What is Index Trading? (Beginner’s Guide): An index is a way to measure the performance of a group of assets.

The Dow Jones is one of the world’s best-performing and most well-known indexes.

The Dow Jones Industrial Average (DJIA) tracks the overall performance of the 30 largest companies in the U.S.

How is index trading defined?

Index trading is defined as the concept of the buying and selling of a specific stock market index.

Investors will keep on speculating on the price of an index that is either rising or falling and will then determine whether they will buy or sell.

As the index represents the performance of the group of stocks, you will not be buying any actual underlying stock but rather the average performance of the group of stocks.

Always remember, when the price of the shares of the companies with an index goes up, then the value of the index will also increase.

But if the price falls, then the value of the index will also fall.

What are the indices in trading?

Index trading is the most common way for traders to gain exposure to financial markets without directly investing in individual company stocks, bonds, assets, and other commodities.

Investors who are new to the financial markets will often start with index trading.

Here, they will trade an index-tracking fund or simply a basket of shares instead of simply buying and selling individual company stocks.

After tracking the performance of the large group of shares, the stock index will aim to reflect the state of the broad market.

The best example of this is the stock market of the country or a very specific sector.

This will mean that the index needs to be diversified.

When you are trading the indices online, there are two main types:

Each of the world’s major financial markets has at least one stock index to represent it.

For example, the S&P 500 (US500) is an index of the 500 largest companies in the US.

The movement in the benchmark value will indicate the health of the economy or industry sector that it will track.

Another benchmark index is the Euronext 100 (N100), which will track the performance of the largest stocks on the European Union’s Euronext exchange.

It comprises the companies that are listed in the Netherlands, Belgium, Portugal, France, and Luxembourg.

The funds’ managers will provide a benchmark for the funds’ managers so as to measure their actively-managed fund performance against.

Fund providers will be creating passive index-linked funds that are associated with associated derivatives and will also be available for investors to buy as well as sell.

How are the stock market indices calculated?

Initially, the trading indices were calculated using simple averages.

In this method, the share prices of all the constituents were totaled and then divided by the number of companies.

However, now the major indices, such as the NASDAQ 100 (US100) and the Hang Sen, are using a weighted average.

Stock indices are calculated in very different ways based on the type of company they track as well as the goals of the index.

The two major formulas that are used to calculate the value of the index are as follows:

#1. Price Weighted:

In the price-weighted index, the stocks are weighted in proportion to their share price rather than the actual size of the company.

This will mean that the companies with the highest share prices will have a strong impact on the value of the index.

Price-weighted indices are less common than those based on market capitalization.

The best price-weighted indices are as follows:

Also Read:What is Share Market and How it works?

#2. Market Capitalization-weighted:

This index uses the value of the constituent companies to rank them.

A company’s market capitalization is calculated by multiplying the stock price of the company by the number of outstanding shares.

Companies that have the largest market capitalization will have the highest influence over the index value.

The market capital of each and every company is calculated based on the free float of shares that are publicly available for trading.

The company’s free float market capitalization is always lower than its total market capital as this will exclude the shares that are held by the company’s insiders.

The best examples of the market capitalization indices are as follows:

Unweighted:

An unweighted or equal-weighted index will give the same weight to each and every constituent company.

This will limit the influence that one stock can have on the overall performance of the index.

This will reduce the volatility while also dampening the effect of the sharp rally in each and every stock.

The S&P 500 Equal Weight Index (EWI) is an equal-weight version of the S&P 500 that will provide an alternative for traders looking for more price stability.

Which are the major world indices?

Some of the most popular world indices will include blue-chip stocks.

A blue-chip is defined as a well-established company with a market capitalization in the billions and is also considered a market leader.

Some of the most popular world indices are as follows:

Must Know:What is Index in Stock Market?

How are the indices compiled?

Indices are managed by the committees, which will set the criteria that the company’s stocks have to meet to be eligible for inclusion.

These committees have to meet regularly so as to review the index rules and then decide whether to add or remove the companies.

Some companies will hold the review quarterly, while others will do it annually.

Committees may remove stocks that can no longer meet the eligibility criteria, whereas the others may allow them to remain or give them time to return to compliance.

Also Read: What are Stock Market Indices?

Types of indices:

There are many types of indices that will cater to the needs of traders.

Apart from stock index trading, you can also trade in commodities as well as bond indices.

Some of the common types of indices are as follows:

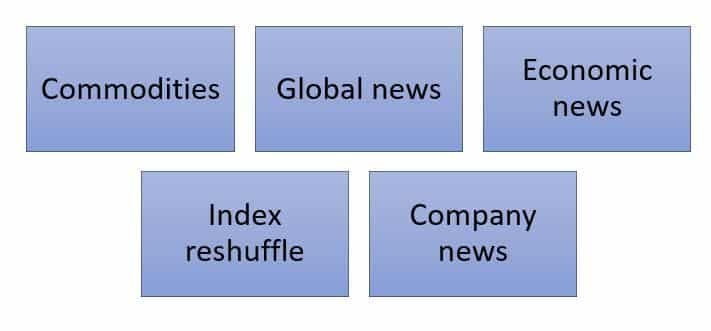

What will move the index market price?

The main movement of the index price is dependent on external forces.

This price will generally decrease in times of uncertainty which can also bring weakness to a particular company’s economy.

Some of the main factors that will impact the movement of the index price are as follows:

#1. Commodities:

Some of the stocks within the index are commodity stocks, with the market fluctuating.

They will have the potential to affect the index price.

#2. Global News:

Natural events such as disasters or pandemics would also negatively impact an index market.

This will affect the economy of the country.

#3. Economic News:

Economic events as well as meetings, such as the central bank’s rate decisions, NFPs, trade agreements, and employee indicators.

#4. Index Reshuffle:

When the stock of a company is added or removed from the index, the prices can also see a shift.

#5. Company News:

Important company news such as new leadership, a merger, or the release of the financial results will also have an impact on the stock of the company.

What is an index trading strategy?

Your stock index trading strategy should incorporate both fundamental as well as technical analysis so as to give you a balanced view of the market.

The three main strategies that are available with the trading indices are as follows:

#1. Trend Trading:

A trend-based strategy for stock index trading will use technical analysis tools so as to identify the trends.

Based on what the technical indicators signal, a price is expected to continue moving in line with the current market trend or the trend that is reversing.

This will also potentially help you identify the best index to trade at any given time.

#2. Support and Resistance Trading:

The technical analysis tool will also help the index trader identify the support level which is likely to represent the bottom for the index price as well as the resistance levels.

Once you identify support and resistance, you can set up take profit, stop-loss, as well as limit orders if you wish to automate the buying and selling of the index within the trading range.

#3. Breakout Trading:

You can also follow the breakout strategy for index trading using technical analysis to identify the support as well as resistance levels.

This will aim to speculate on the prices once they break through resistance or support levels.

Conclusion:

We hope that the above blog has given you clarity about index trading.

Frequently Asked Questions (FAQs)

About Us:

Trading Fuel is our website for blogs where we provide you with details about the stock market, finance, economics, and intraday trading. Stay tuned with us for more such blogs.