Strike price: It is a price in which you as a buyer or seller agreed to exercise the contract.

Expiry date: It is the last trading day of the option after which the contract will expire.

Open interest: Number of options contract which can be brought for that strict, it indicates the option contract that is trader but yet not exercises or squared off.

Change in OI: It indicates the number of contracts that are closed, exercised, or square off.

Volume: Indicate the number of contracts traded.

IV: It means implied volatility. High IV means the potential for a high swing in price. IV does not tell us about the direction.

LTP: It means the last trader price which is the price at which both the buyer as the seller agreed to go in a contract.

Net change: It is the change in the LTP. Positive change is green while a negative change is red.

Bid quantity: It indicates the quantity or number option contract in which the is a buyer interested at the bid price.

Bid price: It indicates the price that a potential buyer is willing to pay.

Ask quantity: It indicates the quantity or number option contract in which the is seller interested in asking price.

Ask price: It indicates the price that a potential seller is willing to pay.

Conclusion:

In this article, we have discussed the basics definition and terminology of the option contract. Options derivative are more complex than future derivative, as in future derivative only the underlying price of the asset affect the derivative price but in case of option derivative there is a various factor that after the pricing of the options. The option price model is based on the mathematical formula given by the Black Scholes model. The beginner must understand the theory and Greeks of the option before trading option.

Contain & Image ©️ Copyright By, Trading Fuel Research Lab