Why do stock prices fluctuate?

- The easiest way to multiply our wealth is by investing in the stock market.

- The main aim of trading in the stock market is to buy low and sell with a good profit margin.

- The main reason behind the stock fluctuations is the continuous turmoil between demand and supply in the economy.

What commonly affects the stock price?

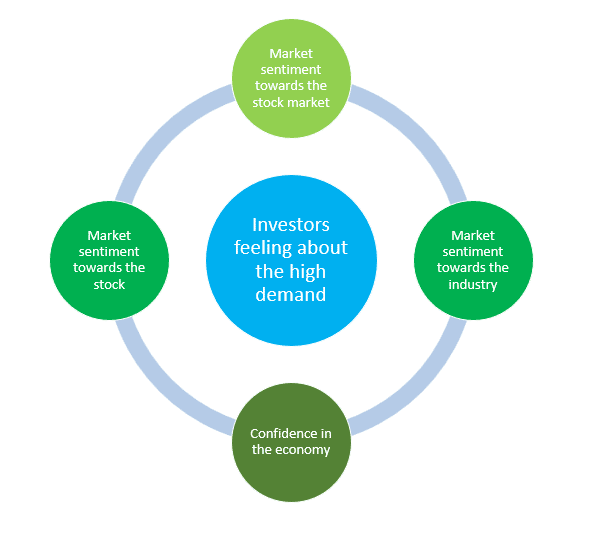

- High demand tends to cause the stock price to rise, but what is the main reason behind these high demands.

- The main reason for the high demand is that demand is influenced by how investors feel.

- The entire crux of the investors’ feelings can be based on the following factors:

- Confidence in the stock market helps to push up the demand and prices for all individual stocks.

- If investors are of the opinion that the stocks are a good investment, either because of attractive valuations or because of the uptrend in the stock market, then the increase in demand for the stocks can push up the prices across the board.

The stock market is an auction:

- The stock market is in itself an auction, where one party wants to sell the ownership interest in a particular company, whereas the other party wants to buy the same ownership interest.

- When both parties agree on a price, the trade is sealed and that price is the new market quotation.

- Here, the buyers and sellers can be individuals, institutions, corporations, government agencies, or any asset management company.

- The number of shares that are traded is called the “trading volume,” which helps to indicate how hot a particular stock is or how much interest there is in it from investors.

The demand and supply factors in the stock market:

- Demand refers to the total number of people who are potential buyers and would also be willing to buy at any price.

- Supply refers to the total number of people who are willing to sell their shares at any price.

- The exact point where demand and supply meet, i.e., all the potential buyers and sellers trade until there is no one left who will agree on a particular price, is called market equilibrium.

- If the number of people who are willing to buy the stock, i.e., demand, is greater than the number of people who want to sell the stock, i.e., supply, then the stock price increases.

- However, if the number of people who wish to sell the stock is greater than the number of people who want to buy the stock, then the stock price will decrease.

What causes the stock price to fluctuate?

The market is very volatile.

There are several reasons that cause the stock prices to fluctuate.

The following are the main reasons behind the same:-

#1. The earnings base:

- Mature companies are measured with the help of dividends per share, which helps to represent what the shareholder actually receives.

- The way earnings power is measured depends on the type of company that is being analyzed.

- People tend to invest in a company that is making good profits and attracting more investors, which will cause its share price to rise.

#2. The valuation multiple:

- This multiple will deal with future expectations.

- Fundamentally, it is based on the discounted present value of the future earnings stream.

These lead us to determine the following two basic factors:

- The expected growth in the entire earnings base.

- The discount rate is useful for calculating the present value of the future stream of earnings.

- A higher growth rate implies a stock with a higher multiple, whereas a higher discount implies a lower multiple.

#3. Technical factors:

- Technical factors are the mix of external conditions that will alter the demand and supply of the company’s stock.

The following components are included in the technical factors:

I) Inflation:

- Low inflation drives high multiples and high inflation drives low multiples.

- Inflation is a huge driver from the technical point of view.

- Deflation signifies a loss in the pricing power of companies.

II) Substitutes:

- Companies compete with the other asset classes of companies on the global stage.

- The relationship between equities and their substitutes is difficult to decipher, but it is crucial.

III) Economic Strength of Markets and Peers:

- The company’s stocks tend to track with the market, their sector, and their peers.

- Some prominent investment firms argue that the overall market and sector movements, as opposed to the company’s individual performance, will help to determine the majority of the stock movement.

- For example, a sudden negative outlay for one stock in a particular sector drags the demand for the whole sector.

IV) Incidental transactions:

- These transactions are the purchase or sale of stocks that are motivated by something other than the intrinsic value of stocks.

- Insider transactions, which are sometimes pre-scheduled or driven by portfolio objectives, drive these transactions.

- Although at times, these transactions may not represent an official vote cast for or against the stock, they do surely impact the supply and demand, which will move the price.

V) Demographics:

- Some important research has been done on the demographics of investors, who have two dynamic concerns:

- older investors tend to pull out of the market to meet the demands of retirement.

- middle-aged investors, who are always into investing in the stock market.

- When the proportion of middle-aged investors increases, the demand for equities will also increase, which, henceforth, will increase the valuation.

VI) Liquidity:

- Liquidity refers to how much interest a specific stock will achieve from investors.

- Generally, large-cap stocks have very high liquidity because they are well followed and heavily traded.

- Many small-cap stocks suffer from liquidity discounts because they are not always on the investor’s radar.

VII) Trends:

- Stocks are often considered to follow a trend.

- On one hand, there is a stock that is moving upwards and then gathering momentum, while on the other hand, a stock sometimes behaves haphazardly and goes in the very opposite direction.

#4. Market sentiments:

- It refers to the psychology of all the market participants, both individually and collectively.

- Market sentiments can be subjective, biased, and obstinate at times.

#5. The bottom line:

- The bottom line of the company allows the investors to depend on different factors.

- Investors who strongly believe in fundamentals can reconcile themselves to all the technical forces.

#6. Good news or bad news:

- If a company reports a hike in interest, acquires another company, or enters into a completely new market segment, it is considered good news and will lead to an increase in the stock price.

- On the other hand, a company that sells a stake is letting go of its employees or sells a major stake is considered bad news, which in turn will lead to a fall in the stock price.

#7. Overvaluation and undervaluation:

- Undervalued shares are always considered worthless when the company is reporting bad news.

- Some experts will buy such undervalued stocks with the guess that this will lead to an increase in demand.

Why do stock prices fluctuate? – Conclusion:

The above list contains all the main factors that often lead to fluctuations in stock prices.

About Us:

Trading Fuel is our website for the blog where we wish to provide you with day-to-day knowledge about finance, economics, the stock market, and several other intraday tips. We hope that you like our blog “Why do stock prices fluctuate?”.

~We wish you happy reading and stay tuned with us for more such blogs~