The pharma sector is the most loved sector in the Indian stock market.

Between 2009 and 2016, the pharma sector gave a return of 30% CAGR, which became the golden period for the very best pharma companies.

What are the pharma companies?

- A pharma company is a commercial business that has a license to research, develop, market, or distribute drugs.

- Most commonly, these companies are in the context of healthcare.

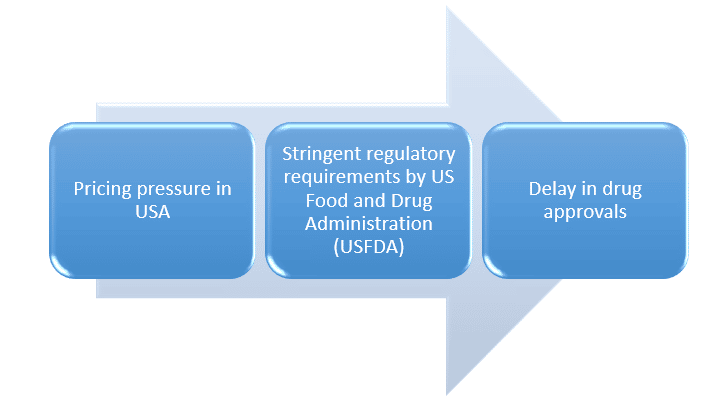

- Apart from giving a return of 30% CAGR, the pharma sector as a whole has underperformed due to the following factors:

Pharma companies can be attractive for long-term investors as well, in spite of their being highly volatile.

List of the Top 10 Pharma Sector Stocks in India:

The following is the list of the top 10 pharma sector stocks in India:

| Sr. No. | Company Name | Stock Price |

| 1 | Abbott India Limited | 17,552.00 |

| 2 | Dr. Reddy’s Laboratories Limited | 4108.50 |

| 3 | Divis Laboratories Limited | 3585.45 |

| 4 | Torrent Pharmaceuticals Limited | 1473.75 |

| 5 | Cipla Limited | 1051.35 |

| 6 | Sun Pharmaceuticals Limited | 877.05 |

| 7 | Lupin Limited | 637.05 |

| 8 | Aurobindo Pharmaceuticals Limited | 534.45 |

| 9 | Zydus Lifesciences Limited | 363.20 |

| 10 | Biocon Limited | 293.10 |

1. Abbott India Limited:

- Abbott India is a publicly listed company and is a subsidiary of Abbott Industries.

- It is one of the fastest-growing pharma companies and is a market leader in pharmaceuticals, devices, nutrition, and diagnostics.

- It has over 400 pharmaceutical brands.

- The company is offering high-quality, trusted medicines in multiple therapeutic categories such as women’s health, cardiology, gastroenterology, metabolic disorders, and primary care.

| Headquarters | Mumbai |

| Stock Price | 17,552.00 |

| Net Profit | 798.70 |

| Revenue | 4910.30 |

Live Price & Info: https://bit.ly/3y35Ck7

2. Reddy’s Laboratories Limited:

- Dr. Reddy’s is among the top Indian generic players in the US market, with a focus on other core priority markets such as India, Russia, and China.

- The earnings of the company will improve with the scale-up of launches in the US as well as the quicker execution of various drugs in an emerging market.

- The company began as a supplier to an Indian drug manufacturer.

- It is already linked to the UK pharma company GlaxoSmithKline.

- It provides products for generic drugs, over-the-counter drugs, vaccines, biologics, and diagnostics.

| Headquarters | Hyderabad |

| Stock Price | 4108.50 |

| Net Profit | 1623.20 |

| Revenue | 14,887.20 |

Live Price & Info: https://bit.ly/3LugVac

3. Divis Laboratories Limited:

- Divis is the largest Indian contract research and manufacturing services (CRAMS) player.

- The company is an authorized manufacturer of Molnupiravir, an oral drug for treating COVID-19.

- With its nature of business, the company has the benefit of volume, pricing, and currency tailwinds.

- The main products of the company are its Active Pharmaceutical Ingredients (API) and intermediaries, custom synthesis, and nutraceuticals.

| Headquarters | Hyderabad |

| Stock Price | 3585.45 |

| Net Profit | 2948.54 |

| Revenue | 8991.08 |

Live Price & Info: bit.ly/3UsOaz2

4. Torrent Pharmaceuticals Limited:

- Torrent Pharmaceuticals is an Indian multinational company and is also owned by Torrent Group.

- The company operates in more than 40 countries with over 2000 products registered.

- The company has forayed into the therapeutic segments of nephrology and oncology, along with strengthening its focus on gynaecology and paediatric segments.

| Headquarters | Ahmedabad |

| Stock Price | 1473.75 |

| Net Profit | 991.45 |

| Revenue | 6946.49 |

Live Price & Info: https://bit.ly/3SigcLF

5. Cipla Limited:

- Cipla is a very strong player in the domestic market.

- It has a strong presence in the chronic segment and market leadership in certain chronic therapies such as respiratory and inhalation.

- The company is also planning to build a US franchise with the focus of launching complex generics for steady growth.

| Headquarters | Mumbai |

| Stock Price | 1051.35 |

| Net Profit | 2957.93 |

| Revenue | 13,758.49 |

Live Price & Info: https://bit.ly/3BX74qe

6. Sun Pharmaceuticals Limited:

- Sun Pharmaceuticals is a specialty generic pharmaceutical company and is the best stock to buy.

- It has a portfolio of generic as well as specialty medicines that will target a spectrum of chronic as well as acute treatments.

- The company is also engaged in the business of manufacturing, developing, and marketing a wide range of generic formulations.

| Headquarters | Mumbai |

| Stock Price | 877.05 |

| Net Profit | (99.99) |

| Revenue | 16,543.90 |

Live Price & Info: https://bit.ly/3BXO1ML

7. Lupin Limited:

- Lupin is an Indian multinational pharmaceutical company.

- It is one of the largest pharma companies by revenue globally.

- The key focus of the company is on pediatrics, anti-infectives, cardiovascular, asthma, diabetesology, and anti-tuberculosis.

| Headquarters | Mumbai |

| Stock Price | 637.35 |

| Net Profit | (188.70) |

| Revenue | 11,922.09 |

Live Price & Info: https://bit.ly/3Skpman

8. Aurobindo Pharmaceuticals Limited:

- Aurobindo Pharma is a leading US generic player with a strong presence in Europe.

- The company is into the manufacturing of generic pharmaceuticals as well as active pharmaceutical ingredients.

- The company is focused on six major therapeutic as well as production areas as follows:

The marketing partners of the company include Pfizer and AstraZeneca.

| Headquarters | Hyderabad |

| Stock Price | 534.45 |

| Net Profit | 1454.71 |

| Revenue | 11,958.13 |

Live Price & Info: https://bit.ly/3xHEEyd

9. Zydus Lifesciences Limited:

- Zydus Lifesciences was formerly known as Cadila Healthcare.

- It is an Indian multinational pharma company that is engaged in the production of generic drugs.

- The company is also ranked 100th on the Fortune India 500 list in 2020.

- The company develops and manufactures an extensive range of pharmaceutical products such as diagnostics, herbal products, skincare products, and other OTC products.

| Headquarters | Ahmedabad |

| Stock Price | 363.20 |

| Net Profit | 1163.90 |

| Revenue | 8160.60 |

Live Price & Info: https://bit.ly/3f9zEvB

10. Biocon Limited:

- Biocon is an Indian bio-pharma company.

- The company manufactures novel biologics as well as biosimilar insulins and antibodies.

| Headquarters | Bengaluru |

| Stock Price | 293.10 |

| Net Profit | 86.10 |

| Revenue | 1925.40 |

Live Price & Info: https://bit.ly/3LuidCa

Conclusion:

We hope the above blog has given you some ideas about which pharmaceutical stock to buy.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, economics, the stock market, as well as intraday trading. Stay tuned with us for more such blogs.