What is MSEI?: MSEI’s full form is the Metropolitan Stock Exchange of India Limited.

How was MSEI formed?

The Metropolitan Stock Exchange of India Limited (MSE) is recognized by the Securities and Exchange Board of India (SEBI) under section 4 of the Securities Contract (Regulation) Act, 1956.

On December 21, 2012, MSEI was notified as a “Recognized Stock Exchange” under Section 2(39) of the Companies Act, 1956 by the Ministry of Corporate Affairs, Government of India.

Initially, the clearing and settlement of trade were done on an exchange through its subsidiary clearing corporation, Metropolitan Clearing Corporation of India Ltd.

After the implementation of the interoperability framework from June 03, 2019, the clearing and settlement of trades can be executed through any clearing corporation like Metropolitan Clearing Corporation (MCCIL), Indian Clearing Corporation (ICCL), and National Securities Clearing Corporation (NSCCL).

Services offered by MSEI:-

Several services that are offered by MSEI:-

- The stock exchange offers an electronic, transparent, and hi-tech platform for trading in several segments like the capital market, futures & options, currency derivatives, and debt markets.

- The exchange also provides an SME trading platform.

- It commenced its Currency Derivatives (CD) segment operations on October 07, 2008, under the regulatory framework of the Reserve Bank of India (RBI) and SEBI.

- The exchange also launched its capital market segment, futures, and options segment, and flagship index “SX40” on February 09, 2013, and started trading on February 11, 2013.

Other derivatives and their other features:-

The following are the derivatives that were launched by MSEI:-

| Name | Commencement Date | Features |

| SX40 | May 15, 2013 | It is a free-float-based index that consists of 40 large-cap stocks and other liquid stocks that will represent the diverse sectors of the economy. Here, the base value is 10,000, and the base date is March 31, 2010. |

| Debt Market Segment | June 10, 2013 | This exchange started with live trading through cash-settled Interest Rate Futures (IRF) through Government of India security, into its Currency Derivative Segment from January 20, 2014. It provides a better option to hedge against volatile market rates. |

Principles followed by MSEI:-

MSEI is based on four base principles:-

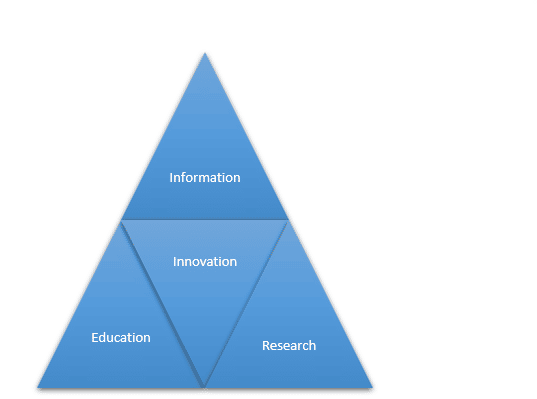

- Information, Innovation, Education, and Research are the four basic pillars of the unique market philosophy used by MSEI.

- Its mission, as conceived by the government of India, is maintained as “Financial Literacy for Financial Inclusion“.

- To fulfill this mission, MSEI conducts investor education and awareness programs that average at least one program per working day, across the length as well as the breadth of the country.

Subsidiaries of the company:-

The company has two subsidiaries:-

(MCCIL) Metropolitan Clearing Corporation of India Limited:-

This subsidiary was set up with the intention of clearing and settling all the trades on the exchange.

It has also set up an agreement with the Indian Commodity Exchange Limited (ICEX) to offer clearing and settlement services to MSEI for all the trades done on their existing commodities and derivative segments.

MSEI holds an 86.94% stake in MCCIL.

MCX-SX KRA:-

This is a wholly-owned subsidiary of the company to completely overtake the business of KYC Registration Agencies and allied activities, subject to registration with SEBI under the SEBI{KYC (Know Your Customer) Registration Agency} Regulations, 2011.

MSEI holds a 100% stake in MCX-SX KRA.

MSEI Listed Share Details:-

The details of the entire list of members registered with SEBI as of 31.03.2019 are as follows:-

| Product | No. of Members |

| Currency Derivatives | 607 |

| Equity Cash | 377 |

| Equity Futures & Options | 367 |

| Debt | 14 |

MSEI Unlisted Share Details:-

The following are the details:-

| Particulars | Narration |

| Total available shares | 200,000 equity shares |

| Face Value | RS. 1 per equity share |

| ISIN | INE312K01010 |

| Lot Size Current Unlisted Share Price | 10,000 equity shares RS. Best in the industry per equity share |

| PAN No. | AAFCM6942F |

MSEI Promoters and Management:-

The following are the promoters and directors of MSEI Unlisted Shares Company:-

| Name | Designation |

| Latika Kundu | Managing Director |

| Prof. Ashima Goya | Chairperson & Public Interest Director |

| Mr. D.G. Patwardhan | Public Interest Director |

| Mr. D.K. Mehrotra | Public Interest Director |

| Mr. Ajai Kumar | Public Interest Director |

| Mr. Ketan Vikamsey | Public Interest Director |

Shareholding Pattern of MSEI:-

The top 10 MSEI shareholders are as under:-

| Sr. NO. | Name of the Shareholder | No. of Shares | % |

| 1 | Multi Commodity Exchange of India | 33,17,77,008 | 6.90 |

| 2 | Siddharth Balachandran | 23,84,09,950 | 4.96 |

| 3 | Radhakishan S Damani | 11,74,63,496 | 2.44 |

| 4 | Trust Investment Advisors Pvt. Ltd. | 11,91,15,930 | 2.48 |

| 5 | IL & FS Financial Services Ltd. | 11,91,09,627 | 2.48 |

| 6 | Union Bank of India | 15,87,50,000 | 3.30 |

| 7 | State Bank of India | 9,74,00,000 | 2.02 |

| 8 | Nemish S Shah | 9,73,70,000 | 2.02 |

| 9 | Aadi Financial Advisors LLP | 9,73,50,000 | 2.02 |

| 10 | Bank of Baroda | 9,37,57,564 | 1.95 |

A few FAQ’s on MSEI Unlisted Shares:-

1. What is the latest news about MSEI’s IPO?

There were rumors that MSEI and ICEX had initiated a merger, which the company strongly denied because the company is currently focusing on the volumes and, hence, trading on the share market will surely be initiated after a successful turnaround of the company.

2. Are the shares of MSEI listed?

No, the shares are currently not listed on any of the stock exchanges. A trader can buy the shares from the stock exchange at the prevailing prices and then the same will be transferred to their Demat account.

3. How to buy the unlisted shares of MSEI?

The following is the step-by-step process for purchasing the unlisted shares of the company:

4. How to sell the unlisted shares of MSEI?

The following is the step-by-step process for selling the unlisted shares of the company:-

5. Is trading MSEI unlisted shares legal in India?

Yes, it is 100% legal.

6. Do we need to pay short-term capital gain taxes on MSEI unlisted shares?

Yes, but only if the shares are sold within 2 years of purchase. The required gain will be added to the income. Hence, per individual tax slab, the capital gain tax must be paid.

7. Do we need to pay long-term capital gain taxes on MSEI unlisted shares?

Yes, if the shares are sold after 2 years of purchase. 20% indexation benefits will be provided.

Conclusion:

We hope to have given you the required clarity about MSEI Exchange.

About Us:

Trading Fuel is our blog website that gives you finance and stock market-related information. We also provide you with information about the other sectors that are functioning in our economy. Stay tuned with us for more of this content.