Introduction of SBI Card IPO

SBI Card IPO Details: SBI Card was incorporated in the year 1998, SBI Cards and the Payment Services Limited is the subsidiary of SBI. India’s largest commercial bank is State Bank of India in terms of deposits, advances and the number of branches. State Bank of India currently holds 689,927,363 Equity Shares, constituting around 74.00% of the pre-offer that is issued, subscribed and paid-up Equity Share capital of the company.

The company holds the 2nd position as the largest credit card issuer in India, with 17.6% and 18.1% market share of the credit card market of India as of on March 31, 2019, and November 30, 2019, respectively. SBI Cards offers a various and wide range of the cards to the individual and the corporate clients including the lifestyle, rewards, shopping, travel, fuel, banking partnership cards and the corporate cards etc.

State Bank of India has the partnership with the several leading names across the industries that includes Air India, Apollo Hospitals, BPCL, Etihad Guest, Fbb, OLA Money and Yatra, amongst others. As the subsidiary of State Bank of India, the company has access to SBI’s extensive network base of 21,961 branches across India. The partnerships enable it to do the marketing of its cards to the huge customer base of 445.5 million customers.

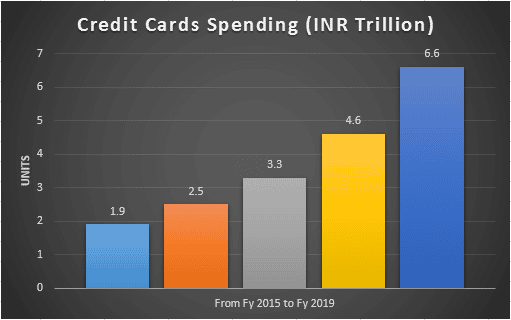

Spending on Credit Cards

According to the CRISIL research Credit Card Industry have registered strong growth and it is expected to maintain the same.

The total number of credit cards that are issued and stands at 47.0 million in the fiscal year of 2019. It has also seen the growth with the CAGR of 20.0% over the last five years and that also it is expected to grow by the 25.0% from the fiscal year of 2020, while the annual average spending of the per card is expected to grow by approximately 1.0% from the fiscal year of 2019 to fiscal of 2020 as per the CRISIL research report.

HDFC Bank, Axis Bank and the ICICI Bank along with SBI Card are the leading companies for issuing the credit cards in India. These companies had captured the 72% of the market share for issuing the credit cards in the Indian Market.

The total outstanding credit cards at 53 million at H1FY20. The credit to debit ratio is around 6% for the system. In India, there is an under-penetrate market that offers huge potential in future.

This chart represents about the distribution channels of the credit cards as of 2019 and the banks remain the dominant channel of the cards.

About SBI Card IPO

State Bank of India owned the SBI Cards & Payment Services initial public offering will be opened for the subscription from 2nd March till 5th March. The company want to raise an amount of Rs 10,341 crore by selling 13.71 crore shares at the upper band price of Rs 750-755. The lot size that has been decided is at 19 shares a lot which means that an individual need to pay at least Rs 14,250 for making a bid for the issue.

SBI Card IPO Event Date 2020

There have been different share quotas set for the category of six different categories of investors that is anchor, qualified institutional buyers, non-institutional investors, retailers, SBI shareholders and employees. The registrar for the SBI Cards is Link Intime India Private Ltd. It is proposed to get listed in the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

The IPO by SBI Cards and Payment Services (SBI) was subscribed 87.55 % on day 2 of the bidding procedure so far. The issue received the bids for 87,537,978 shares compared with the issue size of the 100,279,411 shares. The company has already raised Rs 2,769 crore from 74 anchor investors that are including 12 mutual funds. The second-largest credit card issuer has grown its outstanding cards at a compounded the annual growth rate (CAGR) of 28% over the FY 2015-19 against an industry average of 23% over the same period.

The IPO demands a PE of 45.5 times and P/B of 14.5 times, which the analyst said are on the higher side. But the company has no listed of their peers in India. The biggest strength of the company is the State Bank of India, whose brand is highly trusted. This along with the strong distribution network makes the brokerage believe at a huge premium is justified.

| Category | No. of Equity Shares | Amount (in Cr) | No. of Shares Bid | Amount (In cr) |

| Institutional (QIB) | 24,446,393 | 1,845.70 | 5,184,473 | 391.43 |

| Non-Institutional Investor | 18,334,795 | 1,384.28 | 8,674,032 | 654.89 |

| Retail | 42,781,188 | 3,229.98 | 51,888,506 | 3917.58 |

| Employee | 1,864,669 | 126.80 | 3,434,440 | 233.54 |

| Shareholder | 13,052,680 | 985.48 | 18,356,527 | 1385.92 |

| Total | 100,479,725 | 7,572.23 | 87,537,978 | 6,583.36 |

Excluding the anchor portion (36,669,589 Equity Shares)

About Us

This blog gives the complete information about “SBI Card IPO” and the timing and the amount that the company want to raise. This blog is represented in a nominal language which will help the individual trader or the investor to easily get to know the terms. Trading Fuel is the leading pioneer in terms of providing the informative materials to the keen learners of the financial markets and we charge zero costing in terms to provide this information. Our blog site is representing the generation that has the knowledge and needs more on the same. For any doubts or suggestion, you can directly contact us through the e-mails and can share your feedback for the same. Read and learn more from our blog site.