Options Strategies for Bear Market: The stock market passes through various phases. In a bull market, there are more buyers while in a bear market, there are more sellers. To play the index or stock movement in any direction, options are one of the best modes. In this article, we will list down some of the strategies that you may follow in a bear market.

Options Strategies to Follow in Bear Market

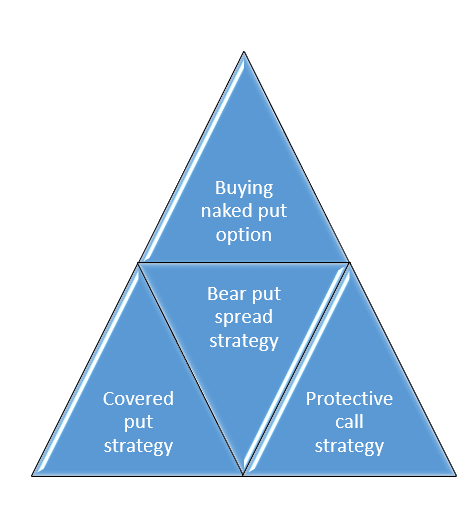

- Buying Naked Put Option

Buying a naked put option is one of the simplest strategies in a bear market. A put option is the right to sell the index or stock without any obligation. The maximum loss that you can incur in this strategy is the amount of premium paid. If you expect any downside in any stock or index, you can simply buy a put option of price up to which you expect the stock to fall. However, if the price starts moving upwards, the trader can suffer heavy losses.

- Protective Call Strategy

A protective call strategy is another strategy for a bearish market but comes with an inbuilt safety. The risk with buying naked put options is that most of the time you end up paying the premium and do not recover anything, leading to big losses. So in a protective call strategy, you sell the futures and hedge yourself by purchasing a higher call option. So this strategy brings down your risk and protects you from suffering heavy losses. However, in this strategy, you are paying the option premium that brings down your breakeven point.

- Covered Put Strategy

A covered put strategy is an ideal strategy when you are moderately bearish on a stock. If you do not expect the price of a stock to fall below a certain price, you may take a position through this strategy. In this strategy, you sell futures of a stock and then sell the put option of strike put up to which you expect the stock to fall. The maximum profit is earned on the downside in this strategy. However, when the stock goes up, the risk is huge.

- Bear Put Spread Strategy

The bear put spread strategy is ideal if you want to cover the upside risk that was open in the covered put strategy. This strategy can be used when you are moderately bearish. In this strategy, you buy a put option of a higher strike price and sell a put option of a lower strike price. The maximum loss in the strategy is the amount of premium paid.

The above-mentioned are some of the options strategies to follow in a bearish market. Options strategies have great potential to generate high returns for the traders. However, one needs to be disciplined while using these strategies. One should enter and exit the position simultaneously. You must never forget to manage your risk in options trading. One wrong position may lead to huge losses and this makes risk management even more important.

Hope this article helped you in learning something new about the stock market. To learn more about the stock market you may subscribe to Trading Fuel. We are one of the leaders in providing free stock market education. All the content on our page is free of cost and you may access it at any time. We regularly update the content on our page.

~Join our page and enhance your stock market knowledge~