Trading Psychology: It is very important to maintain the right mindset while you are trading.

For this, you will have to improve your trading psychology so as to minimize the effect of emotions as well as bias during the time when you trade in the market.

What is the meaning of trading psychology?

- Trading psychology refers to the trader’s mindset while they are allotting their time in the market.

- This psychology will help to determine the extent to which a trader will succeed in securing a profit, or it can provide an explanation as to why a trader has incurred heavy losses.

- The main focus of learning trading psychology is to be aware of various pitfalls that are associated with the negative psychological trail as well as develop more positive characteristics.

- This concept is different for every trader because the same is influenced by their own emotions as well as pre-determined bias.

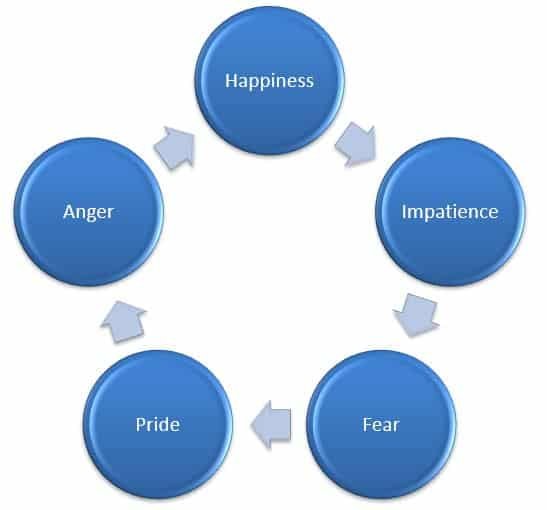

Some of the main emotions that will impact the trading bias are as under:

Apart from the above, there are also other emotions that affect trading bias.

A few of them is fear of missing out (FOMO), greed, regret, ego, and hope.

You Also Like:Psychological Mindset of Successful Traders

How to improve your own trading psychology?

- Improving your trading psychology can be done by becoming aware of your own emotions, personality traits, and biases.

- Once you acknowledge these, you will be able to put a trading plan in place that will take these factors into account with the meager hope of mitigating any effect that they have on our decision-making.

How will bias affect trading with psychology?

- Bias is nothing but a predetermined personal disposition in favor of one thing or another.

- This will result in your decision-making during market times as they might cloud your judgments and will lead you to act on your gut feelings apart from reasoned fundamental or technical analysis.

- The simple reason behind trading bias is that you can be more likely to trade an asset in which you have had past success or to basically avoid an asset in which you have incurred a historic loss.

- There are, in total, five main types of bias.

They are as follows:

#1. Representative bias:

- This will mean that you will stick to or be more inclined to replicate previously successful trades.

- You might end up doing this without carrying out any sort of technical analysis because, in the past, a particular trade has paid you well.

- It is very important to note that even if the two trades look similar, it will become essential to approach each and every trade on its own merits rather than its historical success.

#2. Negativity bias:

- This type of bias will make you more inclined to only look at the negative side of a trade instead of appreciating what went right.

- This will also mean that you can simply scrap an entire strategy when you might need to just tweak it slightly to turn it into a profit.

#3. Confirmation bias:

- This is when you seek out, or rather give greater weight to, news as well as analysis that will in turn confirm your pre-formulated ideas.

- It might also seem that you don’t seek out or disregard any information which will disapprove of your convictions.

#4. Status quo bias:

- This means that you keep on using old strategies or trades instead of exploring new ones.

- Here, the danger will arise when you fail to assess whether those old methods are even feasible in the current market.

#5. Gambler’s fallacy:

- It is when you assume that, as an asset has been increasing, it will simply continue to rise.

EveryTrader Must to Read!

Tips to avoid emotional trading:

In total, there are seven tips to avoid emotional trading.

They are as follows:

#1. Have patience:

- Patience is very much a part of discipline.

- It is critical that you have patience in relation to your positions.

- If you are planning to act on your emotions like fear, it will lead you to miss out on profit by closing a position too early.

- Here, in the stock market, you will have to trust your analysis as well as remain patient and disciplined.

- When you are entering into a trade, it is quite a bit more important to be patient and wait for the right opportunity rather than simply jumping into the trade.

#2. Develop and follow a trading plan:

- A good trading plan will serve as a roadmap for your trade, highlighting your time commitments, risk-reward ratio, available trading funds, and a trading strategy that you are comfortable with.

- Let us understand this with the help of an example where you decide to allocate 1 hour daily, and that too, every morning and evening to trading, and along with that, you also decide that you will never commit more than 5% of the total value of your portfolio to any particular trade.

- This will help to minimize the losses as well as limit the effect of emotions on your trade as the rules for opening as well as closing a position for trade are clearly highlighted to you.

#3. Identify your personality traits:

- To be a successful trader, you will also need to identify your personality traits.

- You will have to be honest with yourself and agree to the point that you might have impulsive tendencies or that you are prone to acting out of anger or frustration.

- It is equally important to identify as well as be aware of your own personality traits as well as emotions in recognizing your bias.

Also Like:How to be a Winner in the Stock Market?

#4. Be adaptive:

- After establishing a good trading plan, you have to remember that no two days in the market are the same and there are no winning streaks in trading.

- You will have to keep this thing in mind and therefore become comfortable in order to assess how the markets are different every day and thereby adapt accordingly.

- Consider that there is volatility on day one in the market compared to the day before and the markets are moving haywire. You might have to put your trading activity on hold till you understand what is exactly happening with the market.

- By being highly adaptive, you can help to limit your emotions as well as rule out representative and status quo biases, thereby enabling you to assess each and every situation on its own merits and also ensure that you are pragmatic with your own time in the markets.

#5. Accept your winnings:

- A successful win, or more importantly, a big win, can make you feel invincible at times, and you try to subsequently rush into another position to try and do the same thing all over again.

- You may even feel inclined to open new positions in the belief that none of your trades will fail and that today is your auspicious day to trade.

- This will prompt you to take unnecessary risks or diversify your portfolio, all without conducting any technical analysis on a specific trade.

- Happiness in the market is just as dangerous as your anger, and more importantly, it is important to recognize when it might be impairing your decision-making or might have a negative effect on your trade.

#6. Take a mandatory break after a loss:

- Sometimes, after a loss, all you need to do is to walk away from your trading account for a short while in order to gather your thoughts and prepare yourself for a good trade instead of rushing into another trade in an attempt to regain your losses.

- The best traders are the ones that will take their losses and then use them as learning opportunities.

- The best traders will also take time to identify what went wrong in a trade before going back to the trading platform and also in order to avoid making the same mistake again.

- By doing this, they will keep their emotions like fear or pride in check by letting themselves cool off before approaching the very next trade with a very clear and sound judgment.

#7. Keep a good trading log:

- A trading log will help you keep a record of your losses as well as gains.

- They will also assist you in identifying the emotions you felt while making a trade.

- A trading log is considered to be the culmination of all the previous points in the article and will be helpful in deciding whether what you did was right or wrong.

Must Know: Trading Psychology – Why do we fail?

Conclusion:

We hope that the above blog gave you immense clarity about the psychology behind trading.

Frequently Asked Questions (FAQs)

About Us:

Trading Fuel is our website for blogs where we provide you with knowledge about finance, economics, stock markets, technical analysis, and intraday trading.

~Stay tuned with us and follow us for more such blogs~