Why can’t RBI Print Unlimited Notes?: Everyone believes that RBI does not print unlimited money.

Well, the RBI, or Reserve Bank of India, has the central authority to print the currency notes in India.

Why does the RBI not print unlimited notes?

- Everyone has this question in mind as to why RBI does not print enough notes and distribute them to the public.

- Let us understand this with the help of an example,

- Suppose there are only 3 people residing in a country named ABC with an income of Rs. 20 per annum and the only good that is purchased in this economy is rice.

- The total value of goods and services produced in the country is equivalent to 3 kg of rice.

- One will have to pay Rs. 20 per kg. to buy 1 kg of rice.

- Just imagine that the government all of a sudden starts printing more money and the income rises from Rs. 20 to Rs. 40, but the supply of rice remains the same at 3 kg.

- With more cash in hand, the demand for rice will go up, and the price of 1 kg of rice has also increased from Rs. 20 to Rs. 40.

- In the above scenario, the quantity produced has not changed but the price has changed due to the excess money printed.

- Hence, the printing of money should always match the production of goods and services in the country, or else inflation will badly destroy the economy.

Don’t Forget to Check: INR Full Form: What is the Full Form of INR?

Why does the RBI print money?

- People often complain that the government is earning revenue in the form of taxes, so why does it not spend it?

- Well, the government does spend the same and when at times the expenditure exceeds the revenue, we call it a fiscal deficit.

- The aim of the government is to keep this fiscal deficit under the target of around 3.5% of the GDP, which is set at 6.8% for FY22.

- But as a matter of fact, the figures are actually more for this year.

- The government has to spend on health, people, hospitals, oxygen supply, vaccination drives, and many other things.

- As the revenues were curbed due to the lockdown, the government was in a very tough spot to do it all alone, and hence the only way out was to borrow and then spend.

- The government has the chance to borrow from several sources, such as the following:

Also Read: Is Options Trading Profitable?

- But in terms of crisis, nobody is willing to help, so then what?

- The government will knock on the last door—the RBI.

- Borrowing from the RBI is not like borrowing from others.

- People will lend you the money already in the system, but the RBI will print new notes.

- This process of the RBI printing money to lend to the government is known as “Monetizing the Deficit.“

- This will increase the circulation of money flow.

Main factors to be considered to print new currency:

The main factors to be considered for printing new currency are as follows:

Also Read: Why are Gold Prices Rising in India?

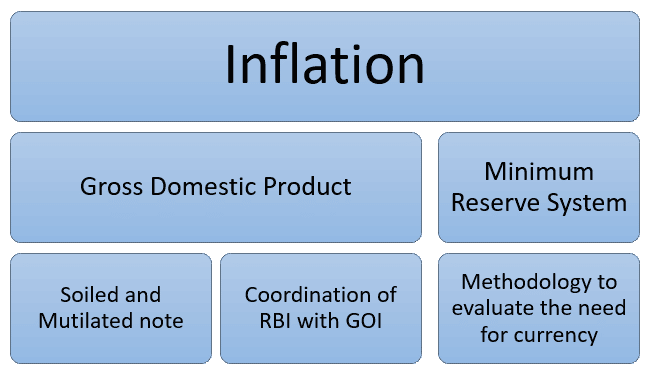

Inflation:

- Inflation is the increase in the price of goods and services with the passage of time.

- This will also increase your cost of living.

- Inflation will also reduce the purchasing power of each unit of currency.

- It will in turn devalue our currency, and this is considered to be the most extreme.

Gross Domestic Product (GDP):

- It is the final value of the goods and services produced within the geographic boundaries of a country during a year.

- It is an important indicator of the economic performance of a country.

- It is also another important factor that will affect the amount of money to be printed in the economy.

- The government will print money of the same value that it has gained in its economy, or in a simple way, GDP.

- Hence, GDP will increase the value of money in circulation since each unit can subsequently be traded for more of these valuable goods and services.

- The most important point to note here is that the government gives the same number of physical notes as a medium of exchange as the value it will get in return from GDP and inflation.

Learn: Top 10 Candlestick Pattern

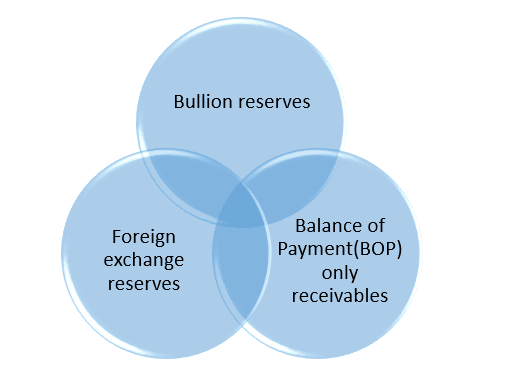

Minimum Reserve System:

- The currency that is issued in the country completely relies upon the reserves that the RBI has with it after meeting all its liabilities.

- The reserves mean the following:

- This Minimum Reserve System (MRS) has been followed since 1956.

- Under the MRS scheme, the RBI has to keep a minimum reserve of Rs. 200 crores that will comprise gold bullion, gold coins, and foreign currencies.

- Gold bullions and gold coins must account for 115 crores of the total of Rs. 200 crores.

- The main purpose of the shift to MRS was to expand the supply of money so as to meet the increasing transactions in the economy.

Soiled and Mutilated Notes:

- Soiled notes are the ones that have become dirty due to usage and also include two-piece notes that are pasted together.

- Mutilated notes are the ones where one portion is missing.

- These notes are not fit for circulation and are thus withdrawn after duly accounting for them in the records of the RBI.

- Hence, for these old notes, the new notes have to be printed.

Coordination of RBI with GOI:

- The RBI will discuss with the GOI respect the denomination, design, and security features of the banknotes that are to be printed in the country and circulated.

- The minting of Re. 1 currency and other coins is under the jurisdiction of GOI.

- After following the laid down procedure, RBI will follow the process of printing and minting.

- The RBI will also pay dividends to the GOI.

Methodology to evaluate the need for currency:

- The projected GDP figure is available from GOI, CMIE, and RBI’s own research wing (D).

- Cash with the RBI and banks will come under the note of stock account (N).

- Then, there will be replacement demand due to the destruction of soiled notes (R).

- Hence, the total notes to be printed = D – N + R.

- In our country, 5% extra is added to meet any sort of emergency.

- The final figure will be compared to the estimates of regional offices and banks.

Also Check: How to Interpret the Contract Note?

Conclusion:

We hope that this blog has given you an understanding of Why can’t RBI Print Unlimited Notes?

About Us:

Trading Fuel is our blog website where we give you knowledge about finance, economics, stock markets, intraday trading, and technical analysis. Do we hope that you get all information on Why can’t RBI Print Unlimited Notes?

Stay tuned for more blogs.