Annual Maintenance Charges (AMC): With the advancement of digitalization, shares are no longer in digital format.

They are totally dematerialized, which makes it easier for traders to buy and sell them easily.

Dematerialization is a process where the physical share certificate is converted into an electronic form.

What is a Demat account?

- Once the dematerialization process is over, the shares will be stored in the Demat account, also known as the dematerialized account.

- This account will hold the shares and securities that we have invested in through an online or electronic platform.

- If you are engaged in the online trading of securities, then the purchased securities are kept in the Demat account, which will also make it easier for the users to trade the securities.

- This account will then hold the investments that you will make across the various asset classes.

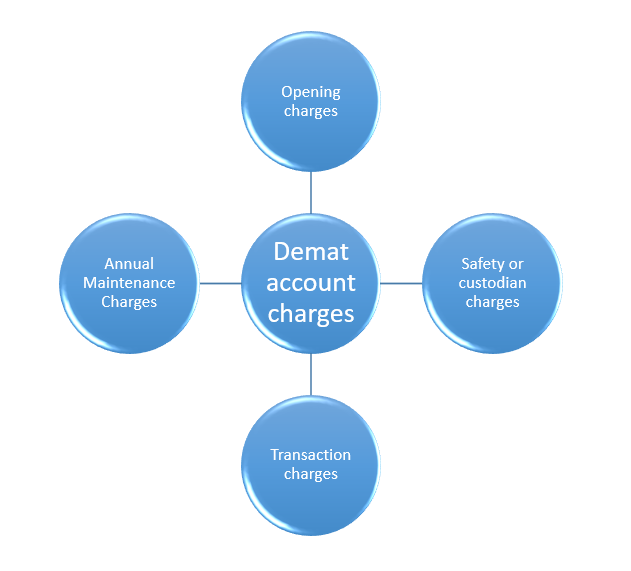

Types of Demat account charges:

There are various types of Demat account charges.

They are as follows:

Also Read: How to Open Mutual Fund Account?

Opening charges:

- Any bank will charge you a nominal opening fee.

- These charges will have to be deposited before the start of the use of the demat account.

Safety or custodian charges:

- These charges are a one-time fee, and the charges will vary based on the securities that are linked to your Demat account.

- The charges can be as little as Rs. 1 for each International Securities Identification Number.

Transaction charges:

- The main depository participant (DP) may charge fees for the services for the transactions that will help you earn money.

- A transaction fee will have to be paid to the DP every time a security moves in or out of the Demat account.

Annual Maintenance Charges (AMC):

- A Demat account holder will have to pay an Annual Maintenance Charge (AMC) to the DP for the services that have been provided to them.

- These charges are also known as folio maintenance charges and will vary as per your account head.

- There are banks that offer you a three-in-one account for Demat, trading, and saving and tend to charge a lower AMC because all the accounts are linked.

Must Know: What is CAGR and how it works?

What is an AMC?

- Annual Maintenance Charges, or AMC, are charged in order to maintain the Demat account of the trader.

- The charges of the AMC depend on the stock broker that you have.

- However, there are a few stock brokers who will provide their customers with a lifetime free AMC with no strings attached.

- Full-service brokers tend to charge a higher amount of AMC than discount brokers.

- The price of AMC will not depend on whether you hold the shares in your Demat account or not.

- Rather, this fee will have to be paid for the sheer maintenance of your accounts, irrespective of whether you are an active investor or not.

- This fee is also not dependent on whether you wish to do positional trading or intraday trading.

- There are brokers who often waive off the AMC for the first year and then charge the AMC from the 2nd year onwards.

- Some might charge zero AMC services to the account holder who also has no shares in the account till the purchase of the first share.

What happens if we do not pay AMC fees?

If we fail to pay the AMC fees, you will have to face the following situations:

- The account will be locked and you will not be able to access it till you make the deposit to clear the remaining balance.

- Every year, this Demat account will continue to rise till you finalize the payment to clear the outstanding balance.

Also Read: How Mutual Funds Work in India

Some of the major stock brokers and their AMC list:

The following are some of the major stock brokers, and their AMC list is as follows:

| Stock Broker | AMC |

| IIFL | 1st year free, Rs. 400 from the 2nd year |

| Motilal Oswal | Rs. 250 |

| 5Paisa | 1st year free, Rs. 25 per month from the 2nd year |

| Angel Broking | 1st year free, Rs. 20 per month from the 2nd year |

| Zerodha | Rs. 300 |

| Upstox | Rs. 25 per month |

| ICICI Direct | Rs. 700 |

| Kotak Securities | Rs. 50 per month or Rs. 600 per year |

| HDFC Securities | 1st year free, Rs. 650 from the 2nd year |

| Sharekhan | Rs. 400 |

| Paytm Money | Rs. 300 (platform charges) |

Must Know: What is the Difference Between Demat and Trading Account?

Conclusion:

We hope that the above blog gives you clarity about the AMC charges in the Demat account.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, economics, stock markets, intraday trading, and technical analysis. Stay tuned with us for more such blogs.