Sharekhan is one of the popular full-service stockbroking firms in India. The company began its operations in February 2020. As per the latest numbers, It currently holds 5% of the retail broking market share. Sharekhan, a subsidiary of S.S. Kantilal Ishwarlal Securities Limited (SSKI) was sold to BNP Paribas for Rs. 2,200 crores. It is now present in more than 575 cities with around 170 branches and more than 2200 franchise partners. It is one of those first companies to have an online presence in the country and still functions with high-level technology.

Sharekhan also provides research reports and tips to its clients. These reports and tips are on the basis of fundamental and technical analysis for long term as well as short term investors. Along with the research reports, the broker also imparts stock market education through their Classrooms. Here the traders and investors are taught about the various concepts of the stock market right from the basic level to the higher level. They also provide its client premium services by providing them with relationship managers to manage their portfolio.

Let us now learn about the segments in which It is present.

Sharekhan Presence

Sharekhan at the moment provides products of NSE, BSE, MCX, NCDEX and MCX-SX in the following segment;

- Derivatives

- Equity

- Mutual Funds

- Commodity

- Currency

- IPO

- Advisory Services

- Portfolio Management Services (PMS)

Let us now learn about Sharekhan trading application

Sharekhan Trading Apps

Sharekhan provides the trading application for both desktop and mobile users. Trade Tiger is the name of the application that users can use on both platforms. It is as powerful as a terminal of a broker and helps you trade across all the segments. As a trader, you can create a watchlist and operate by logging in from different machines. The features of the application are as follows;

- Stock charts with all the high-level details for analysis.

- Access to the research desk for trading using the fundamentals and market tips.

- Notifications and alerts for reminders set on different stocks and other specific information.

- Instant service of pay-in or pay-out.

- Regular updates and technology enhancements to match the advancement of technology.

Sharekhan: Mobile App Download

Let us now learn about the Sharekhan mobile application.

Sharekhan Mobile Application

Sharekhan has launched many mobile applications in the past few years. The history of Sharekhan when it comes to the mobile application has been weird. When the users report negative feedback and poor ratings, instead of improving the application, they launch a new application every time. Currently, the application is in their name and response to it so far has been good. The following are the features of its application;

- Trading across different segments across the stock exchanges.

- Latest market news and information.

- Transferring of funds from bank to Sharekhan demat account.

- Accurate prices, high speed and performance.

The above are some of the features that make Sharekhan mobile application one of the best in the market. However, there are some drawbacks to the application too. Let us learn about them;

- Sometimes there is a login issue.

- Due to lower internet speed in smaller cities, the performance of the application goes down.

- Reports about mutual funds are not available.

In order to address the problem of lower internet speed in smaller cities, the Sharekhan Mini application has been brought by the company.

Sharekhan Mini

For people living in small towns where the internet speed is low Sharekhan Mini is a solution for that. This application works efficiently on lower bandwidth connections and provides a speedy performance even on 2G internet connections. Some of the features of Sharekhan Mini application are as follows;

- You can invest in different asset classes like equity, mutual funds, commodity, currency, etc. using the application.

- Works smoothly even on a slower internet speed connection.

- Various data points such as gainers and losers, 52-week high and low, etc. can be seen on the app.

- You can carry out all the analyses using the company information and charts.

Let us now learn about Sharekhan Neo.

Sharekhan Neo

Sharekhan Neo is an initiative from them towards modernizing trading using the Robo techniques without any intervention of humans. By entering the specific inputs into the tool you can get automatic stock recommendations along with the holding period and risk level. This tool will ask you questions like what is the objective of your investment, risk appetite, the period of investment, etc. It is an ideal tool for people who do not have enough investment and analysis skills.

Sharekhan Desktop

Sharekhan desktop is a trading application for your desktop. You can access your account by logging on to the Sharekhan website and entering your credentials. Some of the features of Sharekhan desktop application are as follows;

- The application is extremely lightweight and requires basic configuration.

- The application can be used for investment in different segments.

- You get access to research and recommendation for more than a hundred companies listed on the stock exchange.

- You get order communication through SMS and email.

- To help investors with long term investments, the application has a “Pattern Finder” feature.

- To integrate the third party technical analysis software you can use the “O Alert” feature.

ShareKhan: Trade Tiger Download

Let us now learn about the research facility provided by Sharekhan

Sharekhan Research

Sharekhan provides its clients with research and recommendations according to their investment tenure and risk-taking ability. There are different types of clients that they provide research report to. They are traders, investors and mutual fund investors. Every client in each segment gets research products on the basis of their preferences. The research report by them is more accurate than the technical reports. There are many communication channels like email, etc. through which the clients can get access to the research reports.

Let us now learn about the charges of Sharekhan.

Sharekhan Charges

The Sharekhan account opening for trading and demat account are as follows;

- For opening trading classic account, the charge is Rs. 750 and for trade tiger account is Rs. 1,000.

- The annual maintenance account for trading is Rs. 0.

- The demat account opening charges are Rs. 0.

- The annual maintenance charge is Rs. 450.

Let us now learn about the delivery and intraday charges.

Delivery and Intraday Charges

- The charges for equity delivery are 0.5% and it is negotiable.

- The equity intraday charge is 0.1%.

- The charges on equity futures are 0.1% on the one side and .02% on squaring off the same day. If the squaring off is done on any other day the transaction is 0.1%.

- The charges for equity options is 2.5% on the premium or Rs.100, whichever is higher.

- The charges for currency futures 0.1%.

- The charges for currency options is 2.5% on the premium or Rs.30, whichever is higher.

- The commodity charges are 0.1%.

Let us now learn about the Sharekhan Post Paid Plans.

Post Paid Plans

|

Equity Cash | Future | Options | |||||

| Margin Scheme | Leg 1 | Leg 2 | Delivery | Leg 1 | Leg 2 (same day) | Leg 2 (next day) | Option (whichever is higher) |

| 25,000 | 0.10% | 0.10% | 0.50% | 0.10% | 0.02% | 0.10% | 2.50% or Rs. 100 per lot |

| 30,000 | 0.10% | 0.00% | 0.50% | 0.10% | 0.00% | 0.10% | 2.50% or Rs. 100 per lot |

| 40,000 | 0.09% | 0.00% | 0.45% | 0.09% | 0.00% | 0.09% | 2.25% or Rs. 95 per lot |

| 50,000 | 0.07% | 0.00% | 0.40% | 0.07% | 0.00% | 0.07% | 1.50% or Rs. 80 per lot |

| 1 Lakh | 0.05% | 0.00% | 0.25% | 0.05% | 0.00% | 0.05% | 1.00% or Rs. 70 per lot |

| 3 Lakh | 0.04% | 0.00% | 0.20% | 0.04% | 0.00% | 0.04% | 1.00% or Rs. 50 per lot |

| 5 lakhs | 0.03% | 0.00% | 0.18% | 0.03% | 0.00% | 0.03% | 0.75% or Rs. 40 per lot |

| 10 Lakhs | 0.02% | 0.00% | 0.15% | 0.02% | 0.00% | 0.02% | 0.60% or Rs. 30 per lot |

| 20 Lakhs | 0.015% | 0.00% | 0.10% | 0.015% | 0.00% | 0.015% | 0.55% or Rs.25 per lot |

Let us now learn about Sharekhan Prepaid Plans

Prepaid Plans

|

| Equity Cash | Future | Options | |||||

| Amount (Rs) | Period | Leg 1 | Leg 2 | Delivery | Leg 1 | Leg 2 (same day) | Leg 2 (next day) | Option (whichever is higher) |

| 750 | 6 months | 0.10% | 0.00% | 0.50% | 0.10% | 0.00% | 0.10% | 2.50% or Rs. 250 per lot |

| 1000 | 6 months | 0.09% | 0.00% | 0.45% | 0.09% | 0.00% | 0.09% | 2.25% or Rs. 238 per lot |

| 2000 | 12 months | 0.07% | 0.00% | 0.40% | 0.07% | 0.00% | 0.07% | 1.50% or Rs. 200 per lot |

| 6000 | 12 months | 0.05% | 0.00% | 0.25% | 0.05% | 0.00% | 0.05% | 1.00% or Rs. 175 per lot |

| 10000 | 12 months | 0.045% | 0.00% | 0.22% | 0.045% | 0.00% | 0.045% | 1.00% or Rs. 150 per lot |

| 18000 | 12 months | 0.04% | 0.00% | 0.20% | 0.04% | 0.00% | 0.04% | 1.00% or Rs. 125 per lot |

| 30000 | 12 months | 0.03% | 0.00% | 0.18% | 0.03% | 0.00% | 0.03% | 0.50% or Rs. 100 per lot |

| 60000 | 12 months | 0.02% | 0.00% | 0.15% | 0.02% | 0.00% | 0.02% | 0.50% or Rs. 75 per lot |

| 100000 | 12 months | 0.015% | 0.00% | 0.10% | 0.015% | 0.00% | 0.015% | 0.50% or Rs. 63 per lot |

| 200000 | 12 months | 0.005% | 0.005% | 0.08% | 0.005% | 0.005% | 0.005% | Flat Rs. 25 per lot |

Let us now learn about the advantages of Sharekhan

Advantages

- It has a large client base and among the top three broking firms in India.

- It has a huge offline presence with many franchises and a network of sub-brokers.

- It provides the services of a quality research team.

- You get the facility to call and trade.

- You can make an application in the IPO through ASBA.

- You can select the brokerage plan according to your preference.

- You can learn about the stock market through Sharekhan classrooms.

- It provides a highly innovative trading platform.

- NRI can also trade using Sharekhan services.

With many advantages, there are some disadvantages too. Let us learn about the disadvantages of Sharekhan.

Disadvantages

- There is no 3 in 1 facility as Sharekhan does not have banking services.

- You cannot place orders after the market hours.

- You have to pay minimum brokerage charges irrespective of the amount of transaction. Therefore, it makes the trading experience costlier.

- The broker needs to improve its mobile application and overcome all the shortcomings.

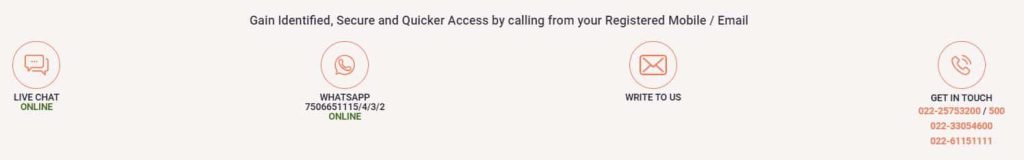

Share Khan Customer Care Number: 022-25753200/500

The above are the few disadvantages of Sharekhan. That needs to be lower down its brokerage rate to be more competitive. It is a good option only for those who are looking for a trustworthy broker and do not mind paying higher brokerage charges. If you want to learn more about the stock market, you can visit the Trading Fuel website. We are the leader in providing stock market education. The blogs and articles on our page are available free of cost. Moreover, we regularly update them to provide you with the latest information. We also provide stock market tips and financial advisory services. If you want to take our services you can contact us via phone or email.